4647 Apple Tree Common Livermore, CA 94551

Springtown NeighborhoodEstimated Value: $714,465 - $917,000

3

Beds

2

Baths

1,395

Sq Ft

$560/Sq Ft

Est. Value

About This Home

This home is located at 4647 Apple Tree Common, Livermore, CA 94551 and is currently estimated at $781,866, approximately $560 per square foot. 4647 Apple Tree Common is a home located in Alameda County with nearby schools including Altamont Creek Elementary School, Andrew N. Christensen Middle School, and Livermore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2019

Sold by

Salkow Robert L and Salkow Leroy Leslie

Bought by

Salkow Robert L and Salkow Leroy Leslie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$465,000

Outstanding Balance

$407,363

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$374,503

Purchase Details

Closed on

Aug 20, 2007

Sold by

Salkow Robert Louis

Bought by

Salkow Robert Louis and Salkow Leroy Leslie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,000

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 12, 2006

Sold by

Vontoussaint Dave

Bought by

Vontoussaint Janet F

Purchase Details

Closed on

May 27, 2004

Sold by

Schorr Suzanne C

Bought by

Salkow Robert Louis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 28, 1999

Sold by

Widmer Sharon L

Bought by

Schorr Suzanne C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

6.98%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Jun 24, 1996

Sold by

Procassini Richard J and Procassini Katerina

Bought by

Widmer Sharon L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Interest Rate

8.09%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Salkow Robert L | -- | Old Republic Title Company | |

| Salkow Robert Louis | $216,000 | Commonwealth Land Title | |

| Vontoussaint Janet F | -- | Financial Title Company | |

| Salkow Robert Louis | $418,000 | North American Title Company | |

| Schorr Suzanne C | $210,000 | North American Title Co | |

| Widmer Sharon L | $178,181 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Salkow Robert L | $465,000 | |

| Closed | Salkow Robert Louis | $384,000 | |

| Previous Owner | Salkow Robert Louis | $324,000 | |

| Previous Owner | Schorr Suzanne C | $168,000 | |

| Previous Owner | Widmer Sharon L | $171,000 | |

| Closed | Schorr Suzanne C | $31,500 | |

| Closed | Salkow Robert Louis | $81,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,318 | $568,791 | $172,737 | $403,054 |

| 2024 | $7,318 | $557,504 | $169,351 | $395,153 |

| 2023 | $7,209 | $553,435 | $166,030 | $387,405 |

| 2022 | $7,105 | $535,585 | $162,775 | $379,810 |

| 2021 | $6,354 | $524,950 | $159,585 | $372,365 |

| 2020 | $6,738 | $526,500 | $157,950 | $368,550 |

| 2019 | $6,744 | $516,175 | $154,852 | $361,323 |

| 2018 | $6,603 | $506,054 | $151,816 | $354,238 |

| 2017 | $6,437 | $496,132 | $148,839 | $347,293 |

| 2016 | $6,125 | $486,404 | $145,921 | $340,483 |

| 2015 | $5,340 | $440,000 | $132,000 | $308,000 |

| 2014 | $4,321 | $346,000 | $103,800 | $242,200 |

Source: Public Records

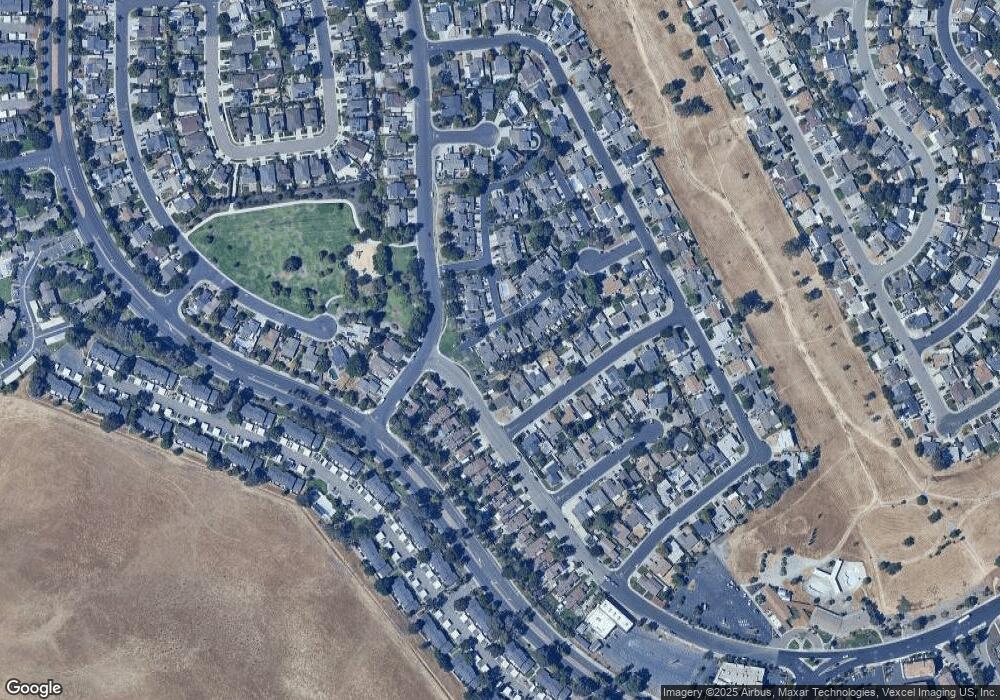

Map

Nearby Homes

- 1128 Larkspur Dr

- 1264 Tulip Way

- 1031 Spring Valley Common

- 5251 Peony Dr

- 1905 Monterey Dr

- 4363 Golf Dr

- 884 Sungold Cir Unit 123

- 1817 Bluebell Dr

- 5457 Treeflower Dr

- 5365 Windflower Dr

- 5473 Rainflower Dr

- 4723 Marengo Common

- 4707 Marengo Common

- 4711 Marengo Common

- 883 Barney Com

- 4715 Marengo Common

- 2060 Broadmoor St

- 4128 Camrose Ave

- 4003 Loch Lomand Way

- 5637 Idlewild Ave

- 4659 Apple Tree Common

- 4625 Apple Tree Common

- 4671 Apple Tree Common

- 4603 Apple Tree Common

- 4693 Apple Tree Common

- 1310 Peachtree Common

- 4715 Apple Tree Common

- 1332 Peachtree Common

- 4738 Lantana Ave

- 4756 Lantana Ave

- 4727 Apple Tree Common

- 1354 Peachtree Common

- 4680 Apple Tree Common

- 4722 Lantana Ave

- 4768 Lantana Ave

- 4739 Apple Tree Common

- 1366 Peachtree Common

- 1378 Peachtree Common Unit CM

- 1378 Peachtree Common

- 4741 Apple Tree Common

Your Personal Tour Guide

Ask me questions while you tour the home.