4955 Singleton Dr Unit 16C Hilliard, OH 43026

Cross Creek NeighborhoodEstimated Value: $186,000 - $195,112

2

Beds

2

Baths

832

Sq Ft

$227/Sq Ft

Est. Value

About This Home

This home is located at 4955 Singleton Dr Unit 16C, Hilliard, OH 43026 and is currently estimated at $189,028, approximately $227 per square foot. 4955 Singleton Dr Unit 16C is a home located in Franklin County with nearby schools including Hilliard Crossing Elementary School, Hilliard Station Sixth Grade Elementary School, and Hilliard Heritage Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2003

Sold by

Hall Anthony J

Bought by

Francisco Steven P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,601

Outstanding Balance

$30,407

Interest Rate

5.36%

Mortgage Type

FHA

Estimated Equity

$158,621

Purchase Details

Closed on

Nov 16, 2000

Sold by

Kern Brendalee K and Harber Brendalee K

Bought by

Hall Anthony J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,000

Interest Rate

7.87%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 21, 1990

Bought by

Harber Gregory E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Francisco Steven P | $73,300 | -- | |

| Hall Anthony J | $60,500 | Chicago Title | |

| Harber Brendalee K | -- | Chicago Title | |

| Harber Gregory E | $52,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Francisco Steven P | $71,601 | |

| Previous Owner | Hall Anthony J | $57,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,617 | $46,340 | $9,800 | $36,540 |

| 2023 | $2,267 | $46,340 | $9,800 | $36,540 |

| 2022 | $2,302 | $37,670 | $4,590 | $33,080 |

| 2021 | $2,300 | $37,670 | $4,590 | $33,080 |

| 2020 | $2,293 | $37,670 | $4,590 | $33,080 |

| 2019 | $1,851 | $25,970 | $3,150 | $22,820 |

| 2018 | $1,715 | $25,970 | $3,150 | $22,820 |

| 2017 | $1,844 | $25,970 | $3,150 | $22,820 |

| 2016 | $1,693 | $22,090 | $3,080 | $19,010 |

| 2015 | $1,587 | $22,090 | $3,080 | $19,010 |

| 2014 | $1,590 | $22,090 | $3,080 | $19,010 |

| 2013 | $895 | $24,535 | $3,430 | $21,105 |

Source: Public Records

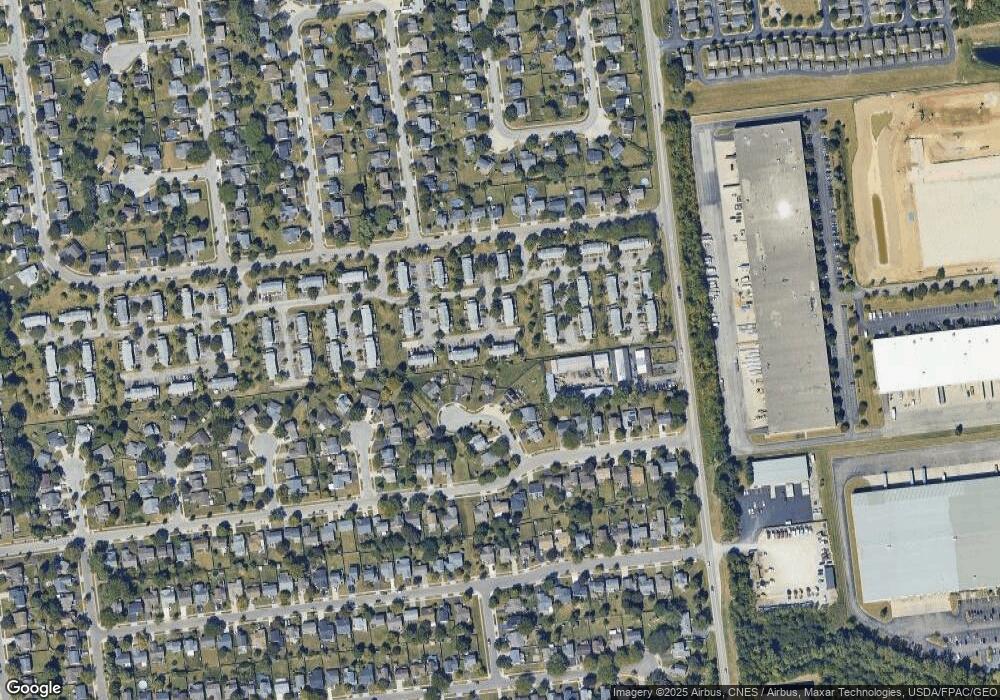

Map

Nearby Homes

- 4995 Singleton Dr

- 4995 Singleton Dr Unit 18c

- 5041 Singleton Dr Unit 26-A

- 5066 Ivywild Ave

- 2962 Carlsbad Dr

- 5052 Bressler Dr

- 2673 Bramble Dr

- 2505 Roberts Ct

- 5138 Roberts Rd

- 3111 Castlebrook Ave

- 4923 Stoneybrook Blvd Unit 21F

- 4997 Meadow Run Dr Unit 4997

- 5053 Stoneybrook Blvd

- 5055 Stoneybrook Blvd Unit 6E

- 2804 Hilliard Rome Rd

- 2477 Crystal Springs Dr

- 5147 Aurora Dr

- 2424 Mills Fall Dr

- 4967 Baycroft Dr

- 3278 Reed Point Dr

- 4957 Singleton Dr

- 4957 Singleton Dr Unit 16D

- 4951 Singleton Dr Unit 16A

- 4953 Singleton Dr Unit 16B

- 4953 Singleton Dr

- 2788 Toms Trace Ct

- 4961 Singleton Dr Unit 17A

- 4947 Singleton Dr

- 4947 Singleton Dr Unit 13D

- 4945 Singleton Dr

- 4971 Singleton Dr Unit 15A

- 4963 Singleton Dr

- 4963 Singleton Dr Unit 17B

- 4973 Singleton Dr Unit 15B

- 4965 Singleton Dr Unit 17C

- 2780 Toms Trace Ct

- 2794 Toms Trace Ct

- 4975 Singleton Dr

- 4967 Singleton Dr Unit 17D

- 2794 Tom's Trace Ct