511 Foxboro Dr Norwalk, CT 06851

Cranbury NeighborhoodEstimated Value: $638,000 - $675,776

2

Beds

3

Baths

1,647

Sq Ft

$402/Sq Ft

Est. Value

About This Home

This home is located at 511 Foxboro Dr, Norwalk, CT 06851 and is currently estimated at $662,694, approximately $402 per square foot. 511 Foxboro Dr is a home located in Fairfield County with nearby schools including Cranbury Elementary School, West Rocks Middle School, and Norwalk High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 8, 2014

Sold by

Spatta Jane

Bought by

Lee Janet

Current Estimated Value

Purchase Details

Closed on

Feb 28, 2014

Sold by

Spatta Walter

Bought by

Spatta Jane

Purchase Details

Closed on

May 29, 1997

Sold by

Dillon Michael P

Bought by

Spatta Walter R and Spatta Jane

Purchase Details

Closed on

Sep 30, 1993

Sold by

Assoc Relocation Mgt

Bought by

Dillon Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,750

Interest Rate

3.63%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 2, 1991

Sold by

Baker Firestone Lp

Bought by

Anderson Gregory and Anderson Serena

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Janet | $412,000 | -- | |

| Lee Janet | $412,000 | -- | |

| Spatta Jane | -- | -- | |

| Spatta Jane | -- | -- | |

| Spatta Walter R | $257,000 | -- | |

| Spatta Walter R | $257,000 | -- | |

| Dillon Michael | $227,500 | -- | |

| Assoc Relocation Mgt | $227,500 | -- | |

| Dillon Michael | $227,500 | -- | |

| Anderson Gregory | $221,722 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Anderson Gregory | $204,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,642 | $406,160 | $0 | $406,160 |

| 2024 | $9,494 | $406,160 | $0 | $406,160 |

| 2023 | $8,299 | $332,420 | $0 | $332,420 |

| 2022 | $8,169 | $332,420 | $0 | $332,420 |

| 2021 | $6,951 | $332,420 | $0 | $332,420 |

| 2020 | $7,847 | $332,420 | $0 | $332,420 |

| 2019 | $7,748 | $332,420 | $0 | $332,420 |

| 2018 | $7,924 | $305,610 | $0 | $305,610 |

| 2017 | $7,648 | $305,610 | $0 | $305,610 |

| 2016 | $7,775 | $305,610 | $0 | $305,610 |

| 2015 | $6,983 | $305,610 | $0 | $305,610 |

| 2014 | $7,652 | $305,610 | $0 | $305,610 |

Source: Public Records

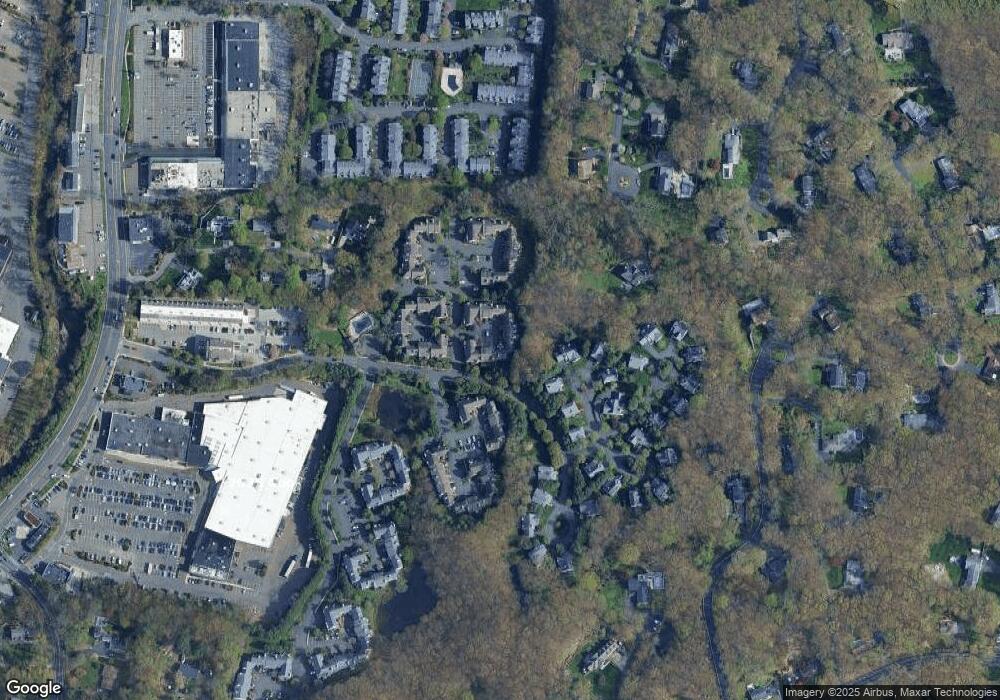

Map

Nearby Homes

- 510 Foxboro Dr

- 123 Old Belden Hill Rd Unit 40

- 515 Belden Hill Rd

- 29 Grumman Ave

- 442 Main Ave Unit A5

- 57 Creeping Hemlock Dr

- 36 Donohue Dr

- 41 Mohawk Dr

- 180 E Rocks Rd

- 8 Caddy Rd

- 27 Stonecrop Rd

- 32 Thistle Rd

- 8 Stonecrop Rd

- 332 Belden Hill Rd

- 4 Frank St

- 18 Singing Woods Rd

- 9 Singing Woods Rd

- 84 Wilton Crest Rd Unit 84

- 71 Aiken St Unit P12

- 256 Mill Rd

- 518 Foxboro Dr

- 517 Foxboro Dr

- 516 Foxboro Dr

- 515 Foxboro Dr

- 514 Foxboro Dr

- 513 Foxboro Dr

- 512 Foxboro Dr

- 509 Foxboro Dr

- 508 Foxboro Dr

- 506 Foxboro Dr

- 505 Foxboro Dr

- 504 Foxboro Dr

- 503 Foxboro Dr

- 502 Foxboro Dr

- 501 Foxboro Dr

- 515 Foxboro Dr Unit 515

- 513 Foxboro Dr Unit 513

- 511 Foxboro Dr Unit 511

- 504 Foxboro Dr Unit 504

- 505 Foxboro Dr Unit 505