4918 Auston St Unit 4918 Springfield, OH 45502

Estimated Value: $177,000 - $189,000

2

Beds

2

Baths

1,252

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 4918 Auston St Unit 4918, Springfield, OH 45502 and is currently estimated at $183,165, approximately $146 per square foot. 4918 Auston St Unit 4918 is a home located in Clark County with nearby schools including Rolling Hills Elementary School, Northridge Middle School, and Kenton Ridge Middle & High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2019

Sold by

Estate Of Mark Lee Cook

Bought by

Cook Linda D

Current Estimated Value

Purchase Details

Closed on

Jun 7, 2002

Sold by

Stuckey Michael D and Stuckey Betty L

Bought by

Cook Mark L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

6.95%

Purchase Details

Closed on

May 26, 1999

Sold by

Poole Rodger L

Bought by

Stuckey Michael D and Stuckey Betty L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,900

Interest Rate

6.92%

Purchase Details

Closed on

Dec 4, 1995

Sold by

Payne Howard E

Bought by

Rodger L Poole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$14,000

Interest Rate

7.44%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cook Linda D | -- | None Available | |

| Cook Mark L | $89,500 | -- | |

| Stuckey Michael D | $84,900 | -- | |

| Rodger L Poole | $67,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Cook Mark L | $85,000 | |

| Previous Owner | Stuckey Michael D | $64,900 | |

| Previous Owner | Rodger L Poole | $14,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,396 | $33,000 | $6,130 | $26,870 |

| 2023 | $1,396 | $33,000 | $6,130 | $26,870 |

| 2022 | $1,401 | $33,000 | $6,130 | $26,870 |

| 2021 | $1,582 | $31,540 | $4,380 | $27,160 |

| 2020 | $1,583 | $31,540 | $4,380 | $27,160 |

| 2019 | $1,613 | $31,540 | $4,380 | $27,160 |

| 2018 | $1,502 | $28,180 | $4,990 | $23,190 |

| 2017 | $1,287 | $26,643 | $4,988 | $21,655 |

| 2016 | $1,278 | $26,643 | $4,988 | $21,655 |

| 2015 | $1,232 | $26,905 | $5,250 | $21,655 |

| 2014 | $1,232 | $26,905 | $5,250 | $21,655 |

| 2013 | $1,203 | $26,905 | $5,250 | $21,655 |

Source: Public Records

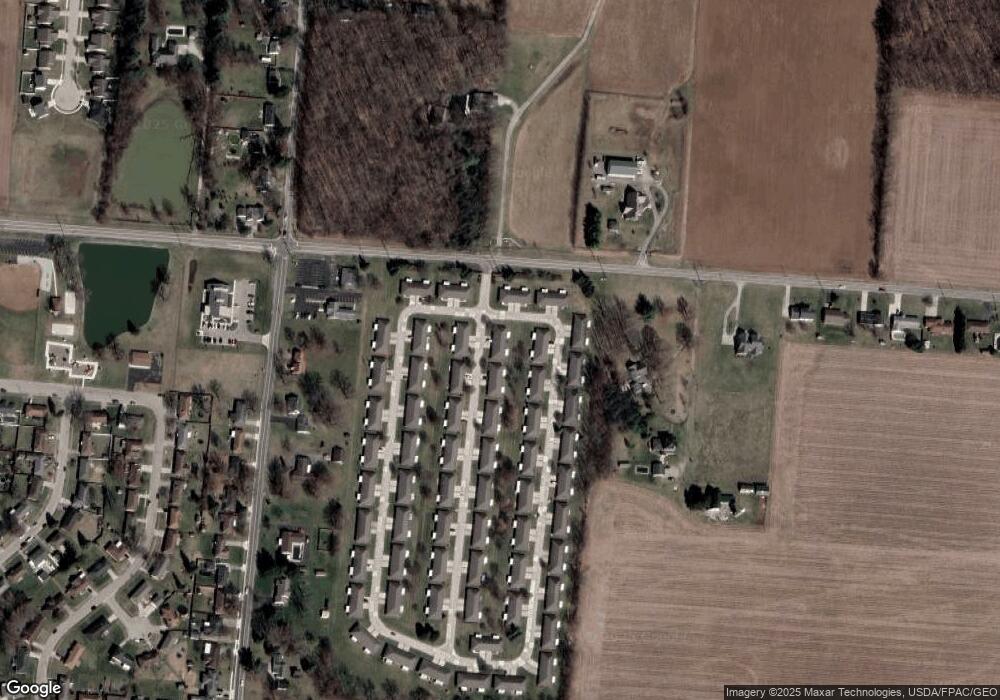

Map

Nearby Homes

- 4924 Brannan Dr E Unit 4924

- 4849 Ashley Dr

- 4644 Middle Urbana Rd

- 4800 Mesa Ln

- 4620 Eldora Dr

- 4620 Eldora St

- 1709 Thomas Dr

- 4740 Merrimont Ave

- 4825 Chippendale Dr

- 1835 Sierra Ave

- 5220 Ridgewood Rd E

- 4524 Ridgewood Rd E

- 4316 Phoenix Dr

- 4512 Ridgewood Rd E

- 4321 Tulane Rd

- 5127 Stoneridge Dr

- 4438 Tacoma St

- 4249 Reno Rd

- 4920 Auston St

- 4908 Auston St Unit 4908

- 4906 Auston St

- 4917 Auston St

- 4919 Auston St

- 4909 Brannan Dr E Unit 4909

- 4911 Brannan Dr E Unit 4911

- 4907 Auston St

- 4907 Auston St

- 4907 Auston St

- 4899 Brannan Dr E

- 4905 Auston St

- 4948 Brannan Dr W

- 4897 Brannan Dr E

- 4946 Brannan Dr E

- 4896 Auston St

- 4951 Brannan Dr W Unit 4951

- 4951 Brannan Dr W

- 4951 Brannan Dr W

- 4936 Brannan Dr E Unit 4936