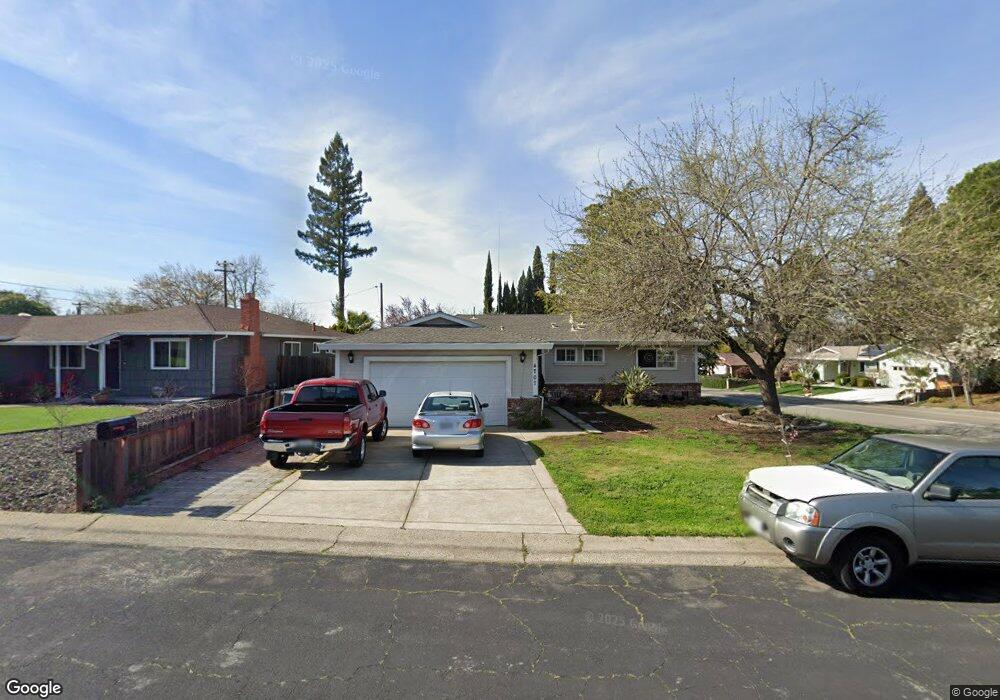

4707 Cimarron Way Granite Bay, CA 95746

Estimated Value: $375,000 - $776,000

3

Beds

2

Baths

1,248

Sq Ft

$465/Sq Ft

Est. Value

About This Home

This home is located at 4707 Cimarron Way, Granite Bay, CA 95746 and is currently estimated at $579,698, approximately $464 per square foot. 4707 Cimarron Way is a home located in Placer County with nearby schools including Greenhills Elementary School, Excelsior Elementary School, and Olympus Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2017

Sold by

Komarchuk Naida

Bought by

Komarchuk Naida

Current Estimated Value

Purchase Details

Closed on

Jul 23, 2002

Sold by

Komarchuk Gennady

Bought by

Komarchuk Naida

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,970

Outstanding Balance

$110,084

Interest Rate

7.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$469,614

Purchase Details

Closed on

Jul 19, 2002

Sold by

Middleton Nathan

Bought by

Komarchuk Naida

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,970

Outstanding Balance

$110,084

Interest Rate

7.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$469,614

Purchase Details

Closed on

May 27, 1999

Sold by

Davenport Gwendolyn Sue

Bought by

Middleton Nathan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,000

Interest Rate

7.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Komarchuk Naida | -- | None Available | |

| Komarchuk Naida | -- | Chicago Title Co | |

| Komarchuk Naida | $273,500 | Chicago Title Co | |

| Middleton Nathan | $120,000 | Fidelity Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Komarchuk Naida | $245,970 | |

| Previous Owner | Middleton Nathan | $96,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,829 | $395,805 | $159,305 | $236,500 |

| 2023 | $4,829 | $380,437 | $153,120 | $227,317 |

| 2022 | $4,757 | $372,978 | $150,118 | $222,860 |

| 2021 | $4,677 | $365,666 | $147,175 | $218,491 |

| 2020 | $4,667 | $361,917 | $145,666 | $216,251 |

| 2019 | $4,633 | $354,821 | $142,810 | $212,011 |

| 2018 | $4,350 | $337,000 | $135,600 | $201,400 |

| 2017 | $4,237 | $318,000 | $128,000 | $190,000 |

| 2016 | $4,025 | $300,000 | $120,700 | $179,300 |

| 2015 | $3,852 | $286,000 | $115,100 | $170,900 |

| 2014 | $3,700 | $271,000 | $109,100 | $161,900 |

Source: Public Records

Map

Nearby Homes

- 8330 Jeanette Way

- 8165 Greenhills Way

- 8402 Seeno Ave

- 4510 Northglen St

- 4470 Rolling Oaks Dr

- 8230 Birch Meadow Ct

- 8320 Cedar Falls Ct

- Residence Three Plan at Magnolia at Granite Bay

- Residence Two Plan at Magnolia at Granite Bay

- Residence Five Plan at Magnolia at Granite Bay

- Residence One Plan at Magnolia at Granite Bay

- Residence Four Plan at Magnolia at Granite Bay

- 8610 Buckbrush Ln

- 8630 Buckbrush Ln

- Plan 5 at Whitehawk

- Plan 4 at Whitehawk

- Plan 3 at Whitehawk

- Plan 2 at Whitehawk

- Plan 1 at Whitehawk

- 8641 Buckbrush Ln

- 4697 Cimarron Way

- 8292 Seeno Ave

- 4677 Cimarron Way

- 4710 Cimarron Way

- 8287 Seeno Ave

- 8282 Seeno Ave

- 8277 Seeno Ave

- 4700 Cimarron Way

- 4667 Cimarron Way

- 8312 Seeno Ave

- 8267 Seeno Ave

- 4690 Cimarron Way

- 8262 Seeno Ave

- 4640 High Ct

- 4645 High Ct

- 4657 Cimarron Way

- 8225 Kingsley Ct

- 4670 Cimarron Way

- 8257 Seeno Ave

- 8307 Seeno Ave