Estimated Value: $251,000 - $272,000

4

Beds

2

Baths

1,720

Sq Ft

$154/Sq Ft

Est. Value

About This Home

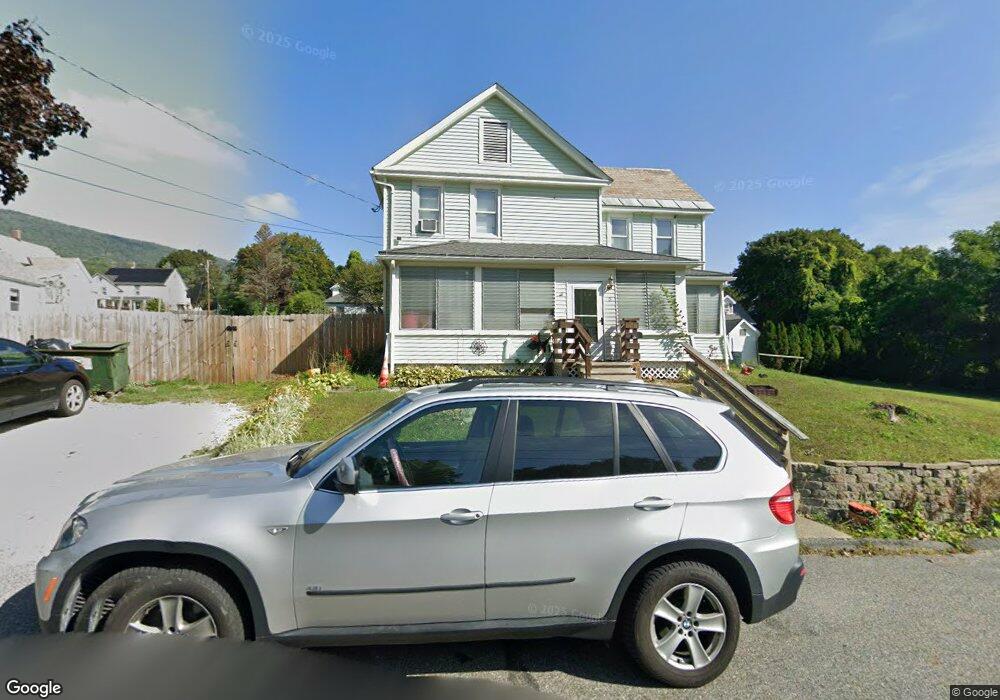

This home is located at 5 Beecher St, Adams, MA 01220 and is currently estimated at $265,038, approximately $154 per square foot. 5 Beecher St is a home located in Berkshire County with nearby schools including Hoosac Valley Middle & High School, Berkshire Arts & Technology Charter Public School, and St. Stanislaus Kostka School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 24, 2012

Sold by

Ir Lorraine E Meczywor

Bought by

Meczywor Lorriane E

Current Estimated Value

Purchase Details

Closed on

Aug 29, 2008

Sold by

Meczywor Lorraine E

Bought by

Meczywor Lorraine E Ir

Purchase Details

Closed on

Dec 20, 2007

Sold by

Kustra Donna M and Meczywor Lorraine E

Bought by

Ranzoni Raymond J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,000

Interest Rate

6.3%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 5, 1988

Sold by

Meczywor Thaddeus E

Bought by

Kustra Mark A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meczywor Lorriane E | -- | -- | |

| Meczywor Lorraine E Ir | -- | -- | |

| Ranzoni Raymond J | $139,000 | -- | |

| Kustra Mark A | $100,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kustra Mark A | $25,000 | |

| Previous Owner | Kustra Mark A | $101,000 | |

| Previous Owner | Ranzoni Raymond J | $99,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,831 | $225,200 | $53,300 | $171,900 |

| 2024 | $3,611 | $205,900 | $50,100 | $155,800 |

| 2023 | $3,359 | $181,100 | $45,500 | $135,600 |

| 2022 | $3,269 | $156,500 | $39,600 | $116,900 |

| 2021 | $3,296 | $145,700 | $39,600 | $106,100 |

| 2020 | $3,140 | $143,500 | $39,600 | $103,900 |

| 2019 | $3,069 | $143,500 | $39,600 | $103,900 |

| 2018 | $3,147 | $141,700 | $39,600 | $102,100 |

| 2017 | $3,028 | $141,700 | $39,600 | $102,100 |

| 2016 | $2,894 | $135,300 | $39,600 | $95,700 |

| 2015 | $2,829 | $132,400 | $41,400 | $91,000 |

| 2014 | $2,641 | $132,400 | $41,400 | $91,000 |

Source: Public Records

Map

Nearby Homes