5211 Slatey Hollow Ln Unit L Columbus, OH 43220

Estimated Value: $771,000 - $810,000

3

Beds

3

Baths

2,638

Sq Ft

$298/Sq Ft

Est. Value

About This Home

This home is located at 5211 Slatey Hollow Ln Unit L, Columbus, OH 43220 and is currently estimated at $786,980, approximately $298 per square foot. 5211 Slatey Hollow Ln Unit L is a home located in Franklin County with nearby schools including Greensview Elementary School, Hastings Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2022

Sold by

Next Dream Holdings Llc

Bought by

Marilyn J Campbell Living Trust and Campbell

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2020

Sold by

Mccabe Teresa M and Mccabe Michael T

Bought by

Next Dream Holdings Llc

Purchase Details

Closed on

Oct 18, 2017

Sold by

Foreman Victor and Foreman Donna

Bought by

Mccabe Michael T and Mccabe Teresa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,000

Interest Rate

3.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 23, 2012

Sold by

Fifth Third Bank

Bought by

Foreman Victor and Foreman Donna

Purchase Details

Closed on

Jan 27, 2012

Sold by

Davis Douglas A

Bought by

Fifth Third Bank

Purchase Details

Closed on

Jun 23, 2010

Sold by

Medfirst Development Ii Ltd

Bought by

Davis Douglas A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$750,000

Interest Rate

4.97%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marilyn J Campbell Living Trust | $650,000 | Stewart Title | |

| Next Dream Holdings Llc | $525,000 | Chicago Title Worthington | |

| Mccabe Michael T | $480,000 | Northwest Title | |

| Foreman Victor | $375,000 | Talon Title | |

| Fifth Third Bank | -- | Attorney | |

| Davis Douglas A | -- | Northwest T |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mccabe Michael T | $384,000 | |

| Previous Owner | Davis Douglas A | $750,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,497 | $225,750 | $45,500 | $180,250 |

| 2023 | $12,335 | $225,750 | $45,500 | $180,250 |

| 2022 | $11,253 | $166,540 | $32,380 | $134,160 |

| 2021 | $10,083 | $166,540 | $32,380 | $134,160 |

| 2020 | $9,623 | $164,020 | $32,380 | $131,640 |

| 2019 | $10,817 | $162,480 | $32,380 | $130,100 |

| 2018 | $9,241 | $162,480 | $32,380 | $130,100 |

| 2017 | $10,727 | $162,480 | $32,380 | $130,100 |

| 2016 | $8,271 | $131,250 | $32,270 | $98,980 |

| 2015 | $8,264 | $131,250 | $32,270 | $98,980 |

| 2014 | $8,274 | $131,250 | $32,270 | $98,980 |

| 2013 | $4,340 | $131,250 | $32,270 | $98,980 |

Source: Public Records

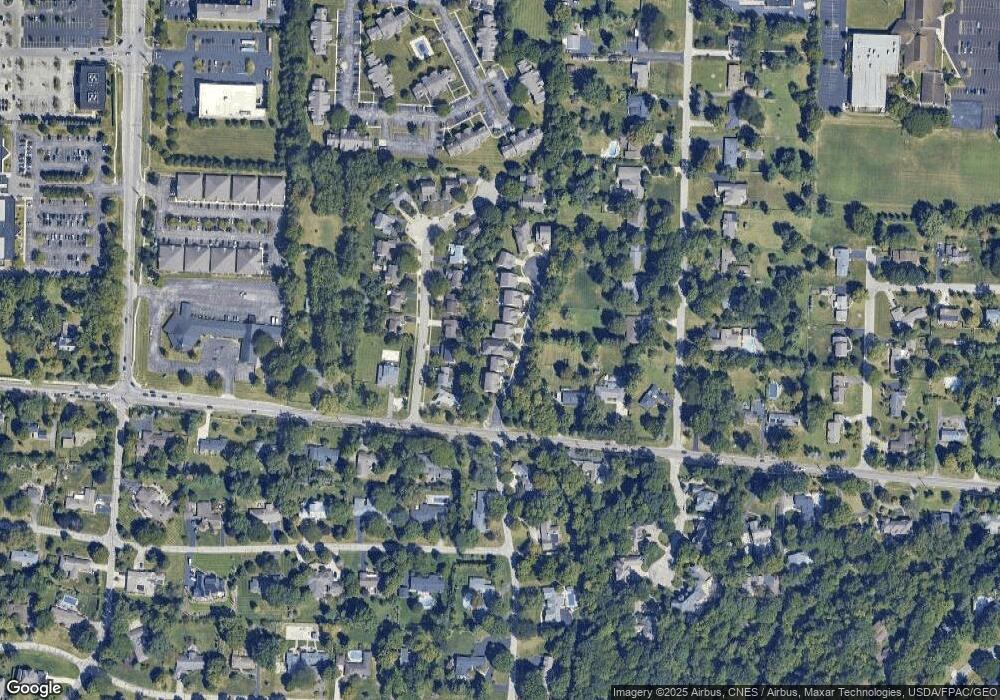

Map

Nearby Homes

- 5227 Brynwood Dr

- 5055 Slate Run Woods Ct

- 5322 Darlington Rd Unit E

- 5000 Slate Run Woods Ct

- 4499 Summit Ridge Rd

- 2744 Greystone Dr Unit E

- 5273 Brandy Oaks Ln

- 5275 Brandy Oaks Ln

- 5277 Brandy Oaks Ln

- 2491 Calais Way

- 5297 Brandy Oaks Ln Unit 5297

- 5294 Brandy Oaks Ln

- 2522 Gardenia Dr Unit 16C

- 2585 Trottersway Dr Unit 2585

- 2622 Trottersway Dr

- 5283 Ruthton Rd Unit 19

- 2560 Trotterslane Dr

- 2527 Maxim Ln Unit 40D

- 3119 Rivermill Dr Unit 24

- 4861 Etrick Dr Unit 22

- 5211 Slatey Hollow Ln

- 5205 Slatey Hollow Ln

- 5205 Slatey Hollow Ln

- 5217 Slatey Hollow Ln

- 0 Slatey Hollow

- 5199 Slatey Hollow Ln

- 5223 Slatey Hollow Ln

- 5206 Brynwood Dr

- 5229 Slatey Hollow Ln

- 5216 Brynwood Dr

- 3544 Henderson Rd

- 5200 Brynwood Dr

- 5222 Brynwood Dr

- 5235 Slatey Hollow Ln

- 5190 Brynwood Dr

- 5236 Brynwood Dr

- 5241 Slatey Hollow Ln

- 5238 Brynwood Dr

- 5229 Slatey Hollow

- 5244 Brynwood Dr