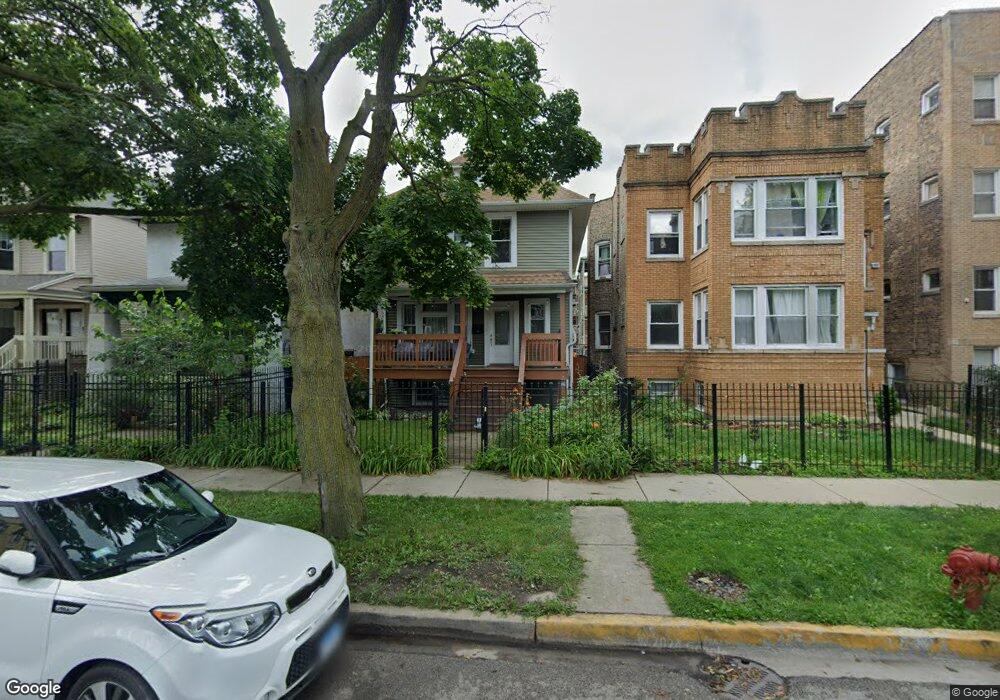

4726 N Drake Ave Chicago, IL 60625

Albany Park NeighborhoodEstimated Value: $782,000 - $944,000

4

Beds

4

Baths

2,549

Sq Ft

$332/Sq Ft

Est. Value

About This Home

This home is located at 4726 N Drake Ave, Chicago, IL 60625 and is currently estimated at $845,731, approximately $331 per square foot. 4726 N Drake Ave is a home located in Cook County with nearby schools including Haugan Elementary School, Roosevelt High School, and ASPIRA Haugan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 31, 2024

Sold by

Grunewald Jeffery S and Grunewald Barbara H

Bought by

Jeffery S Grunewald Revocable Trust and Barbara H Grunewald Revocable Trust

Current Estimated Value

Purchase Details

Closed on

May 24, 2023

Sold by

Tsui Judy and Larsen-Ravenfeather Soren

Bought by

Grunewald Jeffrey S and Grunewald Barbara H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$357,500

Interest Rate

6.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 11, 2020

Sold by

Pellegrini Christopher and Pellegrini Christine

Bought by

Tsui Judy and Larsen Ravenfeather Soren

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$540,000

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 10, 2018

Sold by

Czeptel Kevin A and Czeptel Sarah A

Bought by

Pellegrini Christopher and Pellegrini Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,000

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 27, 2015

Sold by

Chicago Title Land Trust Company

Bought by

Czepiel Kevin and Czepiel Sarah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,975

Interest Rate

3.77%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Nov 2, 2012

Sold by

Salinas Agustina and Ahedo Agustina

Bought by

Ct Land Trust 8002360077

Purchase Details

Closed on

Jun 25, 2004

Sold by

Ahedo Agustina and Salinas Vicente

Bought by

Salinas Agustina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,500

Interest Rate

4.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 11, 2001

Sold by

Ahedo Vicent and Ahedo Agustina

Bought by

Salina Vicente and Ahedo Agustina

Purchase Details

Closed on

May 31, 1996

Sold by

Ruiz Felix

Bought by

Roman Leon and Salinas Agustina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,200

