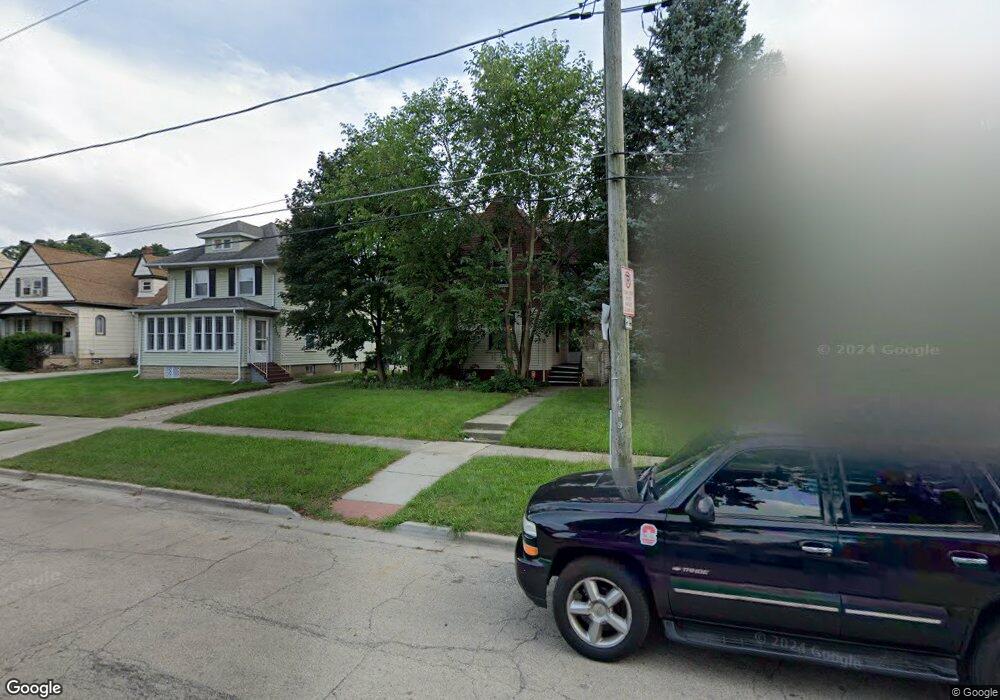

501 Barrett St Elgin, IL 60120

Gifford Park NeighborhoodEstimated Value: $246,000 - $285,000

3

Beds

1

Bath

1,424

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 501 Barrett St, Elgin, IL 60120 and is currently estimated at $260,160, approximately $182 per square foot. 501 Barrett St is a home located in Kane County with nearby schools including Channing Memorial Elementary School, Ellis Middle School, and Elgin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 29, 2001

Sold by

Daniels Gwendolyn and Dennis Gwendolyn

Bought by

Weninger Jason A and Weninger Dawn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,638

Outstanding Balance

$42,556

Interest Rate

7.1%

Mortgage Type

FHA

Estimated Equity

$217,604

Purchase Details

Closed on

Dec 15, 1997

Sold by

St Johns Evangelical Lutheran Church

Bought by

Daniels Gwendolyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,012

Interest Rate

7.26%

Mortgage Type

FHA

Purchase Details

Closed on

May 8, 1997

Sold by

Morton Myra Jane and Kuznik Reverend Rollin

Bought by

St Johns Evangelical Lutheran Church

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weninger Jason A | $119,500 | Ticor Title Insurance Compan | |

| Daniels Gwendolyn | -- | Chicago Title Insurance Co | |

| St Johns Evangelical Lutheran Church | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weninger Jason A | $117,638 | |

| Previous Owner | Daniels Gwendolyn | $96,012 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,196 | $64,923 | $13,630 | $51,293 |

| 2023 | $5,000 | $58,653 | $12,314 | $46,339 |

| 2022 | $4,637 | $53,481 | $11,228 | $42,253 |

| 2021 | $4,461 | $50,001 | $10,497 | $39,504 |

| 2020 | $4,190 | $45,938 | $10,021 | $35,917 |

| 2019 | $4,087 | $43,759 | $9,546 | $34,213 |

| 2018 | $3,886 | $39,304 | $8,993 | $30,311 |

| 2017 | $3,822 | $37,157 | $8,502 | $28,655 |

| 2016 | $3,676 | $34,472 | $7,888 | $26,584 |

| 2015 | -- | $31,597 | $7,230 | $24,367 |

| 2014 | -- | $31,207 | $7,141 | $24,066 |

| 2013 | -- | $36,389 | $7,329 | $29,060 |

Source: Public Records

Map

Nearby Homes

- 483 Barrett St

- 450 Villa St

- 332-334 St Charles St

- 277 Gifford Place

- 262 Bartlett Place

- 457 Arlington Ave

- 631 Bent St

- 518 Raymond St

- 115 N Porter St

- 689 Bent St

- 211 Prairie St

- 216 Prairie St

- 513 Cookane Ave

- 131 N Gifford St

- 7 National St Unit 7

- 3 National St Unit 3

- 453 Addison St

- 833 Forest Ave

- 445 Lucile Ave

- 268 N Gifford St

Your Personal Tour Guide

Ask me questions while you tour the home.