4995 W Country Club Dr Highland, UT 84003

Estimated Value: $793,000 - $914,000

4

Beds

4

Baths

4,002

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 4995 W Country Club Dr, Highland, UT 84003 and is currently estimated at $843,718, approximately $210 per square foot. 4995 W Country Club Dr is a home located in Utah County with nearby schools including Highland Elementary School, Mountain Ridge Junior High School, and Lone Peak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2023

Sold by

Clarke Keith

Bought by

Clarke Tyson and Watts Elizabeth Blair

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$620,000

Interest Rate

6.39%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

May 31, 2023

Sold by

West Harvey and West Carol

Bought by

Clarke Keith

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$620,000

Interest Rate

6.39%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

May 25, 2005

Sold by

Judd Darrel R and Judd Lori C

Bought by

West Harvey and West Carol

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,200

Interest Rate

5.84%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 29, 2001

Sold by

Saunders Ronald J and Saunders Sally I

Bought by

Judd Darrel R and Judd Lori C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,700

Interest Rate

7.15%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clarke Tyson | -- | Capstone Title And Escrow | |

| Clarke Keith | -- | Meridian Title Company | |

| West Harvey | -- | Equity Title | |

| Judd Darrel R | -- | Mountain West Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Clarke Tyson | $620,000 | |

| Previous Owner | West Harvey | $217,200 | |

| Previous Owner | Judd Darrel R | $205,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,150 | $757,600 | $450,600 | $307,000 |

| 2024 | $3,150 | $389,125 | $0 | $0 |

| 2023 | $2,870 | $382,470 | $0 | $0 |

| 2022 | $2,797 | $361,350 | $0 | $0 |

| 2021 | $2,257 | $434,300 | $240,500 | $193,800 |

| 2020 | $2,135 | $402,900 | $209,100 | $193,800 |

| 2019 | $1,921 | $379,200 | $188,100 | $191,100 |

| 2018 | $1,873 | $351,400 | $160,300 | $191,100 |

| 2017 | $1,719 | $172,150 | $0 | $0 |

| 2016 | $1,944 | $181,940 | $0 | $0 |

| 2015 | $1,728 | $153,285 | $0 | $0 |

| 2014 | $1,549 | $136,180 | $0 | $0 |

Source: Public Records

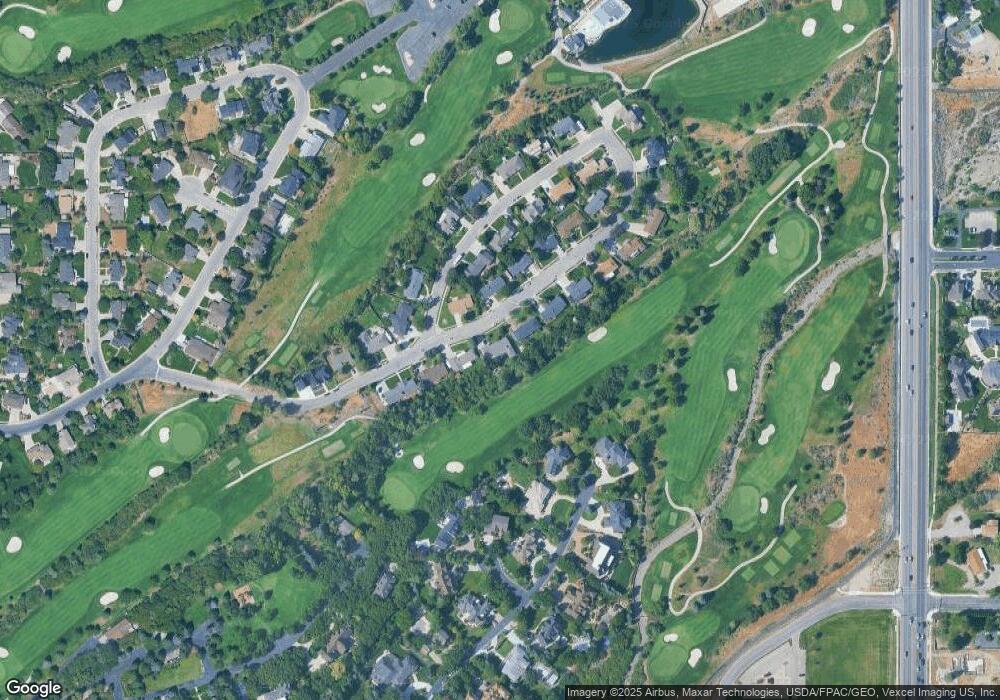

Map

Nearby Homes

- 10685 N Jerling Dr

- 10861 N Panorama Dr

- 10354 Hidden Oak Dr

- 10415 N Cherry Ln

- 10531 N Alpine Hwy

- 5348 W 10700 N Unit 2

- 5077 W 11000 N

- Villa D Plan at TEN700

- Douglas Villa Plan at TEN700

- Villa C Plan at TEN700

- Cottonwood Villa Plan at TEN700

- Villa B Plan at TEN700

- Villa A Plan at TEN700

- 10261 N 5230 W

- 5345 W Tiva Ln Unit 1

- 10734 N Dosh Ln

- 10727 N Dosh Ln Unit 7

- 10733 N Dosh Ln Unit 12

- 5159 W 11000 N

- 10774 N Dosh Ln Unit 16

- 4995 Country Club Dr

- 5005 Country Club Dr

- 4979 W Country Club Dr

- 4979 Country Club Dr

- 4980 Country Club Dr

- 4980 W Country Club Dr

- 5000 W Country Club Dr

- 5000 Country Club Dr

- 5017 W Country Club Dr

- 5017 Country Club Dr

- 4969 Country Club Dr

- 4991 Alpine Cir

- 4970 Country Club Dr

- 4955 Country Club Dr

- 4955 W Country Club Dr

- 5006 Alpine Cir

- 5010 Country Club Dr

- 5010 W Country Club Dr

- 5029 W Country Club Dr

- 5029 Country Club Dr