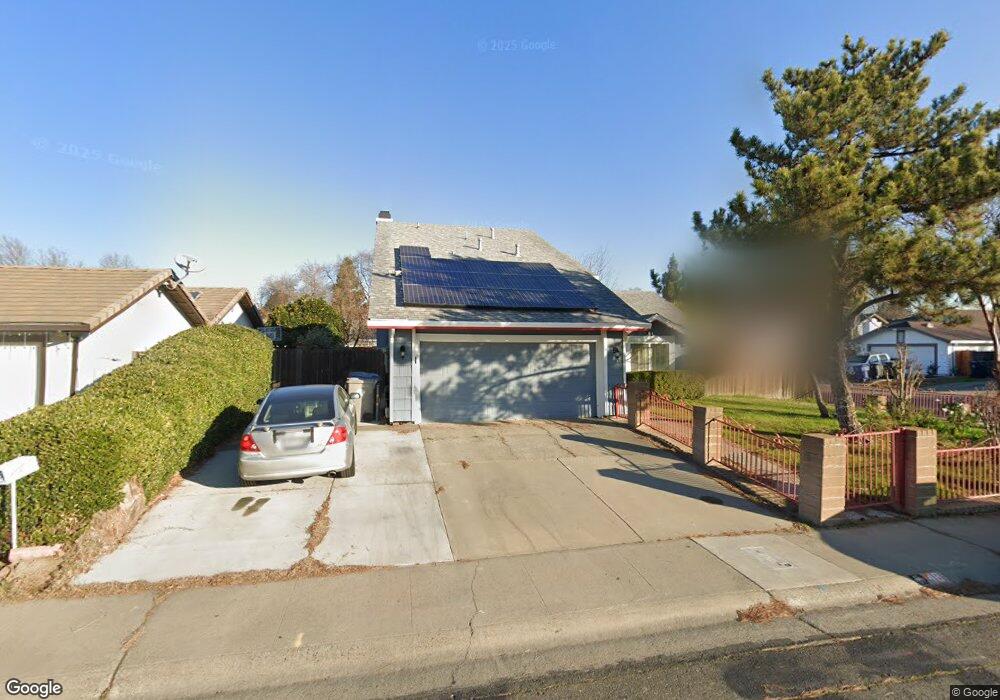

48 Tundra Way Sacramento, CA 95834

South Natomas NeighborhoodEstimated Value: $444,733 - $461,000

4

Beds

3

Baths

1,285

Sq Ft

$351/Sq Ft

Est. Value

About This Home

This home is located at 48 Tundra Way, Sacramento, CA 95834 and is currently estimated at $451,183, approximately $351 per square foot. 48 Tundra Way is a home located in Sacramento County with nearby schools including Garden Valley Elementary, Rio Tierra Junior High School, and Grant Union High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2016

Sold by

Wenger Robert W and Wenger Jeanne J

Bought by

Joyce Roberet William Wenger and Joyce Jeanne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Outstanding Balance

$154,610

Interest Rate

3.62%

Mortgage Type

New Conventional

Estimated Equity

$296,573

Purchase Details

Closed on

Apr 8, 2016

Sold by

Surviving Efren C

Bought by

Wenger Robert W and Wenger Jeanne J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Outstanding Balance

$154,610

Interest Rate

3.62%

Mortgage Type

New Conventional

Estimated Equity

$296,573

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Joyce Roberet William Wenger | -- | None Available | |

| Wenger Robert W | $260,000 | Stewart Title Of Sacramento |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wenger Robert W | $195,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,845 | $307,780 | $88,781 | $218,999 |

| 2024 | $3,845 | $301,746 | $87,041 | $214,705 |

| 2023 | $3,862 | $295,831 | $85,335 | $210,496 |

| 2022 | $3,640 | $290,031 | $83,662 | $206,369 |

| 2021 | $3,625 | $284,345 | $82,022 | $202,323 |

| 2020 | $3,590 | $281,430 | $81,181 | $200,249 |

| 2019 | $3,544 | $275,913 | $79,590 | $196,323 |

| 2018 | $3,378 | $270,504 | $78,030 | $192,474 |

| 2017 | $3,453 | $265,200 | $76,500 | $188,700 |

| 2016 | $2,183 | $165,697 | $36,045 | $129,652 |

| 2015 | $2,046 | $163,209 | $35,504 | $127,705 |

| 2014 | $2,080 | $160,013 | $34,809 | $125,204 |

Source: Public Records

Map

Nearby Homes

- 19 Azorean Ct

- 3318 Lunar Sky Walk

- 3306 Lunar Sky Walk

- 1087 Millet Way

- 3318 Aurora Sky Walk

- 1371 Old Dr W

- 981 San Juan Rd

- 969 San Juan Rd

- 1053 Westward Way

- 3125 Iberian Dr

- Plan 1296 at Skylar

- Plan 1415 at Skylar

- Plan 1306 at Skylar

- Plan 1387 at Skylar

- 3649 Rio Pacifica Way

- 3577 Del Sol Way

- 1355 Senida Way

- 864 Rancho Roble Way

- 56 Ishi Cir

- 867 Brierglen Way

- 52 Tundra Way

- 1200 Chuckwagon Dr

- 56 Tundra Way

- 1210 Chuckwagon Dr

- 9 Pasture Ct

- 5 Pasture Ct

- 47 Tundra Way

- 1 Pasture Ct

- 15 Pasture Ct

- 1220 Chuckwagon Dr

- 51 Tundra Way

- 60 Tundra Way

- 1170 Chuckwagon Dr

- 55 Tundra Way

- 19 Pasture Ct

- 1230 Chuckwagon Dr

- 1160 Chuckwagon Dr

- 59 Tundra Way

- 23 Pasture Ct

- 72 Tundra Way