4799 4799 Via Palm Lks # 1601 Unit 1601 West Palm Beach, FL 33417

Lakeside Green NeighborhoodEstimated Value: $215,348 - $272,000

2

Beds

2

Baths

970

Sq Ft

$240/Sq Ft

Est. Value

About This Home

This home is located at 4799 4799 Via Palm Lks # 1601 Unit 1601, West Palm Beach, FL 33417 and is currently estimated at $232,837, approximately $240 per square foot. 4799 4799 Via Palm Lks # 1601 Unit 1601 is a home located in Palm Beach County with nearby schools including Seminole Trails Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2020

Sold by

De Nine Llc

Bought by

Kenti Llc

Current Estimated Value

Purchase Details

Closed on

Jan 17, 2020

Sold by

Rogelio Llc

Bought by

De Nine Llc

Purchase Details

Closed on

Dec 9, 2019

Sold by

Altamirano Osvaldo Rene

Bought by

Rogelio Llc

Purchase Details

Closed on

Jun 16, 2014

Sold by

Rock Island Foreclosure Llc

Bought by

Altamirano Osvaldo Rene

Purchase Details

Closed on

Sep 9, 2013

Sold by

The Bank Of New York Mellon

Bought by

Rock Island Foreclosure Llc

Purchase Details

Closed on

Jun 27, 2013

Sold by

Smith Chris and Parchment Marsha

Bought by

The Bank Of New Mellon

Purchase Details

Closed on

May 19, 2006

Sold by

Kmc Palm Lake Apartments Florida Llc

Bought by

Smith Chris

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,030

Interest Rate

9.6%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kenti Llc | -- | Attorney | |

| De Nine Llc | $132,000 | Attorney | |

| Rogelio Llc | -- | None Available | |

| Altamirano Osvaldo Rene | $95,900 | Attorney | |

| Rock Island Foreclosure Llc | $72,399 | Premium Title Services Inc | |

| The Bank Of New Mellon | $38,800 | None Available | |

| Smith Chris | $172,900 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Smith Chris | $121,030 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,001 | $165,443 | -- | -- |

| 2024 | $3,001 | $150,403 | -- | -- |

| 2023 | $2,750 | $136,730 | $0 | $0 |

| 2022 | $2,530 | $124,300 | $0 | $0 |

| 2021 | $2,256 | $113,000 | $0 | $113,000 |

| 2020 | $2,164 | $108,000 | $0 | $108,000 |

| 2019 | $2,078 | $102,000 | $0 | $102,000 |

| 2018 | $1,865 | $96,000 | $0 | $96,000 |

| 2017 | $1,745 | $90,000 | $0 | $0 |

| 2016 | $1,615 | $75,900 | $0 | $0 |

| 2015 | $1,504 | $69,000 | $0 | $0 |

| 2014 | $1,425 | $64,000 | $0 | $0 |

Source: Public Records

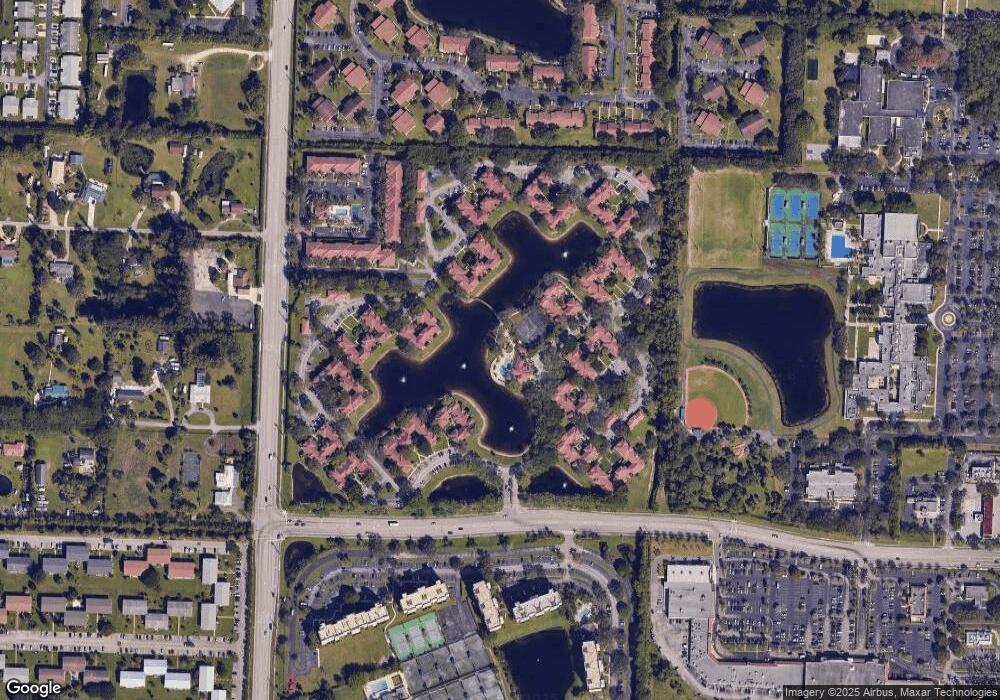

Map

Nearby Homes

- 4791 Via Palm Lakes Unit 1706

- 4791 Via Palm Lakes Unit 1701

- 4899 Sable Pine Cir Unit A2

- 4941 Sable Pine Cir Unit B1

- 4879 Via Palm Lakes Unit 622

- 4955 Sable Pine Cir Unit A1

- 4855 Via Palm Lakes Unit 902

- 4969 Sable Pine Cir Unit A2

- 4871 Sable Pine B2 Cir

- 4863 Via Palm Lakes Unit 806

- 4863 Via Palm Lakes Unit 812

- 3594 Alder Dr Unit H1

- 4992 Sable Pine Cir Unit B1

- 4996 Sable Pine Cir Unit B2

- 4996 Sable Pine Cir Unit C1

- 3606 Alder Dr Unit F2

- 3606 Alder Dr Unit E3

- 3618 Alder Dr Unit D2

- 4759 Sable Pine Cir Unit A1

- 4759 Sable Pine Cir

- 4799 Via Palm Lakes Unit 12

- 4799 Via Palm Lakes Unit 3

- 4799 Via Palm Lakes

- 4799 Via Palm Lakes Unit 5

- 4799 Via Palm Lakes Unit 1

- 4799 Via Palm Lakes Unit 1606

- 4799 Via Palm Lakes Unit 1602

- 4799 Via Palm Lakes Unit 1622

- 4799 Via Palm Lakes Unit 1612

- 4799 Via Palm Lakes Unit 1601

- 4799 Via Palm Lakes Unit 1611

- 4799 Via Palm Lakes Unit 1615

- 4799 Via Palm Lakes Unit 1609

- 4799 Via Palm Lakes Unit 1614

- 4799 Via Palm Lakes Unit 1620

- 4799 Via Palm Lakes Unit 1621

- 4799 Via Palm Lakes Unit 1604

- 4799 Via Palm Lakes Unit 1616

- 4799 Via Palm Lakes Unit 1608

- 4799 Via Palm Lakes Unit 1610