5031 Dorado Dr Unit 101 Huntington Beach, CA 92649

Estimated Value: $570,055 - $867,000

2

Beds

2

Baths

1,002

Sq Ft

$689/Sq Ft

Est. Value

About This Home

This home is located at 5031 Dorado Dr Unit 101, Huntington Beach, CA 92649 and is currently estimated at $690,264, approximately $688 per square foot. 5031 Dorado Dr Unit 101 is a home located in Orange County with nearby schools including Harbour View Elementary School, Marine View Middle, and Huntington Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 14, 2005

Sold by

Torres Carlos J

Bought by

Torres Carlos Javier and Magallanes Torres Alma Vianey

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Outstanding Balance

$170,477

Interest Rate

5.12%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$519,787

Purchase Details

Closed on

Aug 22, 2002

Sold by

Clark Theresa

Bought by

Torres Carlos J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$221,600

Interest Rate

6.17%

Purchase Details

Closed on

Oct 30, 1998

Sold by

Harkey John A and Moshfegh Mina Moshfegh

Bought by

Clark Theresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,400

Interest Rate

6.69%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Torres Carlos Javier | -- | Lsi Title Company | |

| Torres Carlos J | $277,000 | Southland Title Corporation | |

| Clark Theresa | $168,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Torres Carlos Javier | $332,000 | |

| Previous Owner | Torres Carlos J | $221,600 | |

| Previous Owner | Clark Theresa | $134,400 | |

| Closed | Clark Theresa | $16,800 | |

| Closed | Torres Carlos J | $41,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,694 | $401,175 | $288,094 | $113,081 |

| 2024 | $4,694 | $393,309 | $282,445 | $110,864 |

| 2023 | $4,587 | $385,598 | $276,907 | $108,691 |

| 2022 | $4,518 | $378,038 | $271,478 | $106,560 |

| 2021 | $4,436 | $370,626 | $266,155 | $104,471 |

| 2020 | $4,387 | $366,826 | $263,426 | $103,400 |

| 2019 | $4,313 | $359,634 | $258,261 | $101,373 |

| 2018 | $4,218 | $352,583 | $253,197 | $99,386 |

| 2017 | $4,152 | $345,670 | $248,232 | $97,438 |

| 2016 | $3,985 | $338,893 | $243,365 | $95,528 |

| 2015 | $3,925 | $333,803 | $239,709 | $94,094 |

| 2014 | $3,848 | $327,265 | $235,014 | $92,251 |

Source: Public Records

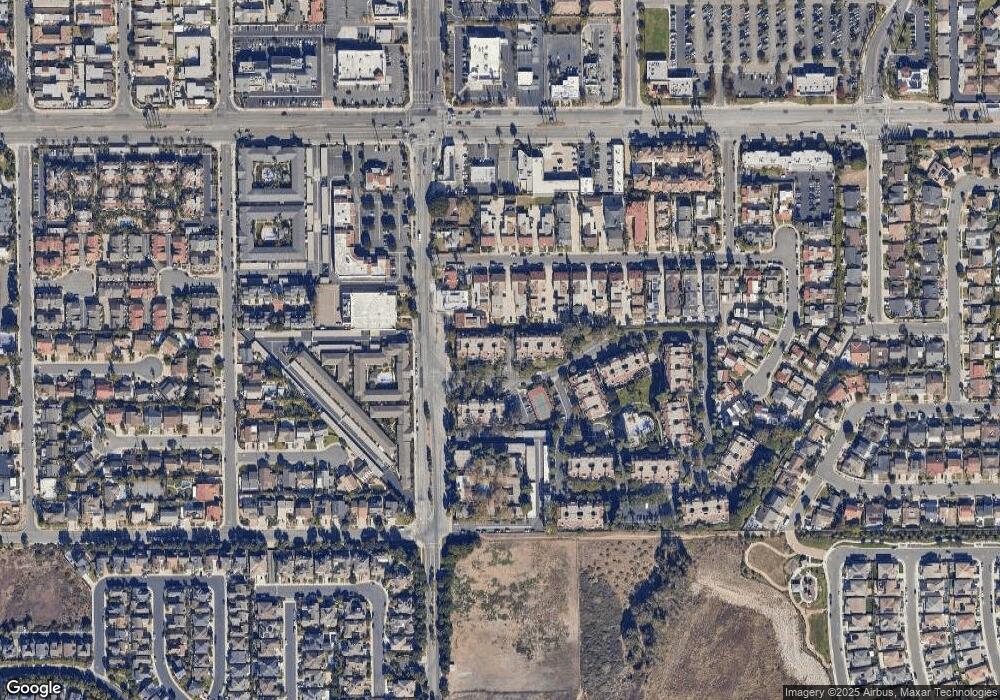

Map

Nearby Homes

- 5031 202 Dorado

- 5241 Glenroy Dr

- 5262 Glenroy Dr

- 16849 Roosevelt Ln

- 17182 Hillside Cir

- 4711 Winthrop Dr

- 4700 Warner Ave Unit 112

- 4682 Warner Ave Unit B102

- 5342 Kenilworth Dr

- 4651 Los Patos Ave

- 16771 Green Ln

- 4561 Warner Ave Unit 201

- 4822 Neely Cir

- 17172 Berlin Ln

- 17301 Juniper Ln

- 16581 Grunion Unit 204

- 4861 Lago Dr Unit 206

- 5200 Heil Ave Unit 18

- 16551 Grunion Unit 204

- 4831 Lago Dr Unit 102

- 5031 Dorado Dr

- 5031 Dorado Dr

- 5031 Dorado Dr Unit 209

- 5031 Dorado Dr Unit 201

- 5031 Dorado Dr Unit 206

- 5031 Dorado Dr Unit 203

- 5031 Dorado Dr Unit 210

- 5031 Dorado Dr Unit 202

- 5031 Dorado Dr Unit 212

- 5031 Dorado Dr Unit 205

- 5031 Dorado Dr Unit 107

- 5031 Dorado Dr Unit 102

- 5031 Dorado Dr Unit 208

- 5031 Dorado Dr Unit 112

- 5031 Dorado Dr Unit 207

- 5031 Dorado Dr Unit 104

- 5031 Dorado Dr Unit 111

- 5031 Dorado Dr Unit 109

- 5031 Dorado Dr Unit 110

- 5031 Dorado Dr Unit 211