498 Novara Way Unit 20 Oak Park, CA 91377

Estimated Value: $845,531 - $960,000

3

Beds

3

Baths

1,625

Sq Ft

$562/Sq Ft

Est. Value

About This Home

This home is located at 498 Novara Way Unit 20, Oak Park, CA 91377 and is currently estimated at $912,883, approximately $561 per square foot. 498 Novara Way Unit 20 is a home located in Ventura County with nearby schools including Medea Creek Middle School, Oak Park High School, and Oaks Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2023

Sold by

Renyer Paul

Bought by

Monkarsh Renyer Family Trust and Renyer

Current Estimated Value

Purchase Details

Closed on

Apr 23, 2015

Sold by

Renyer Paul

Bought by

Renyer Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$362,500

Interest Rate

3.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 10, 2012

Sold by

Renyer Antonella

Bought by

Renyer Paul

Purchase Details

Closed on

May 6, 1994

Sold by

Fisher Paul B and Fisher Lori E

Bought by

Renyer Paul and Renyer Antonella

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Monkarsh Renyer Family Trust | -- | None Listed On Document | |

| Renyer Paul | -- | Western Resources Title | |

| Renyer Paul | -- | None Available | |

| Renyer Paul | $228,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Renyer Paul | $362,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,682 | $382,815 | $153,125 | $229,690 |

| 2024 | $5,682 | $375,309 | $150,122 | $225,187 |

| 2023 | $5,600 | $367,950 | $147,178 | $220,772 |

| 2022 | $5,305 | $360,736 | $144,292 | $216,444 |

| 2021 | $5,065 | $353,663 | $141,463 | $212,200 |

| 2020 | $4,944 | $350,038 | $140,013 | $210,025 |

| 2019 | $4,701 | $343,175 | $137,268 | $205,907 |

| 2018 | $4,566 | $336,447 | $134,577 | $201,870 |

| 2017 | $4,438 | $329,851 | $131,939 | $197,912 |

| 2016 | $4,462 | $323,384 | $129,352 | $194,032 |

| 2015 | $4,476 | $318,528 | $127,410 | $191,118 |

| 2014 | -- | $312,290 | $124,915 | $187,375 |

Source: Public Records

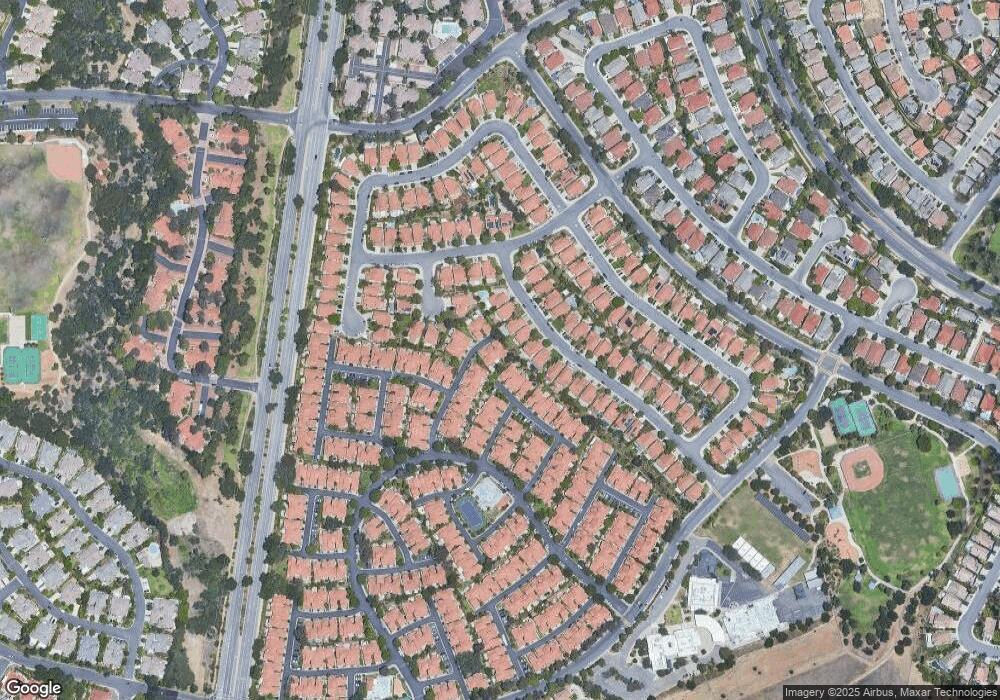

Map

Nearby Homes

- 510 Savona Way

- 5034 Evanwood Ave

- 4826 Piedmont Dr

- 5061 Churchwood Dr

- 817 Sunstone St

- 5567 Spring Hill Ct

- 5566 Spring Hill Ct

- 780 Covewood St

- 5639 Starwood Ct

- 5473 Spanish Oak Ln Unit G

- 5679 White Cloud Cir

- 4953 Kilburn Ct

- 513 Water Oak Ln Unit D

- 614 Calle Mirador

- 5449 S Rim St

- 583 Calle de Las Ovejas

- 6085 Lake Lindero Dr

- 631 Oak Run Trail Unit 312

- 631 Oak Run Trail Unit 205

- 5016 Hunter Valley Ln

- 494 Novara Way Unit 21

- 490 Novara Way Unit 22

- 490 Novara Way

- 490 Belcaro Way

- 486 Novara Way

- 487 Pesaro St

- 486 Belcaro Way

- 491 Pesaro St

- 483 Pesaro St

- 499 Novara Way Unit 19

- 499 Novara Way

- 495 Novara Way

- 482 Novara Way

- 482 Belcaro Way

- 495 Pesaro St

- 478 Novara Way

- 478 Belcaro Way

- 479 Pesaro St

- 491 Novara Way

- 4871 La Vella Dr