4881 Auston St Unit 4881 Springfield, OH 45502

Estimated Value: $179,000 - $191,000

2

Beds

2

Baths

1,252

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 4881 Auston St Unit 4881, Springfield, OH 45502 and is currently estimated at $184,829, approximately $147 per square foot. 4881 Auston St Unit 4881 is a home located in Clark County with nearby schools including Rolling Hills Elementary School, Jose Antonio Navarro Elementary School, and Northridge Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 7, 2023

Sold by

Gnau Raelene S

Bought by

Alice A Mcginnis Trust and Thatcher

Current Estimated Value

Purchase Details

Closed on

Nov 5, 2013

Sold by

Corbin Doris J

Bought by

Gnau Raelene S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,000

Interest Rate

4.23%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 14, 2007

Sold by

Kennedy Eva Louise and Kennedy Michael

Bought by

Corbin Doris J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,500

Interest Rate

6.71%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alice A Mcginnis Trust | $169,900 | Team Title & Closing Services | |

| Gnau Raelene S | $80,000 | Attorney | |

| Corbin Doris J | $89,900 | Ohio Real Estate Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gnau Raelene S | $64,000 | |

| Previous Owner | Corbin Doris J | $64,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,543 | $57,770 | $7,050 | $50,720 |

| 2024 | -- | $34,520 | $6,130 | $28,390 |

| 2023 | $1,072 | $34,520 | $6,130 | $28,390 |

| 2022 | $1,094 | $34,520 | $6,130 | $28,390 |

| 2021 | $1,239 | $33,440 | $4,380 | $29,060 |

| 2020 | $1,240 | $33,440 | $4,380 | $29,060 |

| 2019 | $1,264 | $33,440 | $4,380 | $29,060 |

| 2018 | $1,060 | $28,640 | $4,990 | $23,650 |

| 2017 | $908 | $27,707 | $4,988 | $22,719 |

| 2016 | $902 | $27,707 | $4,988 | $22,719 |

| 2015 | $881 | $27,969 | $5,250 | $22,719 |

| 2014 | $881 | $27,969 | $5,250 | $22,719 |

| 2013 | $860 | $27,969 | $5,250 | $22,719 |

Source: Public Records

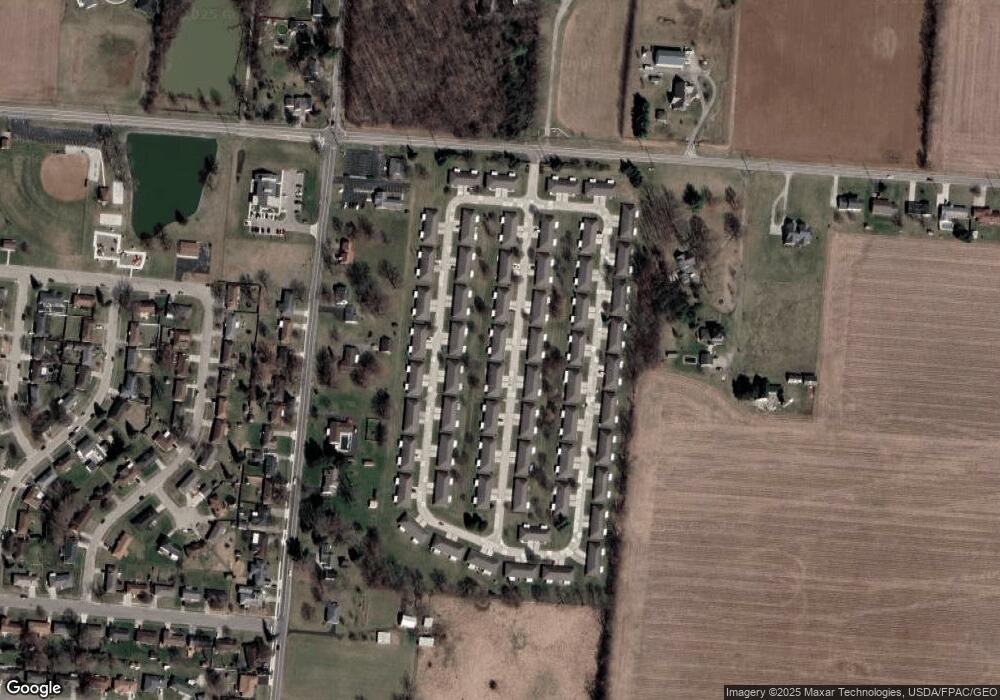

Map

Nearby Homes

- 1709 Thomas Dr

- 5220 Ridgewood Rd E

- 4446 Ridgewood Rd E Unit 3

- 5249 Taywell Dr

- 1707 Berwick Dr

- 1836 Dunseth Ln

- 3969 Covington Dr Unit 3969

- 3963 Covington Dr Unit 3963

- 4028 Ryland Dr Unit 4028

- 1731 Elaina Dr

- 1033 Westmont Cir

- Pendleton Plan at

- Holcombe Plan at

- Newcastle Plan at

- Chatham Plan at

- 1708 New Castle Ln

- 970 Forest Edge Ave

- 1470 Oldham Dr Unit 12

- 4455 Derr Rd

- 916 Sawmill Ct

- 4881 Auston St

- 4881 Auston St

- 4883 Auston St Unit 4883

- 4871 Auston St

- 4882 Auston St

- 4882 Auston St

- 4882 Auston St

- 4893 Auston St

- 4869 Auston St

- 4884 Auston St Unit 4884

- 4890 Brannan Dr W Unit 4890

- 4892 Brannan Dr W

- 4872 Auston St Unit 4872

- 4880 Brannan Dr W

- 4895 Auston St Unit 4895

- 4870 Auston St Unit 4870

- 4894 Auston St

- 4902 Brannan Dr W Unit 4902

- 4878 Brannan Dr W Unit 4878

- 4859 Auston St Unit 4859