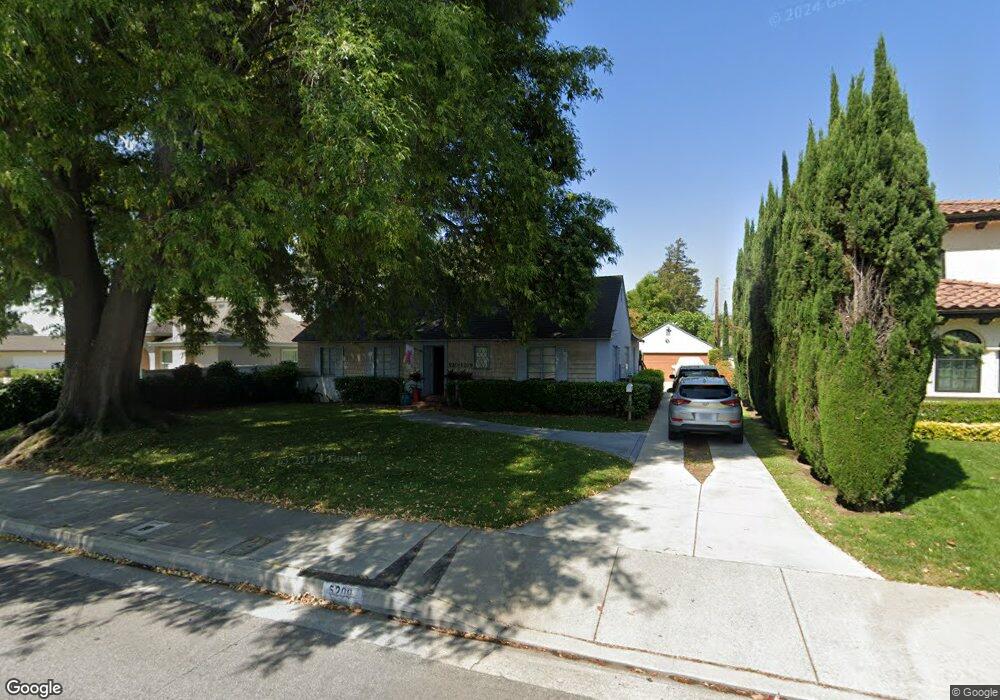

5209 Baldwin Ave Temple City, CA 91780

Estimated Value: $1,042,000 - $1,212,000

3

Beds

2

Baths

1,403

Sq Ft

$793/Sq Ft

Est. Value

About This Home

This home is located at 5209 Baldwin Ave, Temple City, CA 91780 and is currently estimated at $1,112,351, approximately $792 per square foot. 5209 Baldwin Ave is a home located in Los Angeles County with nearby schools including La Rosa Elementary, Oak Avenue Intermediate School, and Temple City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2012

Sold by

Perrou Barry F and Barry Perrou Living Trust 1993

Bought by

Pedraza Gabriel and Pedraza Jennifer S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$490,943

Interest Rate

3.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 15, 1995

Sold by

Perrou Barry

Bought by

Perrou Barry F and Barry Perrou Living Trust 1993

Purchase Details

Closed on

Apr 21, 1995

Sold by

Wallace Linda

Bought by

Wallace Linda Jean and The Linda Jean Wallace Revocab

Purchase Details

Closed on

Nov 4, 1994

Sold by

Perrou Barry and Perrou Family Trust

Bought by

Perrou Barry and Wallace Linda

Purchase Details

Closed on

Mar 15, 1994

Sold by

Perrou Barry and Perrou Emmanuel

Bought by

Perrou Barry and Perrou Family By Pass Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pedraza Gabriel | $500,000 | Lawyers Title | |

| Perrou Barry F | -- | -- | |

| Wallace Linda Jean | -- | -- | |

| Perrou Barry | -- | -- | |

| Perrou Barry | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Pedraza Gabriel | $490,943 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,420 | $615,706 | $492,568 | $123,138 |

| 2024 | $7,420 | $603,634 | $482,910 | $120,724 |

| 2023 | $7,253 | $591,799 | $473,442 | $118,357 |

| 2022 | $6,792 | $580,196 | $464,159 | $116,037 |

| 2021 | $6,915 | $568,820 | $455,058 | $113,762 |

| 2019 | $6,669 | $551,950 | $441,561 | $110,389 |

| 2018 | $6,497 | $541,128 | $432,903 | $108,225 |

| 2016 | $6,228 | $520,117 | $416,094 | $104,023 |

| 2015 | $6,124 | $512,305 | $409,844 | $102,461 |

| 2014 | $6,038 | $502,270 | $401,816 | $100,454 |

Source: Public Records

Map

Nearby Homes

- 5109 Baldwin Ave

- 5340 Village Circle Dr

- 5305 Glickman Ave

- 5313 Golden West Ave

- 9968 Daines Dr

- 4851 Agnes Ave

- 9713 Nadine St

- 5224 Hallowell Ave

- 5707 Baldwin Ave

- 10451 Mulhall St Unit 25

- 9429 La Rosa Dr

- 5003 Heleo Ave

- 5333 El Monte Ave

- 9406 La Rosa Dr

- 9409 Olive St

- 10721 Arrowood St

- 5530 Alessandro Ave

- 6022 Rowland Ave

- 4951 Mcclintock Ave

- 628 W Palm Dr

- 9969 Miloann St

- 5219 Baldwin Ave

- 5223 Baldwin Ave

- 5210 Willmonte Ave

- 5216 Willmonte Ave

- 5204 Willmonte Ave

- 5139 Baldwin Ave

- 5226 Willmonte Ave

- 5231 Baldwin Ave

- 9916 Miloann St

- 5232 Willmonte Ave

- 9950 Miloann St

- 5140 Baldwin Ave

- 5131 Baldwin Ave

- 5239 Baldwin Ave

- 5301 Village Circle R 6 Dr Unit 6

- 9944 Miloann St

- 10014 Green St

- 5125 Baldwin Ave

- 9931 Miloann St