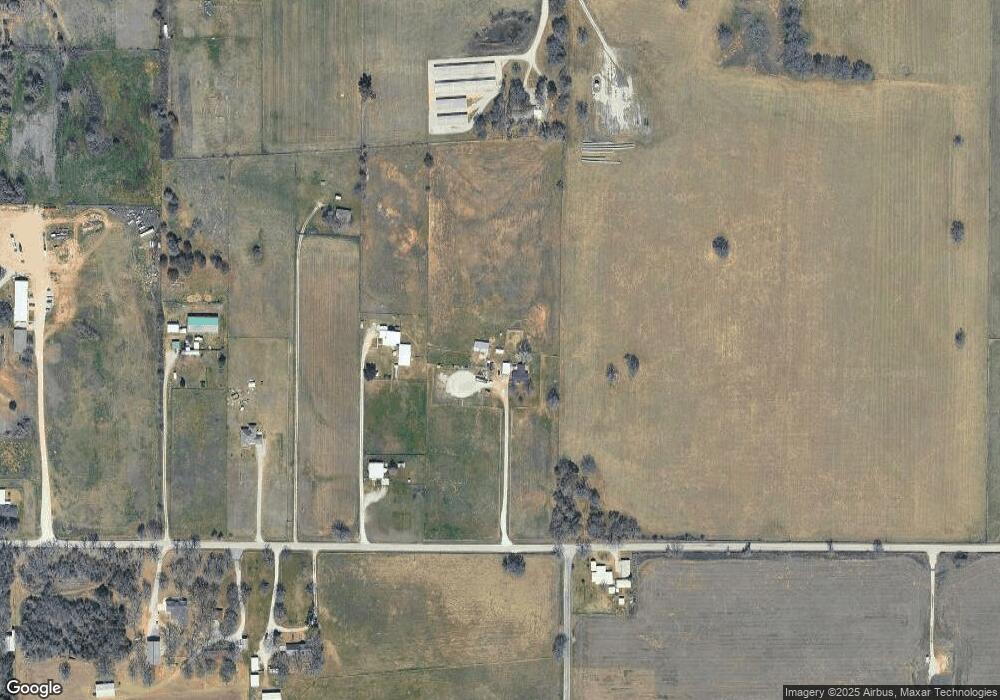

522 County Road 3336 Paradise, TX 76073

Estimated Value: $758,000

3

Beds

2

Baths

1,821

Sq Ft

$416/Sq Ft

Est. Value

About This Home

This home is located at 522 County Road 3336, Paradise, TX 76073 and is currently estimated at $758,000, approximately $416 per square foot. 522 County Road 3336 is a home located in Wise County with nearby schools including Paradise Elementary School, Paradise Intermediate School, and Paradise Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 22, 2019

Sold by

Marquez Brenda

Bought by

Rivera Miguel A

Current Estimated Value

Purchase Details

Closed on

May 30, 2017

Sold by

Anderson Charlsa

Bought by

Rivera Miguel A and Marquez Brenda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,602

Interest Rate

3.97%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 31, 2005

Sold by

Anderson Michael L and Anderson Linda Harmon

Bought by

Anderson Charlsa

Purchase Details

Closed on

Nov 1, 2001

Sold by

Winters Jimmy D and Winters Freda D

Bought by

Rivera Miguel A and Marquez Brenda

Purchase Details

Closed on

Jun 8, 1992

Bought by

Rivera Miguel A and Marquez Brenda

Purchase Details

Closed on

Jan 1, 1901

Bought by

Rivera Miguel A and Marquez Brenda

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rivera Miguel A | -- | None Available | |

| Rivera Miguel A | $292,602 | None Available | |

| Anderson Charlsa | -- | None Available | |

| Rivera Miguel A | -- | -- | |

| Rivera Miguel A | -- | -- | |

| Rivera Miguel A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rivera Miguel A | $292,602 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,439 | $266,052 | $24,617 | $241,435 |

| 2024 | $2,439 | $260,772 | $0 | $0 |

| 2023 | $3,238 | $479,859 | $0 | $0 |

| 2022 | $3,128 | $433,653 | $0 | $0 |

| 2021 | $3,043 | $391,330 | $222,200 | $169,130 |

| 2020 | $2,775 | $333,290 | $182,190 | $151,100 |

| 2019 | $1,433 | $165,460 | $91,100 | $74,360 |

| 2018 | $1,470 | $141,830 | $69,990 | $71,840 |

| 2017 | $2,545 | $242,610 | $113,310 | $129,300 |

| 2016 | $2,315 | $223,470 | $102,200 | $121,270 |

| 2015 | -- | $211,740 | $97,760 | $113,980 |

| 2014 | -- | $124,910 | $14,000 | $110,910 |

Source: Public Records

Map

Nearby Homes

- 340 County Road 3336

- 854 County Road 3330

- 00 County Road 3342

- 886 County Road 3341

- 611 County Road 3214

- The Silverwood Plan at Honeysuckle Ranch

- The Sydney Plan at Honeysuckle Ranch

- The Caddo Plan at Honeysuckle Ranch

- The Salado Plan at Honeysuckle Ranch

- The Bradford Plan at Honeysuckle Ranch

- The Cibolo Plan at Honeysuckle Ranch

- The Leona II Plan at Honeysuckle Ranch

- The Carter Plan at Honeysuckle Ranch

- The Renner Plan at Honeysuckle Ranch

- The Colorado II Plan at Honeysuckle Ranch

- The Campbell Plan at Honeysuckle Ranch

- The Aubrey Plan at Honeysuckle Ranch

- The Aylin Plan at Honeysuckle Ranch

- The Sapphire Ranch II Plan at Honeysuckle Ranch

- 485 Honeysuckle

- 554 County Road 3336

- 479 County Road 3336

- 296 Private Road 3333

- 261 Private Road 3333

- 261 Private Road 3333

- 650 County Road 3336

- 182 County Road 3340

- 633 County Road 3336

- 322 County Road 3340

- 111 County Road 3340

- 637 County Road 3336

- 280 County Road 3340

- 676 County Road 3336

- 196 County Road 3340

- 333 County Road 3330

- 864 County Road 3340

- 210 County Road 3340

- 692 County Road 3336

- 138 Private Road 3339

- 3330 Cr