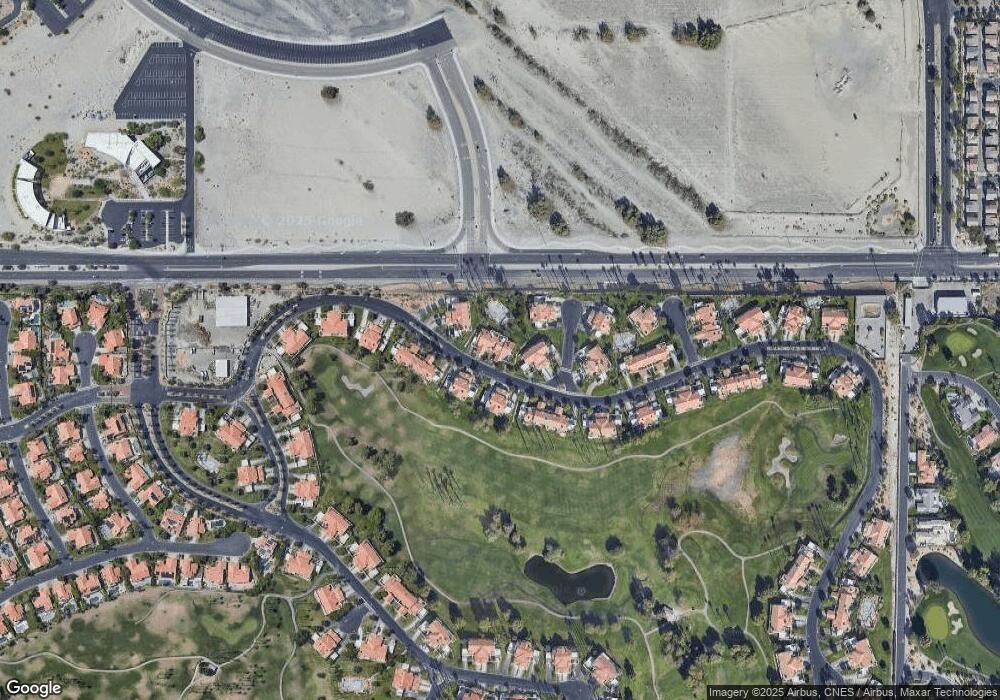

492 Desert Falls Dr E Palm Desert, CA 92211

Desert Falls NeighborhoodEstimated Value: $398,000 - $437,000

2

Beds

2

Baths

1,360

Sq Ft

$305/Sq Ft

Est. Value

About This Home

This home is located at 492 Desert Falls Dr E, Palm Desert, CA 92211 and is currently estimated at $415,283, approximately $305 per square foot. 492 Desert Falls Dr E is a home located in Riverside County with nearby schools including James Earl Carter Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2025

Sold by

Barlin Carole A

Bought by

Carole A Barlin Trust and Barlin

Current Estimated Value

Purchase Details

Closed on

Apr 20, 2018

Sold by

Jennings Richard M

Bought by

Barlln Carole A

Purchase Details

Closed on

Aug 3, 2011

Sold by

Jennings Richard M

Bought by

Jennings Richard M

Purchase Details

Closed on

Apr 29, 2004

Sold by

Martov Martin and Martov Roselyn

Bought by

Jennings Richard M and Barlin Carole A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,761

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 26, 2003

Sold by

Payne John R and Payne Betty J

Bought by

Martov Martin and Martov Roselyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,000

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carole A Barlin Trust | -- | None Listed On Document | |

| Barlln Carole A | $90,000 | Stewart Title Of California | |

| Jennings Richard M | -- | None Available | |

| Jennings Richard M | $249,500 | First American Title Co | |

| Martov Martin | $197,500 | Fidelity Natl Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jennings Richard M | $79,761 | |

| Previous Owner | Martov Martin | $158,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,549 | $320,231 | $80,052 | $240,179 |

| 2023 | $4,549 | $307,798 | $76,945 | $230,853 |

| 2022 | $4,252 | $301,764 | $75,437 | $226,327 |

| 2021 | $3,767 | $267,388 | $66,847 | $200,541 |

| 2020 | $3,443 | $243,080 | $60,770 | $182,310 |

| 2019 | $3,354 | $317,980 | $79,490 | $238,490 |

| 2018 | $3,353 | $236,000 | $59,000 | $177,000 |

| 2017 | $3,259 | $229,000 | $57,000 | $172,000 |

| 2016 | $3,467 | $248,000 | $62,000 | $186,000 |

| 2015 | $3,469 | $244,000 | $61,000 | $183,000 |

| 2014 | $3,225 | $232,000 | $58,000 | $174,000 |

Source: Public Records

Map

Nearby Homes

- 510 Desert Falls Dr N

- 465 Desert Falls Dr N

- 529 Desert Falls Dr N

- 450 Desert Falls Dr N

- 523 Desert Falls Dr N

- 344 Vista Royale Dr

- 340 Vista Royale Dr

- 201 Augusta Dr

- 230 Augusta Dr

- 357 Desert Falls Dr E

- 172 Torrey Pine Dr

- 378 Desert Falls Dr E

- 404 Links Dr

- 609 Calle Vibrante

- 75715 Heritage W

- 190 Firestone Dr

- 414 Via de la Paz

- 272 Vista Royale Cir E

- 38131 Tandika Trail N

- 407 Cypress Point Dr

- 492 Desert Falls Dr N

- 494 Desert Falls Dr N

- 496 Desert Falls Dr N

- 488 Evergreen Ash

- 486 Evergreen Ash

- 508 Desert Falls Dr N

- 510 Deesert Falls Dr Dr N

- 484 Evergreen Ash

- 482 Evergreen Ash

- 480 Evergreen Ash

- 491 Desert Falls Dr E

- 491 Desert Falls Dr N

- 493 Desert Falls Dr N

- 478 Evergreen Ash

- 489 Desert Falls Dr N

- 512 Desert Falls Dr N

- 476 Evergreen Ash Unit 16

- 474 Evergreen Ash

- 505 Desert Falls Dr N

- 497 Desert Falls Dr N