4750 Citrus Colony Rd Loomis, CA 95650

Estimated Value: $318,000 - $975,913

3

Beds

4

Baths

2,210

Sq Ft

$283/Sq Ft

Est. Value

About This Home

This home is located at 4750 Citrus Colony Rd, Loomis, CA 95650 and is currently estimated at $625,228, approximately $282 per square foot. 4750 Citrus Colony Rd is a home located in Placer County with nearby schools including Del Oro High School and Sierra Foothills Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2025

Sold by

Jack Dale Grinder Revocable Trust and Lamar Kimberly

Bought by

Lamar Kim and Lamar Jim

Current Estimated Value

Purchase Details

Closed on

Aug 15, 2012

Sold by

Grinder Jack D

Bought by

Grinder Jack Dale

Purchase Details

Closed on

Mar 11, 2011

Sold by

Grinder Deborah Lynn

Bought by

Grinder Jack D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,000

Interest Rate

4.77%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 19, 2001

Sold by

Camillucci Mark

Bought by

Grinder Jack D and Grinder Deborah L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lamar Kim | $310,000 | None Listed On Document | |

| Lamar Kim | -- | None Listed On Document | |

| Lamar Kim | -- | None Listed On Document | |

| Grinder Jack Dale | -- | None Available | |

| Grinder Jack D | -- | First American Title Company | |

| Grinder Jack D | $75,000 | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Grinder Jack D | $191,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,421 | $1,000,000 | $350,000 | $650,000 |

| 2023 | $4,421 | $377,880 | $86,731 | $291,149 |

| 2022 | $4,331 | $370,472 | $85,031 | $285,441 |

| 2021 | $4,216 | $363,209 | $83,364 | $279,845 |

| 2020 | $4,161 | $359,486 | $82,510 | $276,976 |

| 2019 | $4,086 | $352,439 | $80,893 | $271,546 |

| 2018 | $3,874 | $345,529 | $79,307 | $266,222 |

| 2017 | $3,804 | $338,754 | $77,752 | $261,002 |

| 2016 | $3,719 | $332,113 | $76,228 | $255,885 |

| 2015 | $3,639 | $327,125 | $75,083 | $252,042 |

| 2014 | $3,580 | $320,718 | $73,613 | $247,105 |

Source: Public Records

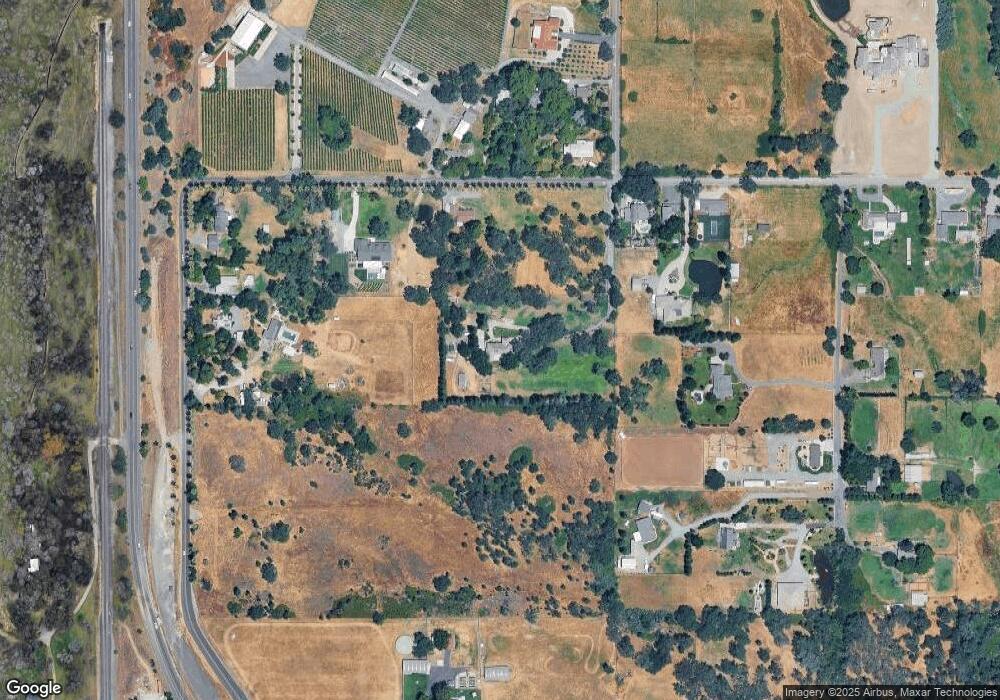

Map

Nearby Homes

- 2840 Delmar Ave

- 2615 Delmar Ave

- 4330 Leisa Ln

- 3005 Chimney Ct

- 4700 King Rd

- 3420 Grove Cir

- 3407 Reyman Ln

- 3631 Brighton Ct

- 3720 Coldwater Dr Unit 32

- 0 Tracy Ln

- 2367 Clubhouse Dr

- 3501 Saberton Ct

- 5769 Connie Ct

- 5480 Granite Dell Ct

- 4000 Coldwater Dr

- 0 Creekside Unit 223008458

- 4990 Del Rd

- 5922 Angelo Dr

- 5986 Mareta Ln

- 3261 Black Oak Dr

- 2955 Delmar Ave

- 4770 Citrus Colony Rd

- 2975 Delmar Ave

- 4790 Citrus Colony Rd

- 3131 Delmar Ave

- 2902 Delmar Ave

- 3024 Carlile Dr

- 3044 Carlile Dr

- 4808 Citrus Colony Rd

- 2958 Delmar Ave

- 2924 Delmar Ave

- 4900 Citrus Colony Rd

- 3021 Delmar Ave

- 3031 Delmar Ave

- 3055 Delmar Ave

- 1850 Delmar Ave

- 2850 Delmar Ave

- 3056 Carlile Dr

- 3005 Delmar Ave

- 3153 Delmar Ave