514 Kings Ct Tuttle, OK 73089

Estimated Value: $457,000 - $589,000

4

Beds

4

Baths

3,068

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 514 Kings Ct, Tuttle, OK 73089 and is currently estimated at $513,602, approximately $167 per square foot. 514 Kings Ct is a home with nearby schools including Tuttle Elementary School, Tuttle Intermediate School, and Tuttle Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2017

Sold by

Koeltzow Homes Llc

Bought by

Robinson Brent and Robinson Tammy K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,160

Interest Rate

4.02%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Apr 21, 2017

Sold by

Koeltzow Marvin G and Koeltzow Moena F

Bought by

Koeltzow Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,160

Interest Rate

4.02%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Jul 11, 2014

Sold by

Castle Heights Llc

Bought by

Koeltzow Marvin G and Koeltzow Moe

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robinson Brent | $47,000 | None Available | |

| Koeltzow Homes Llc | -- | None Available | |

| Koeltzow Marvin G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Robinson Brent | $300,160 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,813 | $56,179 | $6,727 | $49,452 |

| 2024 | $6,082 | $54,543 | $6,531 | $48,012 |

| 2023 | $6,082 | $52,954 | $5,775 | $47,179 |

| 2022 | $5,420 | $50,344 | $6,179 | $44,165 |

| 2021 | $5,280 | $48,878 | $6,179 | $42,699 |

| 2020 | $5,251 | $48,120 | $6,021 | $42,099 |

| 2019 | $5,018 | $45,829 | $4,610 | $41,219 |

| 2018 | $535 | $5,170 | $5,170 | $0 |

| 2017 | $41 | $386 | $386 | $0 |

| 2016 | $40 | $367 | $367 | $0 |

| 2015 | $34 | $350 | $350 | $0 |

| 2014 | $34 | $333 | $333 | $0 |

Source: Public Records

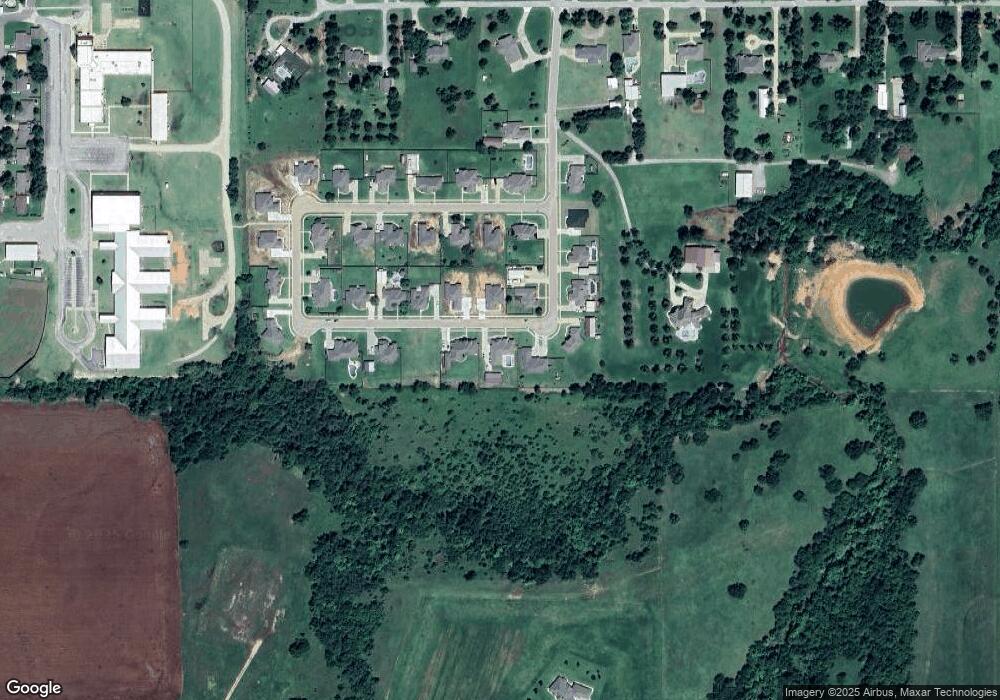

Map

Nearby Homes

- 516 Kings Ct

- 509 Cantebury Dr

- 508 Kings Ct

- 00 Chad Dr

- 605 SW 4th St

- 2029 E Rock Creek Rd

- 2025 E Rock Creek Rd

- 401 SW 4th St

- 304 SW 5th St

- 1301 E Rock Creek Rd

- 2 NW 6th St

- 1825 County Road 1205

- 949 County Street 2932

- 1720 County Road 1213

- 0 Frisco Rd

- 215 N Cemetery Rd

- 410 Sky Ln

- 2803 E Sh-37

- 928 County Street 2932

- 1003 Heritage Hills Dr

- 512 Kings Ct

- 511 Kings Ct

- 503 Kings Ct

- 513 Kings Ct

- 405 Windsor Ln

- 518 Kings Ct

- 406 Windsor Ln

- 404 Windsor Ln

- 514 Country Dr

- 510 Country Dr

- 507 Kings Ct

- 512 Cantebury Dr Unit 36631071

- 512 Cantebury Dr Unit 36628100

- 512 Cantebury Dr

- 508 Cantebury Dr

- 514 Cantebury Dr

- 507 Cantebury Dr

- 506 Kings Ct

- 506 Cantebury Dr

- 405 Rochester Ct