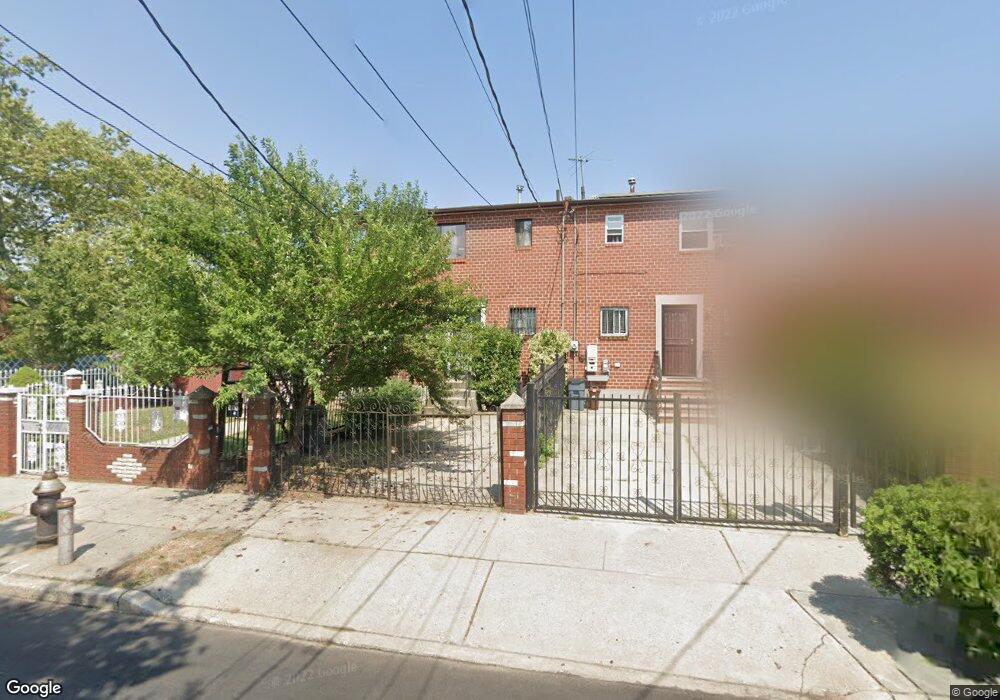

489 Christopher Ave Unit Building Brooklyn, NY 11212

Brownsville NeighborhoodEstimated Value: $572,000 - $752,000

--

Bed

2

Baths

1,128

Sq Ft

$575/Sq Ft

Est. Value

About This Home

This home is located at 489 Christopher Ave Unit Building, Brooklyn, NY 11212 and is currently estimated at $648,436, approximately $574 per square foot. 489 Christopher Ave Unit Building is a home located in Kings County with nearby schools including P.S. 165 Ida Posner, P.S. 150 - Christopher, and P.S. 156 Waverly.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2024

Sold by

Christopher 489 2 Llc

Bought by

Martinez Alba and Rosario Oliver

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$569,999

Outstanding Balance

$560,024

Interest Rate

6.95%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$88,412

Purchase Details

Closed on

Dec 13, 2022

Sold by

Bank Of America Na

Bought by

Christopher 489 2 Llc

Purchase Details

Closed on

Jun 13, 2019

Sold by

Blank Esq Helene

Bought by

Bank Of America N A

Purchase Details

Closed on

Jun 15, 1989

Sold by

Green Edward Lee

Bought by

Green Deloise and Green Edward Lee

Purchase Details

Closed on

Feb 9, 1989

Sold by

East Bklyn Chu

Bought by

Green Edward Lee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martinez Alba | $600,000 | -- | |

| Martinez Alba | $600,000 | -- | |

| Christopher 489 2 Llc | $364,661 | -- | |

| Christopher 489 2 Llc | $364,661 | -- | |

| Bank Of America N A | $410,000 | -- | |

| Bank Of America N A | $410,000 | -- | |

| Green Deloise | -- | -- | |

| Green Deloise | -- | -- | |

| Green Edward Lee | -- | -- | |

| Green Edward Lee | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martinez Alba | $569,999 | |

| Closed | Martinez Alba | $569,999 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,373 | $34,260 | $13,560 | $20,700 |

| 2024 | $4,373 | $32,520 | $13,560 | $18,960 |

| 2023 | $4,422 | $33,120 | $13,560 | $19,560 |

| 2022 | $4,314 | $34,440 | $13,560 | $20,880 |

| 2021 | $4,290 | $30,840 | $13,560 | $17,280 |

| 2020 | $3,218 | $25,140 | $13,560 | $11,580 |

| 2019 | $3,503 | $25,140 | $13,560 | $11,580 |

| 2018 | $3,401 | $18,144 | $11,486 | $6,658 |

| 2017 | $3,371 | $18,007 | $11,899 | $6,108 |

| 2016 | $3,086 | $16,988 | $12,629 | $4,359 |

| 2015 | $1,914 | $16,027 | $11,201 | $4,826 |

| 2014 | $1,914 | $15,120 | $11,280 | $3,840 |

Source: Public Records

Map

Nearby Homes

- 699 Sackman St

- 546 Powell St

- 797 Mother Gaston Blvd

- 563 Powell St

- 258 Lott Ave

- 555 Christopher Ave

- 578 Christopher Ave

- 587 Osborn St

- 533 Snediker Ave

- 442 Newport St

- 584 Hinsdale St

- 504 Thatford Ave

- 892 Mother Gaston Blvd

- 541 Hinsdale St

- 589 Hinsdale St

- 578 Williams Ave

- 576 Williams Ave

- 923 Rockaway Ave

- 582 Williams Ave

- 632 Osborn St

- 489 Christopher Ave

- 491 Christopher Ave

- 487 Christopher Ave

- 493 Christopher Ave

- 495 Christopher Ave

- 497 Christopher Ave

- 499 Christopher Ave

- 702 Sackman St

- 700 Sackman St

- 700 Sackman St Unit 2

- 706 Sackman St

- 483 Christopher Ave

- 708 Sackman St

- 501 Christopher Ave

- 712 Sackman St

- 310 Newport St

- 714 Sackman St

- 503 Christopher Ave

- 481 Christopher Ave

- 718 Sackman St