5087 Shalimar Cir Unit 37 Fremont, CA 94555

Ardenwood NeighborhoodEstimated Value: $827,836 - $881,000

2

Beds

3

Baths

1,110

Sq Ft

$766/Sq Ft

Est. Value

About This Home

This home is located at 5087 Shalimar Cir Unit 37, Fremont, CA 94555 and is currently estimated at $850,209, approximately $765 per square foot. 5087 Shalimar Cir Unit 37 is a home located in Alameda County with nearby schools including Forest Park Elementary, Thornton Middle School, and American High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2004

Sold by

Yaung Andrew and Yaung Anne Marie

Bought by

Yaung Bruce and Yaung Andrew

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,910

Interest Rate

5.69%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 29, 2001

Sold by

Yaung Bruce and Yaung Juliana H

Bought by

Yaung Bruce and Yaung Juliana H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,500

Interest Rate

7.06%

Purchase Details

Closed on

Mar 23, 2001

Sold by

Yaung Bruce and Yaung Juliana H

Bought by

Yaung Andrew and Yaung Anne Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,500

Interest Rate

7.06%

Purchase Details

Closed on

Mar 18, 1994

Sold by

Soper David B and Soper Rebecca E

Bought by

Yaung Andrew and Yaung Anne Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

7.21%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yaung Bruce | $118,500 | Chicago Title Company | |

| Yaung Bruce | -- | -- | |

| Yaung Andrew | -- | North American Title Co | |

| Yaung Andrew | $177,500 | North American Title Co Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Yaung Bruce | $118,910 | |

| Closed | Yaung Andrew | $131,500 | |

| Closed | Yaung Andrew | $140,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,089 | $301,678 | $90,588 | $211,090 |

| 2024 | $4,089 | $295,763 | $88,812 | $206,951 |

| 2023 | $3,964 | $289,965 | $87,071 | $202,894 |

| 2022 | $3,896 | $284,280 | $85,364 | $198,916 |

| 2021 | $3,812 | $278,706 | $83,690 | $195,016 |

| 2020 | $3,756 | $275,848 | $82,832 | $193,016 |

| 2019 | $3,728 | $270,440 | $81,208 | $189,232 |

| 2018 | $3,654 | $265,138 | $79,616 | $185,522 |

| 2017 | $3,564 | $259,940 | $78,055 | $181,885 |

| 2016 | $3,495 | $254,845 | $76,525 | $178,320 |

| 2015 | $3,438 | $251,018 | $75,376 | $175,642 |

| 2014 | $3,380 | $246,101 | $73,899 | $172,202 |

Source: Public Records

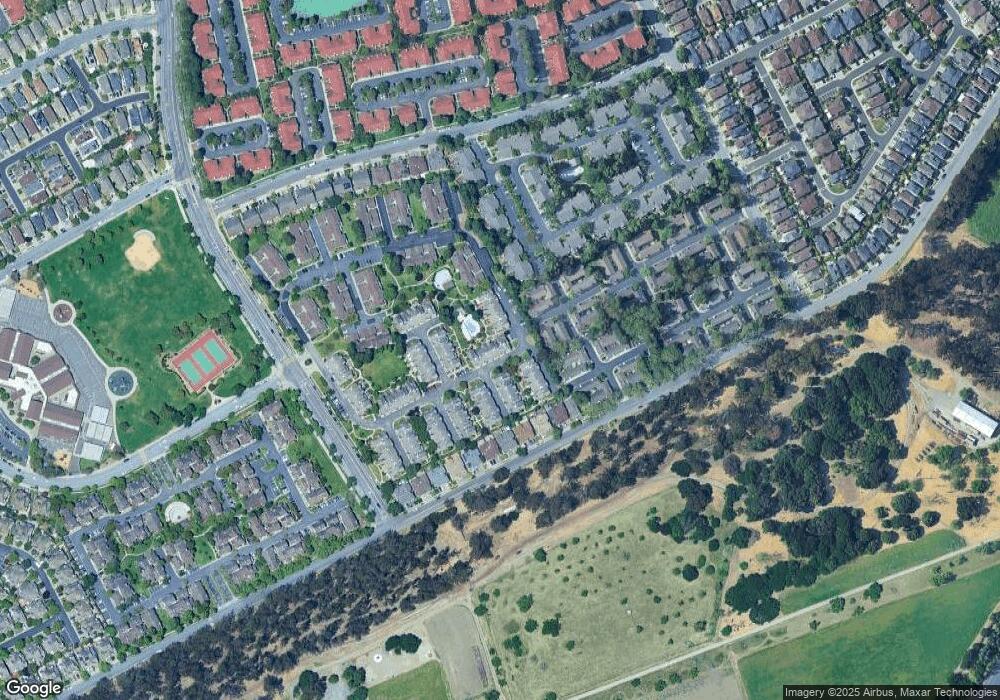

Map

Nearby Homes

- 34771 Tuxedo Common Unit 52

- 34565 Pueblo Terrace

- 34607 Pueblo Terrace

- 34627 Pueblo Terrace

- 5004 Crandallwood Dr

- 34648 Musk Terrace

- 5176 Tacoma Common

- 4834 Garnet Common

- 5220 Fairbanks Common

- 5308 Tacoma Common

- 4772 Mendocino Terrace

- 34348 Siward Dr

- 35220 Cornwall Place

- 5301 Shamrock Common

- 34294 Dunhill Dr

- 35345 Cabral Dr

- 34198 Tony Terrace

- 5303 Stirling Ct

- 34579 Bluestone Common

- 4512 Macbeth Ave

- 5089 Shalimar Cir Unit 36

- 5085 Shalimar Cir Unit 38

- 5095 Shalimar Cir

- 5091 Shalimar Cir

- 5091 Shalimar CI

- 5093 Shalimar Cir Unit 34

- 5075 Shalimar Cir Unit 39

- 34754 Jovan Terrace

- 34767 Shalimar Terrace Unit 45

- 34767 Shalimar Terrace

- 5071 Shalimar Cir

- 5069 Shalimar Cir

- 5073 Shalimar Cir

- 34756 Jovan Terrace Unit 52

- 34764 Jovan Terrace

- 34760 Jovan Terrace

- 34758 Jovan Terrace

- 5067 Shalimar Cir Unit 43

- 34771 Shalimar Terrace Unit 47

- 34769 Shalimar Terrace