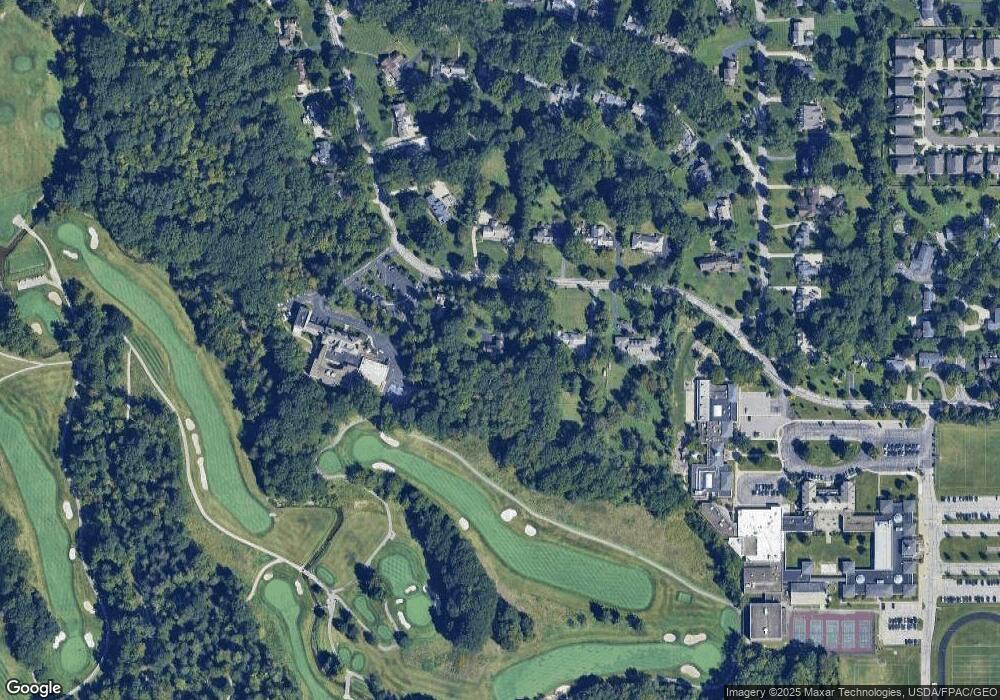

4892 Clubside Rd Cleveland, OH 44124

Estimated Value: $506,000 - $630,968

5

Beds

6

Baths

3,629

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 4892 Clubside Rd, Cleveland, OH 44124 and is currently estimated at $569,242, approximately $156 per square foot. 4892 Clubside Rd is a home located in Cuyahoga County with nearby schools including Sunview Elementary School, Greenview Upper Elementary School, and Memorial Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 13, 2006

Sold by

Valentine David and Valentine Ellen

Bought by

Schaul Frances Mitchell

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$312,200

Outstanding Balance

$175,756

Interest Rate

6.2%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$393,486

Purchase Details

Closed on

Jan 31, 2005

Sold by

Calfee Peter H

Bought by

Valentine David and Valentine Ellen

Purchase Details

Closed on

Feb 28, 1992

Sold by

Calfee Nancy L

Bought by

Calfee, Nancy L (Trustee)

Purchase Details

Closed on

Jan 1, 1975

Bought by

Calfee Nancy L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schaul Frances Mitchell | $367,350 | Chicago Title Insurance C | |

| Valentine David | $345,000 | Chicago Title Insurance C | |

| Calfee, Nancy L (Trustee) | -- | -- | |

| Calfee Nancy L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schaul Frances Mitchell | $312,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,731 | $168,735 | $45,990 | $122,745 |

| 2023 | $10,638 | $123,210 | $34,200 | $89,010 |

| 2022 | $10,577 | $123,200 | $34,200 | $89,010 |

| 2021 | $10,487 | $123,200 | $34,200 | $89,010 |

| 2020 | $10,859 | $112,000 | $31,080 | $80,920 |

| 2019 | $9,804 | $320,000 | $88,800 | $231,200 |

| 2018 | $9,752 | $112,000 | $31,080 | $80,920 |

| 2017 | $10,471 | $110,750 | $27,970 | $82,780 |

| 2016 | $10,396 | $110,750 | $27,970 | $82,780 |

| 2015 | $9,667 | $110,750 | $27,970 | $82,780 |

| 2014 | $9,667 | $103,500 | $26,150 | $77,350 |

Source: Public Records

Map

Nearby Homes

- 5027 Bristol Ct

- 1667 Richmond Rd

- 1512 Parkside Cir

- 5079 Haverford Dr

- 1691 Harwich Rd

- 5144 Oakmont Dr

- 4695 Mayfield Rd Unit A

- 4685 Mayfield Rd Unit F

- 5159 Haverford Dr

- 1333 Clearview Rd

- 4800 Farnhurst Rd

- 1503 Oakmount Rd

- 5204 Haverford Dr

- 5103 Eastover Rd

- 1827 Maywood Rd

- 5243 Oakmont Dr

- 1834 Maywood Rd

- 0 River Trail

- 1884 Maywood Rd

- 4482 Shirley Dr

- 4916 Clubside Rd

- 4895 Clubside Rd

- 4907 Clubside Rd

- 4940 Clubside Rd

- 4923 Clubside Rd

- 1619 Clubside Rd

- 4939 Clubside Rd

- 1599 Clubside Rd

- 4955 Clubside Rd

- 1600 Clubside Rd

- 1581 Clubside Rd

- 4920 Middledale Rd

- 4908 Middledale Rd

- 4932 Middledale Rd

- 4986 Countryside Rd

- 4896 Middledale Rd

- 1588 Clubside Rd

- 4970 Middledale Rd

- 4956 Middledale Rd

- 4884 Middledale Rd