5111 Neuse Commons Ln Raleigh, NC 27616

Forestville NeighborhoodEstimated Value: $295,000 - $328,000

3

Beds

3

Baths

2,627

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 5111 Neuse Commons Ln, Raleigh, NC 27616 and is currently estimated at $310,766, approximately $118 per square foot. 5111 Neuse Commons Ln is a home located in Wake County with nearby schools including Wildwood Forest Elementary, East Millbrook Middle, and Wakefield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 24, 2006

Sold by

Gowins Gerard D

Bought by

Ilan Felixberto R and Ilan Marivic B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$96,649

Interest Rate

9.05%

Mortgage Type

Balloon

Estimated Equity

$214,117

Purchase Details

Closed on

Apr 22, 2005

Sold by

Tidewater Land Llc

Bought by

Gowins Gerard D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,250

Interest Rate

5.79%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 2, 2003

Sold by

Perry Creek Commons Inc

Bought by

Tidewater Land Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ilan Felixberto R | $180,000 | None Available | |

| Gowins Gerard D | $162,500 | -- | |

| Tidewater Land Co | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ilan Felixberto R | $144,000 | |

| Previous Owner | Gowins Gerard D | $160,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,806 | $319,463 | $70,000 | $249,463 |

| 2024 | $2,795 | $319,463 | $70,000 | $249,463 |

| 2023 | $2,096 | $190,429 | $30,000 | $160,429 |

| 2022 | $1,948 | $190,429 | $30,000 | $160,429 |

| 2021 | $1,873 | $190,429 | $30,000 | $160,429 |

| 2020 | $1,839 | $190,429 | $30,000 | $160,429 |

| 2019 | $1,842 | $157,198 | $25,000 | $132,198 |

| 2018 | $1,738 | $157,198 | $25,000 | $132,198 |

| 2017 | $1,655 | $157,198 | $25,000 | $132,198 |

| 2016 | $1,622 | $157,198 | $25,000 | $132,198 |

| 2015 | $2,032 | $194,322 | $39,000 | $155,322 |

| 2014 | $1,928 | $194,322 | $39,000 | $155,322 |

Source: Public Records

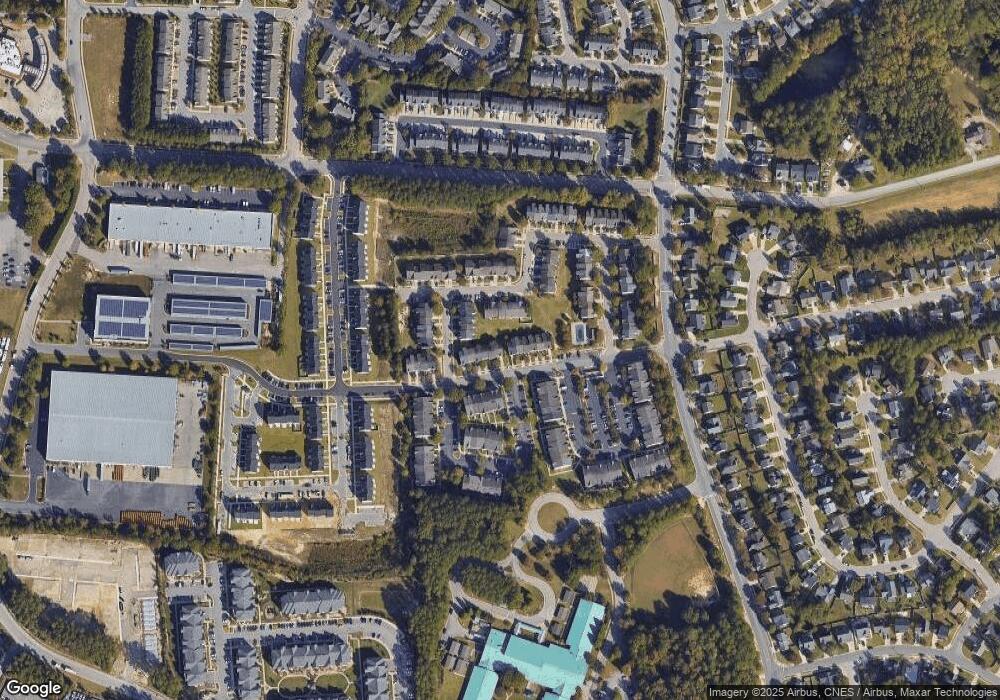

Map

Nearby Homes

- 8707 River Keeper Way

- 5121 Neuse Commons Ln

- 8620 Neuse Club Ln Unit 107

- 8610 Neuse Landing Ln Unit 103

- 5163 Sandy Banks Rd

- 8640 Neuse Landing Ln Unit 110

- 8857 Thornton Town Place

- 5126 Thornton Knoll Way

- 8885 Commons Townes Dr

- 8957 Commons Townes Dr

- 8947 Commons Townes Dr

- 4821 Gossamer Ln Unit 103

- 4821 Gossamer Ln Unit 102

- 8611 Brushfoot Way Unit 107

- 8911 Elizabeth Benneth Place

- 4820 Gossamer Ln Unit 101 & 102

- 4801 Gossamer Ln Unit 106

- 4810 Gossamer Ln Unit 105

- 5309 Neuse Wood Dr

- 8019 Satillo Ln

- 5109 Neuse Commons Ln

- 5113 Neuse Commons Ln

- 5107 Neuse Commons Ln

- 5115 Neuse Commons Ln

- 5105 Neuse Commons Ln

- 8600 Neuse Club Ln

- 8600 Neuse Club Ln Unit 109

- 5117 Neuse Commons Ln

- 5103 Neuse Commons Ln

- 5119 Neuse Commons Ln

- 8704 River Keeper Way

- 8706 River Keeper Way

- 5101 Neuse Commons Ln

- 5112 Sandy Banks Rd

- 5114 Sandy Banks Rd

- 5116 Sandy Banks Rd

- 5110 Sandy Banks Rd

- 8708 River Keeper Way

- 5118 Sandy Banks Rd

- 5123 Neuse Commons Ln