513 Allegheny Dr Walnut Creek, CA 94598

Diablo Hills NeighborhoodEstimated Value: $1,192,604 - $1,275,000

3

Beds

3

Baths

2,080

Sq Ft

$596/Sq Ft

Est. Value

About This Home

This home is located at 513 Allegheny Dr, Walnut Creek, CA 94598 and is currently estimated at $1,240,401, approximately $596 per square foot. 513 Allegheny Dr is a home located in Contra Costa County with nearby schools including Bancroft Elementary School, Foothill Middle School, and Northgate High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 17, 2003

Sold by

Ludders Joseph Deane and Ludders Kathryn Rose

Bought by

Thorne Marilyn

Current Estimated Value

Purchase Details

Closed on

Jan 9, 2001

Sold by

Fitzgerald Mike E Tre

Bought by

Ludders Joseph Deane and Ludders Kathryn Rose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Interest Rate

7.54%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 17, 1997

Sold by

Fitzgerald Mike E

Bought by

Fitzgerald Mike

Purchase Details

Closed on

Mar 13, 1997

Sold by

Selma Spondre and Fitzgerald Mike E

Bought by

Fitzgerald Mike E

Purchase Details

Closed on

Sep 15, 1994

Sold by

Chenu Robert J and Chenu Kathryn L

Bought by

Spondre Selma and Fitzgerald Mike E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thorne Marilyn | $534,000 | Financial Title | |

| Ludders Joseph Deane | $485,000 | Fidelity National Title Co | |

| Fitzgerald Mike | -- | -- | |

| Fitzgerald Mike E | -- | -- | |

| Spondre Selma | $281,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ludders Joseph Deane | $325,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,046 | $773,386 | $382,347 | $391,039 |

| 2024 | $8,896 | $758,222 | $374,850 | $383,372 |

| 2023 | $8,896 | $743,355 | $367,500 | $375,855 |

| 2022 | $8,817 | $728,781 | $360,295 | $368,486 |

| 2021 | $8,616 | $714,492 | $353,231 | $361,261 |

| 2019 | $8,426 | $693,302 | $342,755 | $350,547 |

| 2018 | $8,118 | $679,709 | $336,035 | $343,674 |

| 2017 | $7,856 | $666,383 | $329,447 | $336,936 |

| 2016 | $7,664 | $653,318 | $322,988 | $330,330 |

| 2015 | $7,607 | $643,506 | $318,137 | $325,369 |

| 2014 | $7,571 | $630,902 | $311,906 | $318,996 |

Source: Public Records

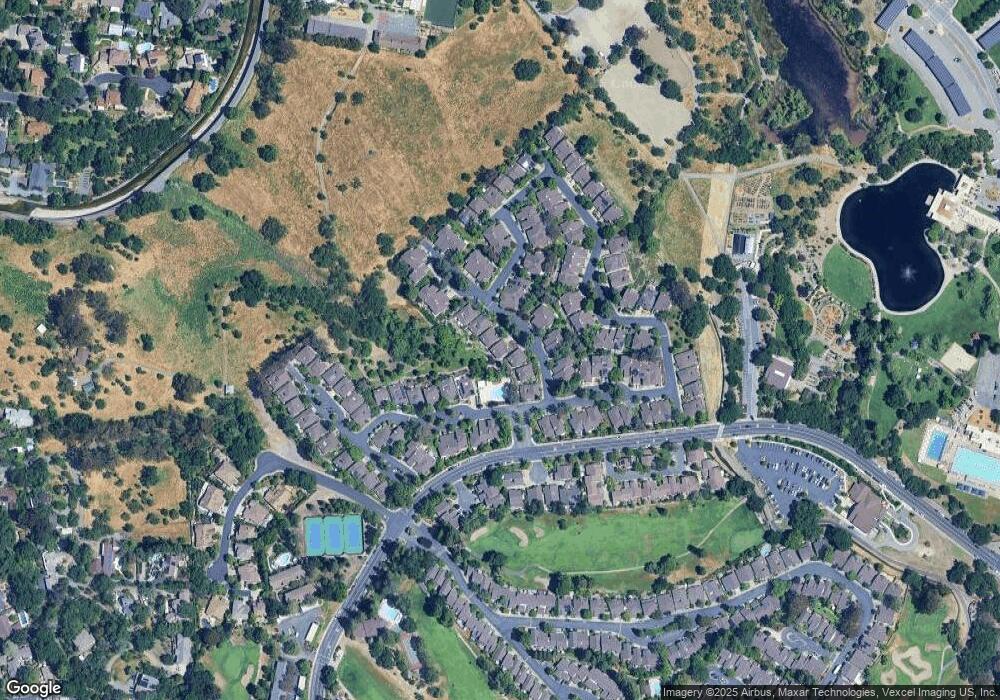

Map

Nearby Homes

- 1513 Siskiyou Dr

- 55 Cora Ct

- 295 Kinross Dr

- 1471 Marchbanks Dr Unit 4

- 1463 Marchbanks Dr Unit 2

- 1457 Marchbanks Dr Unit 1

- 1411 Marchbanks Dr Unit 2

- 1417 Marchbanks Dr Unit 4

- 205 Masters Ct Unit 3

- 1936 Nero Ct

- 2720 Oak Rd Unit 127

- 2720 Oak Rd Unit 129

- 100 Alderwood Rd

- 2704 Oak Rd Unit 77

- 2578 Oak Rd Unit 212

- 567 Cabot Ct

- 2550 Oak Rd Unit 209

- 2712 Oak Rd Unit 60

- 2742 Oak Rd Unit 191

- 1308 Walden Rd Unit 32

- 517 Allegheny Dr

- 509 Allegheny Dr

- 521 Allegheny Dr

- 505 Allegheny Dr

- 525 Allegheny Dr

- 501 Allegheny Dr

- 1541 Pyrenees Place

- 1520 Gilboa Dr

- 514 Allegheny Dr

- 512 Allegheny Dr

- 510 Allegheny Dr

- 508 Allegheny Dr

- 1543 Pyrenees Place

- 504 Allegheny Dr

- 1545 Pyrenees Place

- 502 Allegheny Dr

- 528 Allegheny Dr

- 533 Allegheny Dr

- 1512 Gilboa Dr

- 537 Allegheny Dr