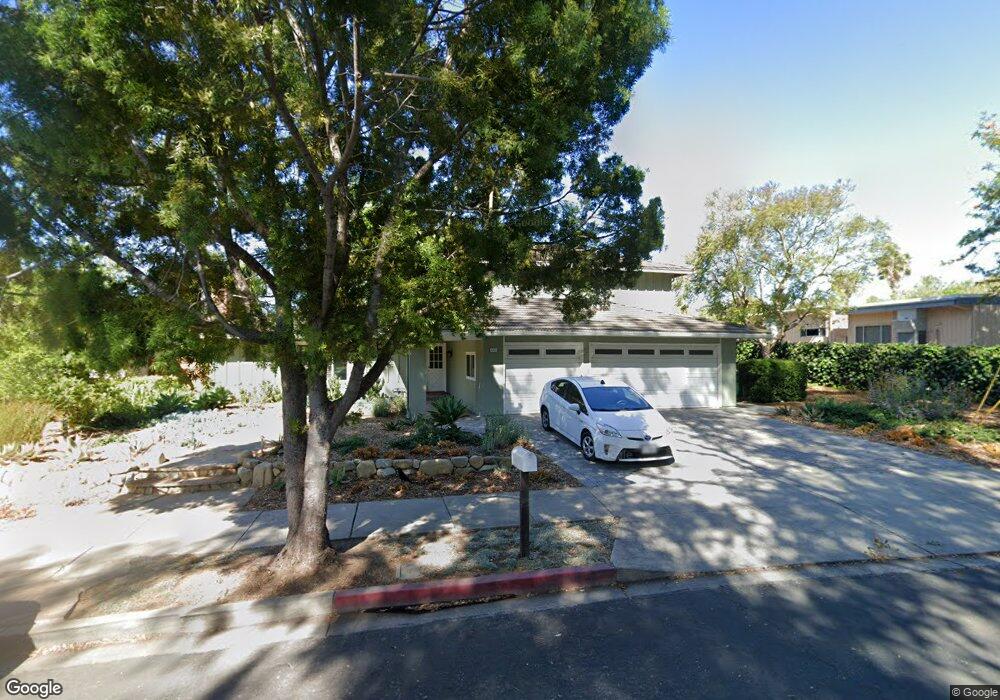

485 N La Patera Ln Goleta, CA 93117

Estimated Value: $1,664,000 - $2,005,000

4

Beds

3

Baths

2,233

Sq Ft

$838/Sq Ft

Est. Value

About This Home

This home is located at 485 N La Patera Ln, Goleta, CA 93117 and is currently estimated at $1,870,573, approximately $837 per square foot. 485 N La Patera Ln is a home located in Santa Barbara County with nearby schools including Goleta Valley Junior High School, Dos Pueblos Senior High School, and Montessori Center School of Santa Barbara.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2016

Sold by

Wyss Andre R and Walker Susan S

Bought by

The Wyss Walker Family Trust and Walker Susan S

Current Estimated Value

Purchase Details

Closed on

Aug 9, 2001

Sold by

Pettijohn Kevin L and Pettijohn Janis R

Bought by

Wyss Andre and Walker Susan S

Purchase Details

Closed on

Mar 2, 1999

Sold by

Pettijohn Kevin L and Pettijohn Janis R

Bought by

Pettijohn Kevin L and Pettijohn Janis R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

6.42%

Purchase Details

Closed on

Feb 23, 1999

Sold by

Pettijohn Kevin L and Pettijohn Janis R

Bought by

Pettijohn Kevin L and Pettijohn Janis R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

6.42%

Purchase Details

Closed on

May 10, 1995

Sold by

Pettijohn Kevin L and Pettijohn Janis R

Bought by

Pettijohn Kevin L and Pettijohn Janis R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Wyss Walker Family Trust | -- | None Available | |

| Wyss Andre | -- | First American Title | |

| Pettijohn Kevin L | -- | Stewart Title | |

| Pettijohn Kevin L | -- | Stewart Title | |

| Pettijohn Kevin L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Pettijohn Kevin L | $188,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,724 | $1,003,070 | $517,047 | $486,023 |

| 2023 | $10,724 | $964,121 | $496,970 | $467,151 |

| 2022 | $10,250 | $945,218 | $487,226 | $457,992 |

| 2021 | $10,080 | $926,685 | $477,673 | $449,012 |

| 2020 | $9,812 | $917,184 | $472,776 | $444,408 |

| 2019 | $9,631 | $899,201 | $463,506 | $435,695 |

| 2018 | $9,450 | $881,570 | $454,418 | $427,152 |

| 2017 | $9,296 | $864,285 | $445,508 | $418,777 |

| 2016 | $9,055 | $847,339 | $436,773 | $410,566 |

| 2015 | $8,934 | $834,612 | $430,213 | $404,399 |

| 2014 | $8,777 | $818,264 | $421,786 | $396,478 |

Source: Public Records

Map

Nearby Homes

- 6252 Avenida Ganso

- 677 Windsor Ave

- 258 Iris Ave

- 6193 Barrington Dr

- 6236 Cumberland Dr

- 6279 Newcastle Ave

- 6528 Calle Koral

- 0 N Fairview Ave Unit SR24087795

- 00 N Fairview Ave

- 5964 Berkeley Rd

- 6633 Calle Koral

- 243 Moreton Bay Ln Unit 2

- 267 Moreton Bay Ln Unit 2

- 6658 Sand Castle Place

- 313 Moreton Bay Ln Unit 1

- 5859 Mandarin Dr

- 5745 Berkeley Rd

- 5776 Alondra Dr

- 5710 Stow Canyon Rd

- 1192 Edward Place

- 473 N La Patera Ln

- 456 Camino Talavera

- 452 Camino Talavera

- 461 N La Patera Ln

- 460 Camino Talavera

- 446 Camino Talavera

- 449 N La Patera Ln

- 438 Camino Talavera

- 0 Camino Talavera Unit RN-2962

- 0 Camino Talavera

- 466 Camino Talavera

- 465 Windsor Ave

- 433 N La Patera Ln

- 453 Windsor Ave

- 477 Windsor Ave

- 430 Camino Talavera

- 441 Windsor Ave

- 474 Camino Talavera

- 491 Windsor Ave

- 447 Camino Talavera