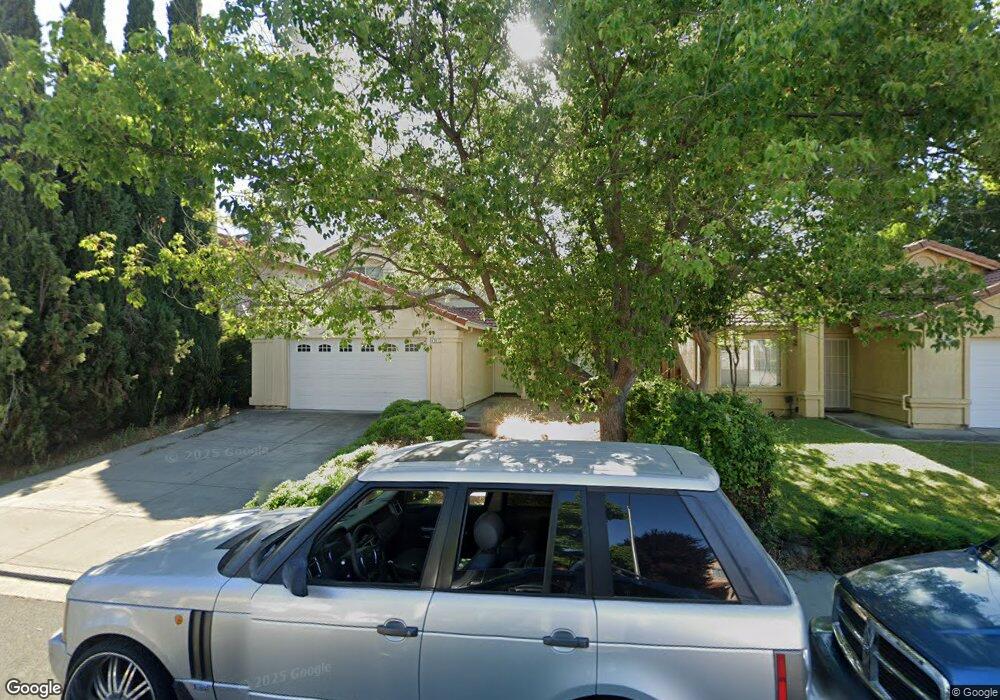

4941 Lefebvre Way Antioch, CA 94531

Country Hills NeighborhoodEstimated Value: $499,000 - $620,000

3

Beds

3

Baths

1,785

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 4941 Lefebvre Way, Antioch, CA 94531 and is currently estimated at $579,797, approximately $324 per square foot. 4941 Lefebvre Way is a home located in Contra Costa County with nearby schools including Carmen Dragon Elementary School, Black Diamond Middle School, and Deer Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2015

Sold by

Fannie Mae

Bought by

Wibowo Tedy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,800

Outstanding Balance

$217,272

Interest Rate

3.73%

Mortgage Type

New Conventional

Estimated Equity

$362,525

Purchase Details

Closed on

Sep 11, 2014

Sold by

Sol Juan E M

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jul 28, 2005

Sold by

Matalsol Fatima D

Bought by

Matalsol Juan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$357,000

Interest Rate

5.22%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wibowo Tedy | $346,000 | Servicelink | |

| Federal National Mortgage Association | $399,102 | First American Title Ins Co | |

| Matalsol Juan E | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wibowo Tedy | $276,800 | |

| Previous Owner | Matalsol Juan E | $357,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,680 | $302,009 | $97,244 | $204,765 |

| 2024 | $3,545 | $296,088 | $95,338 | $200,750 |

| 2023 | $3,545 | $290,283 | $93,469 | $196,814 |

| 2022 | $3,493 | $284,592 | $91,637 | $192,955 |

| 2021 | $3,387 | $279,013 | $89,841 | $189,172 |

| 2019 | $3,302 | $270,739 | $87,177 | $183,562 |

| 2018 | $3,184 | $265,431 | $85,468 | $179,963 |

| 2017 | $3,115 | $260,228 | $83,793 | $176,435 |

| 2016 | $3,033 | $255,126 | $82,150 | $172,976 |

| 2015 | $3,228 | $251,295 | $80,917 | $170,378 |

| 2014 | $3,957 | $246,373 | $79,332 | $167,041 |

Source: Public Records

Map

Nearby Homes

- 4866 Vinewood Way

- 4848 Pineview Way

- 4816 Chism Way

- 5124 Longdale Ct

- 5137 Twincreek Ct

- 4813 Silver Hill Ct

- 4671 Copper Hill Ct

- 5213 Walker Ct

- 5041 Wagon Wheel Way

- 5115 Equestrian Ct

- 5305 Cardinal St

- 5004 Havenrock Ct

- 5021 Wagon Wheel Way

- 4651 Shetland Way

- 5401 Mountain Ridge Way

- 5052 Perry Way

- 5000 Morgan Way

- 5132 Pioneer Way

- 5447 Benttree Way

- 5165 Hereford Way

- 4945 Lefebvre Way

- 4937 Lefebvre Way

- 4949 Lefebvre Way

- 4933 Lefebvre Way

- 5013 Woodmont Way

- 5017 Woodmont Way

- 4953 Lefebvre Way

- 4929 Lefebvre Way

- 5005 Woodmont Way

- 4940 Lefebvre Way

- 4936 Lefebvre Way

- 4944 Lefebvre Way

- 5021 Woodmont Way

- 4948 Lefebvre Way

- 4930 Lefebvre Way

- 4925 Lefebvre Way

- 4957 Lefebvre Way

- 5001 Woodmont Way

- 4952 Lefebvre Way

- 4926 Lefebvre Way