5132 N 31st Way Unit 117 Phoenix, AZ 85016

Camelback East Village NeighborhoodEstimated Value: $298,169 - $384,000

--

Bed

2

Baths

1,319

Sq Ft

$264/Sq Ft

Est. Value

About This Home

This home is located at 5132 N 31st Way Unit 117, Phoenix, AZ 85016 and is currently estimated at $348,792, approximately $264 per square foot. 5132 N 31st Way Unit 117 is a home located in Maricopa County with nearby schools including Madison Rose Lane Elementary School, Camelback High School, and Phoenix Coding Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2003

Sold by

Stamatis Gerri Laina

Bought by

Apostle Christopher

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,113

Outstanding Balance

$66,300

Interest Rate

5.89%

Mortgage Type

FHA

Estimated Equity

$282,492

Purchase Details

Closed on

Sep 29, 1997

Sold by

Tobin Michele Marie

Bought by

Stamatis Gerri Laina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,200

Interest Rate

7.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 8, 1995

Sold by

Jack Walsh & Associates Inc

Bought by

Tobin Michele Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,800

Interest Rate

7.62%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Apostle Christopher | $148,571 | Stewart Title & Trust | |

| Stamatis Gerri Laina | $109,000 | First American Title | |

| Tobin Michele Marie | $91,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Apostle Christopher | $144,113 | |

| Previous Owner | Stamatis Gerri Laina | $87,200 | |

| Previous Owner | Tobin Michele Marie | $86,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,571 | $20,601 | -- | -- |

| 2024 | $2,490 | $19,620 | -- | -- |

| 2023 | $2,490 | $28,080 | $5,610 | $22,470 |

| 2022 | $2,416 | $22,320 | $4,460 | $17,860 |

| 2021 | $2,437 | $20,860 | $4,170 | $16,690 |

| 2020 | $2,399 | $19,110 | $3,820 | $15,290 |

| 2019 | $2,346 | $18,270 | $3,650 | $14,620 |

| 2018 | $2,289 | $17,530 | $3,500 | $14,030 |

| 2017 | $2,181 | $16,900 | $3,380 | $13,520 |

| 2016 | $2,106 | $15,770 | $3,150 | $12,620 |

| 2015 | $1,956 | $15,530 | $3,100 | $12,430 |

Source: Public Records

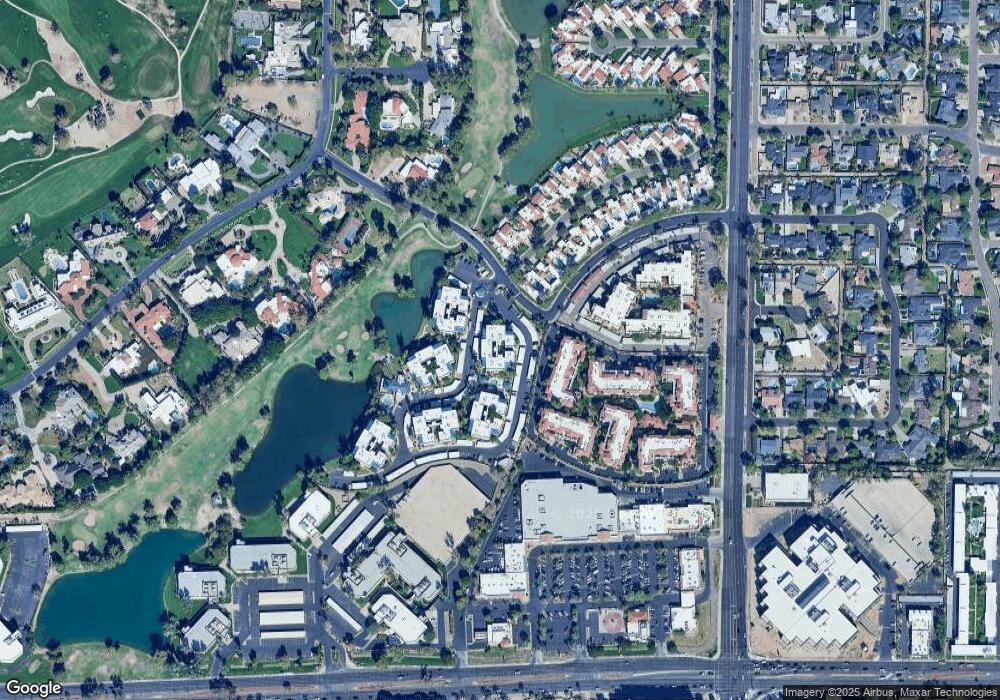

Map

Nearby Homes

- 5132 N 31st Way Unit 114

- 5132 N 31st Way Unit 134

- 5132 N 31st Way Unit 123

- 5122 N 31st Way Unit 244

- 5136 N 31st Place Unit 613

- 5124 N 31st Place Unit 536

- 5110 N 31st Way Unit 317

- 5110 N 31st Way Unit 345

- 5102 N 31st Place Unit 412

- 5102 N 31st Place Unit 425

- 5104 N 32nd St Unit 208

- 5104 N 32nd St Unit 150

- 5104 N 32nd St Unit 218

- 5104 N 32nd St Unit 332

- 5104 N 32nd St Unit 453

- 5104 N 32nd St Unit 323

- 87 Biltmore Estate

- 89 Biltmore Estate

- 3102 E Mariposa St

- 15 Biltmore Estates Dr

- 5132 N 31st Way Unit 142

- 5132 N 31st Way Unit 132

- 5132 N 31st Way Unit 116

- 5132 N 31st Way Unit 111

- 5132 N 31st Way Unit 148

- 5132 N 31st Way Unit 138

- 5132 N 31st Way Unit 113

- 5132 N 31st Way Unit 126

- 5132 N 31st Way Unit 137

- 5132 N 31st Way Unit 125

- 5132 N 31st Way Unit 135

- 5132 N 31st Way Unit 136

- 5132 N 31st Way Unit 115

- 5132 N 31st Way Unit 131

- 5132 N 31st Way Unit 146

- 5132 N 31st Way Unit 122

- 5132 N 31st Way Unit 145

- 5132 N 31st Way Unit 141

- 5132 N 31st Way Unit 133

- 5132 N 31st Way Unit 147