Interest Rate

8.31%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 16, 1996

Sold by

Jost Shirley and Jost Thomas

Bought by

Ruiz Felix

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,250

Interest Rate

7.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jeffery S Grunewald Revocable Trust | -- | None Listed On Document | |

| Jeffery S Grunewald Revocable Trust | -- | None Listed On Document | |

| Grunewald Jeffrey S | $715,000 | Stewart Title | |

| Tsui Judy | $675,000 | Prairie Title | |

| Pellegrini Christopher | $562,500 | Attorney | |

| Czepiel Kevin | $410,000 | Chicago Title Land Trust Co | |

| Ct Land Trust 8002360077 | $116,500 | None Available | |

| Salinas Agustina | -- | Rtc | |

| Salina Vicente | -- | Stewart Title | |

| Roman Leon | $146,000 | Attorneys Natl Title Network | |

| Ruiz Felix | $99,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Grunewald Jeffrey S | $357,500 | |

| Previous Owner | Tsui Judy | $540,000 | |

| Previous Owner | Pellegrini Christopher | $450,000 | |

| Previous Owner | Czepiel Kevin | $40,975 | |

| Previous Owner | Czepiel Kevin | $328,000 | |

| Previous Owner | Salinas Agustina | $219,500 | |

| Previous Owner | Roman Leon | $144,200 | |

| Previous Owner | Ruiz Felix | $74,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,579 | $72,000 | $13,125 | $58,875 |

| 2023 | $11,266 | $58,000 | $10,500 | $47,500 |

| 2022 | $11,266 | $58,000 | $10,500 | $47,500 |

| 2021 | $11,030 | $58,000 | $10,500 | $47,500 |

| 2020 | $8,393 | $37,545 | $5,437 | $32,108 |

| 2019 | $8,504 | $42,186 | $5,437 | $36,749 |

| 2018 | $7,679 | $42,186 | $5,437 | $36,749 |

| 2017 | $4,029 | $22,028 | $4,875 | $17,153 |

| 2016 | $4,427 | $22,028 | $4,875 | $17,153 |

| 2015 | $4,051 | $22,028 | $4,875 | $17,153 |

| 2014 | $3,570 | $19,173 | $4,500 | $14,673 |

| 2013 | $3,953 | $21,653 | $4,500 | $17,153 |

Source: Public Records

Map

Nearby Homes

- 4734 N Drake Ave

- 4621 N Monticello Ave

- 4619 N Lawndale Ave Unit 1

- 3711 W Lawrence Ave

- 4534 N Saint Louis Ave

- 4906 N Drake Ave Unit 3

- 4903 N Monticello Ave Unit 3

- 3618 W Ainslie St Unit 3W

- 4900 N Lawndale Ave Unit G

- 4919 N Lawndale Ave

- 4938 N Central Park Ave

- 4714 N Spaulding Ave

- 4426 N Drake Ave

- 4948 N Kimball Ave Unit 4W

- 4515 N Hamlin Ave

- 3733 W Sunnyside Ave

- 3550 W Montrose Ave Unit 107

- 5007 N Lawndale Ave

- 3210 W Lawrence Ave

- 4944 N Spaulding Ave Unit 4944

- 4726 N Drake Ave

- 4730 N Drake Ave

- 4724 N Drake Ave

- 4734 N Drake Ave Unit 3

- 4722 N Drake Ave Unit 2

- 4722 N Drake Ave

- 4722 N Drake Ave

- 4722 N Drake Ave Unit 1

- 4736 N Drake Ave

- 4720 N Drake Ave

- 4740 N Drake Ave

- 4740 N Drake Ave Unit 1

- 4718 N Drake Ave

- 4742 N Drake Ave Unit 2

- 4727 N Central Park Ave Unit 1

- 4712 N Drake Ave Unit 1

- 4712 N Drake Ave

- 4731 N Drake Ave Unit 1

- 4729 N Drake Ave Unit 2

- 4729 N Drake Ave