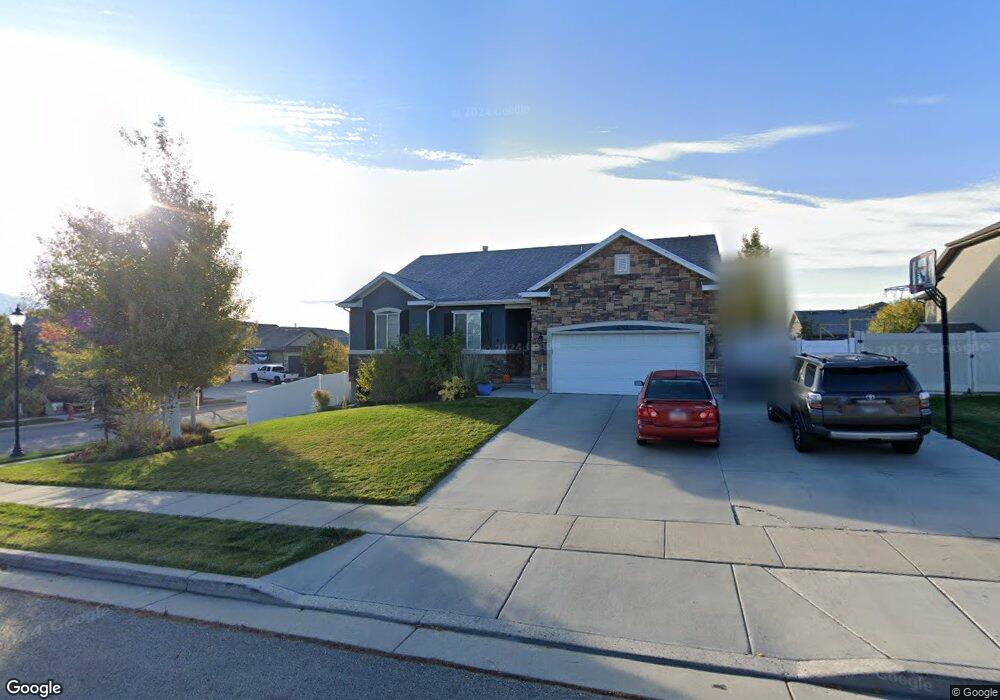

4743 W 7470 S West Jordan, UT 84084

Shadow Mountain NeighborhoodEstimated Value: $671,000 - $763,000

5

Beds

3

Baths

3,292

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 4743 W 7470 S, West Jordan, UT 84084 and is currently estimated at $717,513, approximately $217 per square foot. 4743 W 7470 S is a home located in Salt Lake County with nearby schools including Hayden Peak Elementary School, West Hills Middle School, and Copper Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2021

Sold by

Christensen Joel

Bought by

Christensen Joel and Christensen Kami

Current Estimated Value

Purchase Details

Closed on

Jun 3, 2014

Sold by

Jacobsen Matt and Jacobsen Carol

Bought by

Christensen Joel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,286

Outstanding Balance

$222,899

Interest Rate

3.25%

Mortgage Type

FHA

Estimated Equity

$494,614

Purchase Details

Closed on

Nov 5, 2012

Sold by

Richmond American Homes Of Utah Inc

Bought by

Jacobsen Matt and Jacobsen Carol

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,960

Interest Rate

3.62%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christensen Joel | -- | First American Title | |

| Christensen Joel | -- | United Title Services | |

| Jacobsen Matt | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Christensen Joel | $304,286 | |

| Previous Owner | Jacobsen Matt | $269,960 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,285 | $659,100 | $167,600 | $491,500 |

| 2024 | $3,285 | $632,000 | $160,600 | $471,400 |

| 2023 | $3,298 | $598,000 | $151,500 | $446,500 |

| 2022 | $3,339 | $595,600 | $148,500 | $447,100 |

| 2021 | $2,838 | $460,900 | $113,900 | $347,000 |

| 2020 | $2,731 | $416,200 | $113,900 | $302,300 |

| 2019 | $2,721 | $406,700 | $89,100 | $317,600 |

| 2018 | $2,588 | $383,600 | $86,000 | $297,600 |

| 2017 | $2,421 | $357,300 | $86,000 | $271,300 |

| 2016 | $2,404 | $333,300 | $86,000 | $247,300 |

| 2015 | $2,243 | $303,200 | $85,300 | $217,900 |

| 2014 | $2,211 | $294,300 | $83,600 | $210,700 |

Source: Public Records

Map

Nearby Homes

- 7502 S Lace Wood Dr Unit 417

- 7493 S Lace Wood Dr

- 7518 Park Village Dr

- 6880 S Survey Peak Ln

- 6884 S Survey Peak Ln

- 6888 S Survey Peak Ln

- 7173 S Kristilyn Ln

- 7556 S Opal Mountain Way W Unit 311

- 7569 S Opal Mountain Way W Unit 308

- 7554 S Opal Mountain Way W Unit 310

- 7553 S Opal Mountain Way W Unit 302

- 7138 S Brittany Town Dr

- 7093 S Greensand Dr

- 4678 Emmons Dr

- 7414 Regal Hill Dr

- 7973 S Nebo Dr

- 7071 S Kristilyn Ln

- 7288 Comet Hill Cir

- 5151 Case Mountain Rd

- 7908 Cold Stone Ln Unit N3

- 4743 W 7470 S Unit 362

- 4757 W 7470 S Unit 363

- 4748 W 7510 S

- 4748 W 7510 S Unit 361

- 4752 W 7510 S Unit 360

- 7491 S 4730 W Unit 308

- 7491 S 4730 W

- 7473 S 4730 W Unit 307

- 4769 W 7470 S Unit 364

- 4769 W 7470 S

- 4738 W 7470 S

- 4738 W 7470 S Unit 305

- 4746 W 7470 S Unit 304

- 4746 W 7470 S

- 7503 S 4730 W

- 7503 S 4730 W Unit 309

- 4768 W 7510 S

- 4726 W 7470 S

- 4726 W 7470 S Unit 306

- 4764 W 7470 S Unit 303