4785 Hoseah St Columbus, OH 43228

Estimated Value: $281,000 - $286,000

3

Beds

2

Baths

1,200

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 4785 Hoseah St, Columbus, OH 43228 and is currently estimated at $282,667, approximately $235 per square foot. 4785 Hoseah St is a home located in Franklin County with nearby schools including J W Reason Elementary School, Hilliard Tharp Sixth Grade Elementary School, and Hilliard Weaver Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2021

Sold by

Fkh Sfr C2 Lp

Bought by

Fkh Sfr C2 Lp

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,069,055

Outstanding Balance

$329,100

Interest Rate

2.8%

Mortgage Type

Commercial

Estimated Equity

-$46,433

Purchase Details

Closed on

Jan 14, 2021

Sold by

Longbrake Andrea L

Bought by

Cerberus Sfr Holdings V Lp

Purchase Details

Closed on

Aug 31, 2018

Sold by

Wellman Ursula J and Warnick Ursula

Bought by

Longbrake Andrea L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,500

Interest Rate

4.5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fkh Sfr C2 Lp | -- | Os National Llc | |

| Cerberus Sfr Holdings V Lp | $195,000 | Contract Processing & Title Ag | |

| Longbrake Andrea L | $155,000 | Independent Title Box |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fkh Sfr C2 Lp | $2,069,055 | |

| Previous Owner | Longbrake Andrea L | $139,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,544 | $78,760 | $15,580 | $63,180 |

| 2023 | $3,950 | $78,760 | $15,580 | $63,180 |

| 2022 | $3,358 | $53,590 | $8,440 | $45,150 |

| 2021 | $3,271 | $53,590 | $8,440 | $45,150 |

| 2020 | $3,262 | $53,590 | $8,440 | $45,150 |

| 2019 | $2,937 | $41,200 | $6,480 | $34,720 |

| 2018 | $2,795 | $41,200 | $6,480 | $34,720 |

| 2017 | $2,925 | $41,200 | $6,480 | $34,720 |

| 2016 | $2,844 | $37,110 | $6,480 | $30,630 |

| 2015 | $2,666 | $37,110 | $6,480 | $30,630 |

| 2014 | $2,671 | $37,110 | $6,480 | $30,630 |

| 2013 | $1,288 | $35,315 | $6,160 | $29,155 |

Source: Public Records

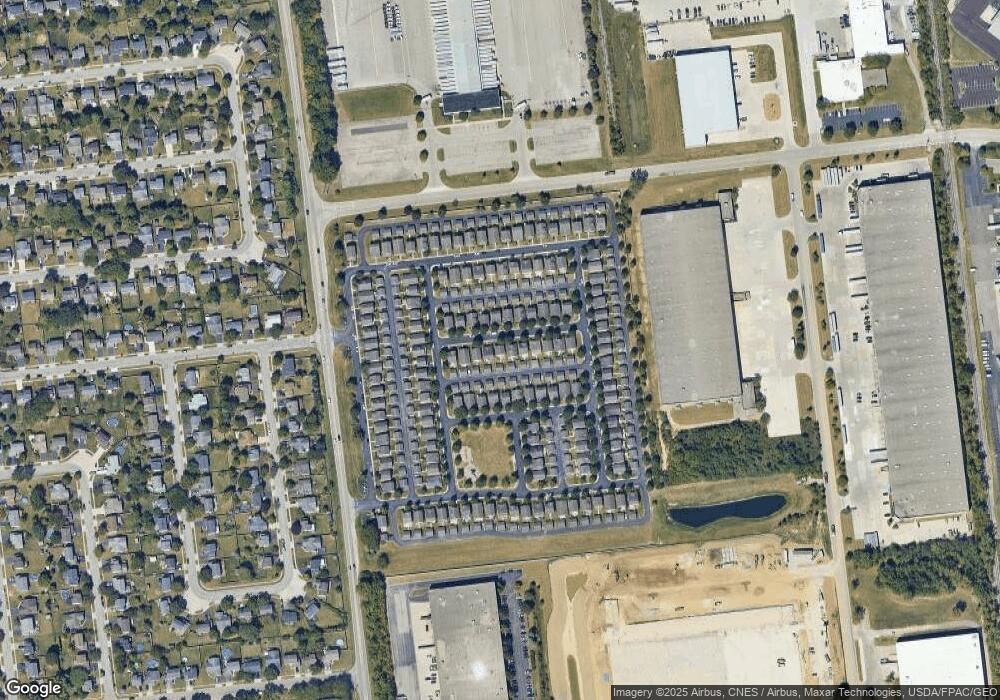

Map

Nearby Homes

- 3012 Papin St Unit 39

- 4843 Stoneybrook Blvd Unit 30E

- 4857 Stoneybrook Blvd Unit 29E

- 4862 Stoneybrook Blvd Unit 24E

- 4945 Singleton Dr Unit 13C

- 4995 Singleton Dr

- 4995 Singleton Dr Unit 18c

- 5041 Stoneybrook Blvd Unit 9E

- 2756 Shelton Cir

- 4976 Shady Oak Dr

- 3267 Scioto Farms Dr

- 5062 Stoneybrook Blvd Unit 3F

- 2967 Castlebrook Ave

- 5078 Stoneybrook Blvd Unit 2E

- 5080 Stoneybrook Blvd Unit 2D

- 2759 Lyndley Ct

- 3255 Reed Point Dr

- 3264 Prairie Gardens Dr

- 5052 Bressler Dr

- 5208 Springdale Blvd

- 4785 Hoseah St Unit 124

- 4789 Hoseah St Unit 123

- 4781 Hoseah St Unit 125

- 4793 Hoseah St Unit 122

- 4777 Hoseah St Unit 126

- 4786 Hoseah St Unit 115

- 4790 Hoseah St Unit 116

- 4773 Hoseah St Unit 127

- 4797 Hoseah St Unit 121

- 4782 Hoseah St Unit 114

- 4778 Hoseah St Unit 113

- 4794 Hoseah St Unit 117

- 4780 Benoit St Unit 136

- 4769 Hoseah St Unit 128

- 4784 Benoit St Unit 137

- 4774 Hoseah St

- 4774 Hoseah St Unit 112

- 4801 Hoseah St Unit 120

- 4798 Hoseah St Unit 118

- 4788 Benoit St Unit 138