4821 Flying Cloud Way Carlsbad, CA 92008

Hedionda Point NeighborhoodEstimated Value: $1,176,761 - $1,375,000

2

Beds

3

Baths

1,740

Sq Ft

$757/Sq Ft

Est. Value

About This Home

This home is located at 4821 Flying Cloud Way, Carlsbad, CA 92008 and is currently estimated at $1,317,190, approximately $757 per square foot. 4821 Flying Cloud Way is a home located in San Diego County with nearby schools including Kelly Elementary School, Carlsbad High School, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2019

Sold by

Jordan Dennis and Jordan Mary Lou

Bought by

Mary Lou And Dennis Jordan Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Mar 3, 1999

Sold by

Revelle Family Trust and Paul

Bought by

Jordan Dennis and Jordan Mary Lou

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,000

Interest Rate

6.73%

Purchase Details

Closed on

Jul 22, 1996

Sold by

Revelle Paul and Revelle Dorothy J

Bought by

Revelle Paul and Revelle Dorothy J

Purchase Details

Closed on

Feb 24, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mary Lou And Dennis Jordan Revocable Trust | -- | -- | |

| Jordan Dennis | $282,500 | First American Title Ins Co | |

| Revelle Paul | -- | -- | |

| -- | $159,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jordan Dennis | $226,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,663 | $442,856 | $144,335 | $298,521 |

| 2024 | $4,663 | $434,173 | $141,505 | $292,668 |

| 2023 | $4,638 | $425,661 | $138,731 | $286,930 |

| 2022 | $4,567 | $409,134 | $133,345 | $275,789 |

| 2021 | $4,532 | $409,134 | $133,345 | $275,789 |

| 2020 | $4,502 | $404,940 | $131,978 | $272,962 |

| 2019 | $4,421 | $397,001 | $129,391 | $267,610 |

| 2018 | $4,235 | $389,217 | $126,854 | $262,363 |

| 2017 | $4,164 | $381,586 | $124,367 | $257,219 |

| 2016 | $3,997 | $374,105 | $121,929 | $252,176 |

| 2015 | $3,981 | $368,487 | $120,098 | $248,389 |

| 2014 | $3,915 | $361,270 | $117,746 | $243,524 |

Source: Public Records

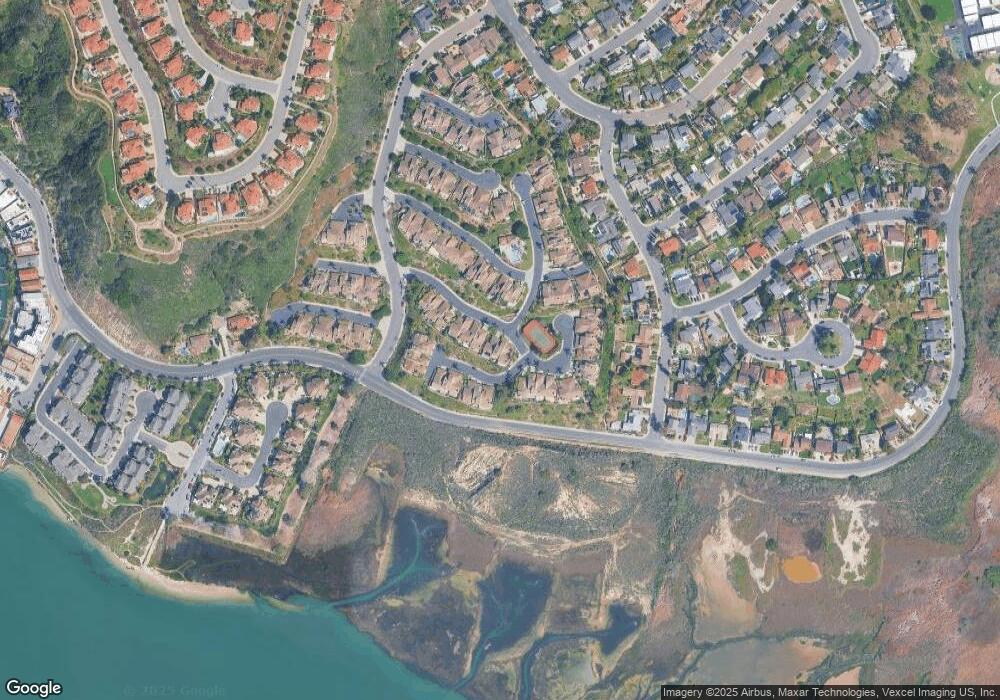

Map

Nearby Homes

- 4781 Argosy Ln

- 4843 Flying Cloud Way

- 4735 Bryce Cir

- 4705 Marina Dr Unit 10

- 4747 Marina Dr Unit 23

- 4814 Refugio Ave

- 4874 Park Dr

- 4876 Park Dr

- 1741 Bruce Rd

- 4640 Sunburst Rd

- 0 Adams St Unit OC24201399

- 4623 Telescope Ave

- 0 Sunny Creek Unit PI25230627

- 0 Park Dr

- 4143 Sunnyhill Dr

- 2508 Chamomile Ln

- 2541 Delphinium Ln

- 2513 Delphinium Ln

- 1095 Hoover St

- 4718 Amberwood Ct

- 4819 Flying Cloud Way

- 4823 Flying Cloud Way

- 4817 Flying Cloud Way

- 4815 Flying Cloud Way

- 4813 Flying Cloud Way Unit 2

- 4825 Vigilant Way

- 4827 Flying Cloud Way

- 4811 Flying Cloud Way

- 4821 Vigilant Way

- 4819 Vigilant Way

- 4817 Vigilant Way

- 4829 Argosy Ln

- 4827 Argosy Ln

- 4829 Flying Cloud Way

- 4815 Vigilant Way

- 4825 Argosy Ln

- 4809 Flying Cloud Way

- 4831 Flying Cloud Way

- 4823 Argosy Ln

- 4811 Vigilant Way