495 E Rolling Hills Dr Eagle Point, OR 97524

Estimated Value: $297,000 - $381,387

3

Beds

2

Baths

1,856

Sq Ft

$181/Sq Ft

Est. Value

About This Home

This home is located at 495 E Rolling Hills Dr, Eagle Point, OR 97524 and is currently estimated at $336,129, approximately $181 per square foot. 495 E Rolling Hills Dr is a home located in Jackson County with nearby schools including Eagle Rock Elementary School, Eagle Point Middle School, and White Mountain Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2020

Sold by

Shawn William and Dawe William

Bought by

Villa Taisha Ruvalcaba

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2011

Sold by

Daw Debra W and Dawe Debra W

Bought by

Daw William Shawn and Dawe William Shawn

Purchase Details

Closed on

Nov 21, 2003

Sold by

Dawe William S

Bought by

Dawe William S and Dawe Debra W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,000

Interest Rate

6%

Mortgage Type

Commercial

Purchase Details

Closed on

Sep 26, 1997

Sold by

Vinson L H and Vinson Kathryn C

Bought by

Dawe William S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Villa Taisha Ruvalcaba | $300,000 | Ticor Title Company Of Or | |

| Daw William Shawn | -- | None Available | |

| Dawe William S | -- | Lawyers Title Insurance Corp | |

| Dawe William S | $100,000 | Jackson County Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dawe William S | $167,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,139 | $273,940 | -- | -- |

| 2025 | $3,052 | $265,970 | $165,440 | $100,530 |

| 2024 | $3,052 | $258,230 | $210,950 | $47,280 |

| 2023 | $2,948 | $250,710 | $204,810 | $45,900 |

| 2022 | $2,870 | $250,710 | $204,810 | $45,900 |

| 2021 | $2,787 | $243,410 | $198,850 | $44,560 |

| 2020 | $1,774 | $135,129 | $93,989 | $41,140 |

| 2019 | $1,757 | $132,186 | $93,916 | $38,270 |

| 2018 | $1,745 | $117,201 | $80,131 | $37,070 |

| 2017 | $1,596 | $117,201 | $80,131 | $37,070 |

| 2016 | $1,552 | $114,702 | $75,582 | $39,120 |

| 2015 | $1,459 | $107,412 | $69,452 | $37,960 |

| 2014 | $1,381 | $102,069 | $62,609 | $39,460 |

Source: Public Records

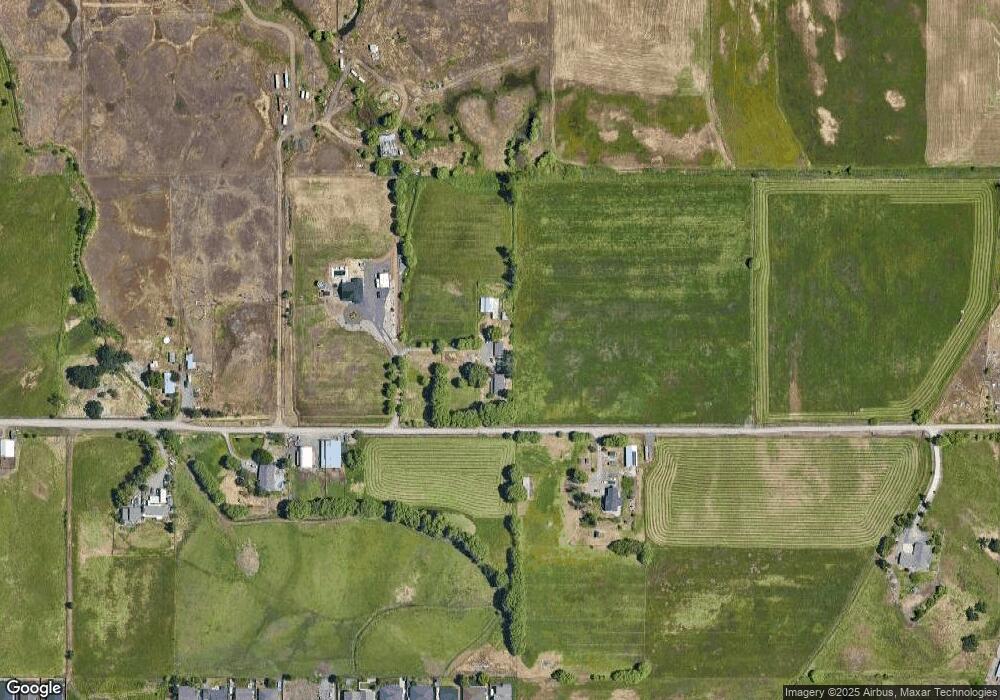

Map

Nearby Homes

- 417 E Rolling Hills Dr

- 631 Nottingham Terrace

- 700 Nottingham Terrace

- 712 Nottingham Terrace

- 945 Win Way

- 1017 Havenwood Dr

- 208 Northview Dr Unit 1B

- 438 Westminster Dr

- 1023 Highlands Dr

- 110 Linton Way

- 925 Sellwood Dr

- 912 Stonewater Dr

- 911 Stonewater Dr

- 917 Stonewater Dr

- 388 Crystal Dr

- 417 Crystal Dr

- 407 N Deanjou Ave

- 403 N Deanjou Ave

- 545 N Heights Dr

- 468 Merlee Cir

- 421 E Rolling Hills Dr

- 584 E Rolling Hills Dr

- 0 E Rolling Hills Dr

- 550 E Rolling Hills Dr

- 488 Rolling Hills Rd

- 488 E Rolling Hills Dr

- 313 E Rolling Hills Dr

- 313 E Rolling Hiills Dr

- 610 Nottingham Terrace

- 604 Nottingham Terrace

- 616 Nottingham Terrace

- 610 Nottingham Terrace

- 622 Nottingham Terrace

- 622 Nottingham Terrace

- 628 Nottingham Terrace

- 628 Nottingham Terrace

- 634 Nottingham Terrace

- 634 Nottingham Terrace

- 640 Nottingham Terrace

- 640 Nottingham Terrace

Your Personal Tour Guide

Ask me questions while you tour the home.