501 N 5th St Thornton, IA 50479

Estimated Value: $81,000 - $127,869

3

Beds

2

Baths

1,706

Sq Ft

$63/Sq Ft

Est. Value

About This Home

This home is located at 501 N 5th St, Thornton, IA 50479 and is currently estimated at $106,717, approximately $62 per square foot. 501 N 5th St is a home located in Cerro Gordo County with nearby schools including West Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 29, 2024

Sold by

Sestina Jeffrey L and Sestina Danielle D

Bought by

Dietzenbach Jared R and Dietzenbach Tori J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Outstanding Balance

$44,473

Interest Rate

5.76%

Mortgage Type

Credit Line Revolving

Estimated Equity

$62,244

Purchase Details

Closed on

Aug 31, 2012

Sold by

Dorenkamp Gary and Dorenkamp Gary L

Bought by

Sestina Jeffrey L and Sestina Danielle D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$37,050

Interest Rate

3.48%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Apr 9, 2009

Sold by

Grantor Engebretson Rex C

Bought by

Residuar Engebretson Rex C and Eleanor M Engebretson Residuary Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dietzenbach Jared R | $60,000 | None Listed On Document | |

| Sestina Jeffrey L | $39,000 | None Available | |

| Residuar Engebretson Rex C | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dietzenbach Jared R | $48,000 | |

| Previous Owner | Sestina Jeffrey L | $37,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,516 | $110,120 | $10,250 | $99,870 |

| 2024 | $1,516 | $100,330 | $10,250 | $90,080 |

| 2023 | $1,396 | $100,330 | $10,250 | $90,080 |

| 2022 | $1,236 | $83,030 | $8,200 | $74,830 |

| 2021 | $1,254 | $74,170 | $8,200 | $65,970 |

| 2020 | $1,254 | $72,400 | $8,200 | $64,200 |

| 2019 | $1,264 | $0 | $0 | $0 |

| 2018 | $888 | $0 | $0 | $0 |

| 2017 | $914 | $0 | $0 | $0 |

| 2016 | $864 | $0 | $0 | $0 |

| 2015 | $864 | $0 | $0 | $0 |

| 2014 | $926 | $0 | $0 | $0 |

| 2013 | $872 | $0 | $0 | $0 |

Source: Public Records

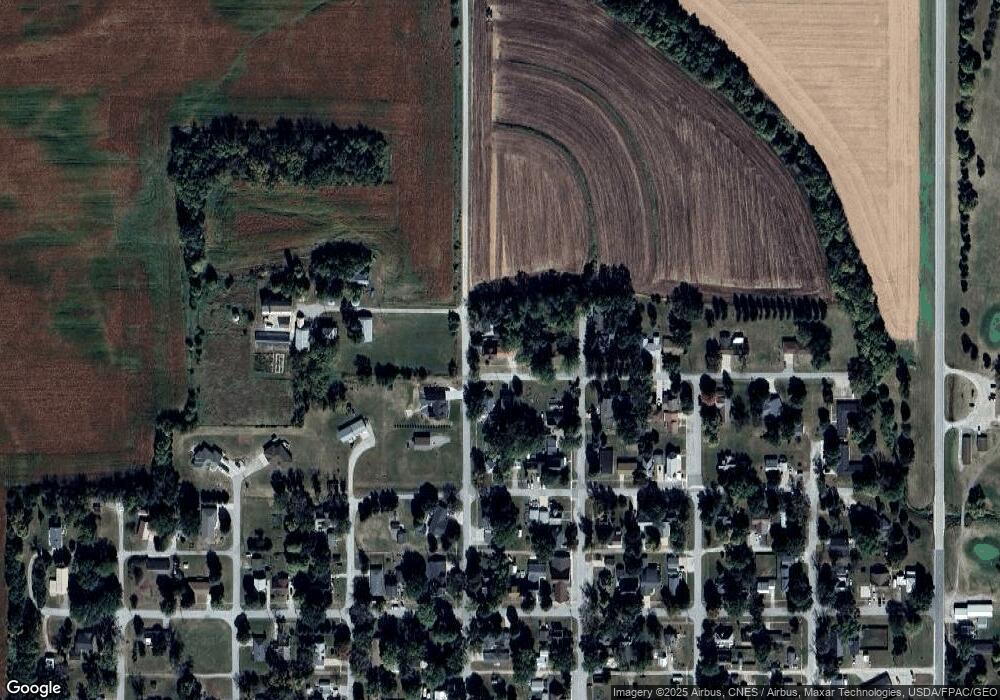

Map

Nearby Homes

- 400 N 4th St

- 300 S 5th St

- 5950 Jonquil Ave

- 9213 160th St

- 940 250th St

- 627 2nd St

- 190th St

- 12972 120th St

- 602 Claydigger Run

- 421 Brickyard Rd

- 419 Brickyard Rd

- 417 Brickyard Rd

- 109 N Lincoln St

- 410 Brickyard Rd

- 409 Brickyard Rd

- 319 N 6th St

- 319 S Lincoln St

- 601 Gilman St

- 608 Sherman St

- 202 Brickyard Ct