4657 Joanna Ct Fremont, CA 94536

Estimated Value: $1,414,000 - $1,550,000

3

Beds

2

Baths

1,232

Sq Ft

$1,191/Sq Ft

Est. Value

About This Home

This home is located at 4657 Joanna Ct, Fremont, CA 94536 and is currently estimated at $1,467,248, approximately $1,190 per square foot. 4657 Joanna Ct is a home located in Alameda County with nearby schools including Patterson Elementary School, Thornton Middle School, and American High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2006

Sold by

Yanez Marcos R and Yanez Claudia R

Bought by

Yanez Marcos R and Yanez Claudia P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$405,500

Outstanding Balance

$248,613

Interest Rate

7.25%

Mortgage Type

Negative Amortization

Estimated Equity

$1,218,635

Purchase Details

Closed on

Mar 16, 2001

Sold by

Rosa Jose M and Rosa Elisa B

Bought by

Yanez Marcos R and Leyva Claudia P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$420,000

Interest Rate

7.06%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Oct 14, 1993

Sold by

Warn Michael R and Warn Kathryn A

Bought by

Rosa Jose M and Rosa Elisa B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,000

Interest Rate

6.81%

Purchase Details

Closed on

Apr 14, 1993

Sold by

Garcia Rosa Jose Manuel and Garcia Rosa Jose

Bought by

Rosa Jose Manuel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yanez Marcos R | -- | Fidelity National Title Co | |

| Yanez Marcos R | $420,000 | Chicago Title Co | |

| Rosa Jose M | $186,000 | North American Title Co | |

| Rosa Jose Manuel | $115,500 | Fidelity National Title Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yanez Marcos R | $405,500 | |

| Closed | Yanez Marcos R | $420,000 | |

| Previous Owner | Rosa Jose M | $87,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,770 | $625,825 | $189,847 | $442,978 |

| 2024 | $7,770 | $613,418 | $186,125 | $434,293 |

| 2023 | $7,555 | $608,255 | $182,476 | $425,779 |

| 2022 | $7,448 | $589,331 | $178,899 | $417,432 |

| 2021 | $7,267 | $577,640 | $175,392 | $409,248 |

| 2020 | $7,260 | $578,645 | $173,593 | $405,052 |

| 2019 | $7,178 | $567,301 | $170,190 | $397,111 |

| 2018 | $7,036 | $556,180 | $166,854 | $389,326 |

| 2017 | $6,859 | $545,277 | $163,583 | $381,694 |

| 2016 | $6,738 | $534,588 | $160,376 | $374,212 |

| 2015 | $6,644 | $526,561 | $157,968 | $368,593 |

| 2014 | $6,526 | $516,250 | $154,875 | $361,375 |

Source: Public Records

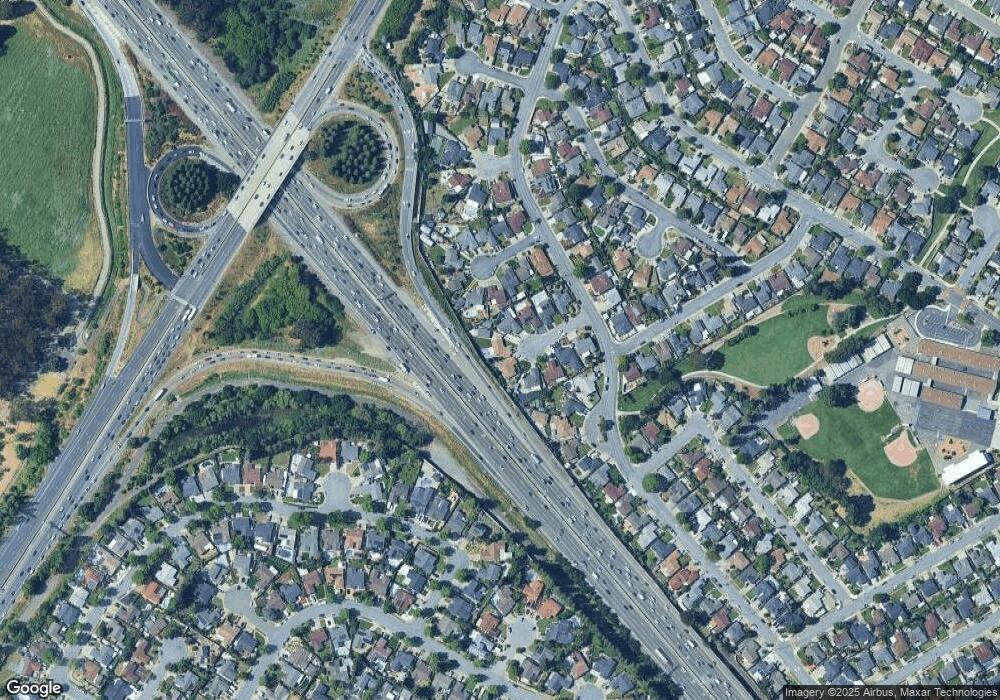

Map

Nearby Homes

- 35345 Cabral Dr

- 35377 Cabrillo Dr

- 35794 Cabral Dr

- 4626 Alhambra Dr

- 35856 Adobe Dr

- 35282 Cano Ct

- 34768 Swain Common

- 35942 Adobe Dr

- 35936 Magellan Dr

- 35605 Scarborough Dr

- 5093 Dorking Ct

- 35978 Magellan Dr

- 4987 Winchester Place

- 34627 Pueblo Terrace

- 34917 Sea Cliff Terrace

- 34607 Pueblo Terrace

- 34771 Tuxedo Common Unit 52

- 4955 Swindon Place

- 4027 Sunset Terrace

- 34656 Greenstone Common

- 4643 Joanna Ct

- 4658 Joanna Ct

- 4670 Claudia Ct

- 4629 Joanna Ct

- 4656 Claudia Ct

- 4644 Joanna Ct

- 4615 Joanna Ct

- 4642 Claudia Ct

- 4630 Joanna Ct

- 4684 Claudia Ct

- 4616 Joanna Ct

- 4628 Claudia Ct

- 4601 Joanna Ct

- 35303 Cabral Dr

- 4602 Joanna Ct

- 4614 Claudia Ct

- 35317 Cabral Dr

- 35289 Cabral Dr

- 4681 Claudia Ct

- 4643 Claudia Ct