5233 County Road 803 Joshua, TX 76058

Estimated Value: $418,000 - $582,000

4

Beds

2

Baths

2,519

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 5233 County Road 803, Joshua, TX 76058 and is currently estimated at $476,723, approximately $189 per square foot. 5233 County Road 803 is a home located in Johnson County with nearby schools including A.G. Elder Elementary School, Joshua High School, and Joshua High School - 9th Grade Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 25, 2017

Sold by

Twisted Ag Llc

Bought by

Holderby Christopher

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

3.78%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 15, 2013

Sold by

Shipman Companies Lp

Bought by

Twisted Ag Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Interest Rate

3.43%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 20, 2012

Sold by

Smith Olive Irene

Bought by

Shipman Companies Lp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Holderby Christopher | -- | None Available | |

| Twisted Ag Llc | -- | None Available | |

| Shipman Companies Lp | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Holderby Christopher | $185,000 | |

| Previous Owner | Twisted Ag Llc | $165,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,987 | $287,813 | $34,000 | $253,813 |

| 2024 | $3,987 | $228,580 | $0 | $0 |

| 2023 | $2,999 | $190,483 | $34,000 | $156,483 |

| 2022 | $2,325 | $129,322 | $25,000 | $104,322 |

| 2021 | $2,354 | $0 | $0 | $0 |

| 2020 | $2,551 | $0 | $0 | $0 |

| 2019 | $2,718 | $0 | $0 | $0 |

| 2018 | $2,712 | $0 | $0 | $0 |

| 2017 | $2,710 | $0 | $0 | $0 |

| 2016 | $2,590 | $0 | $0 | $0 |

| 2015 | $2,347 | $0 | $0 | $0 |

| 2014 | $2,347 | $0 | $0 | $0 |

Source: Public Records

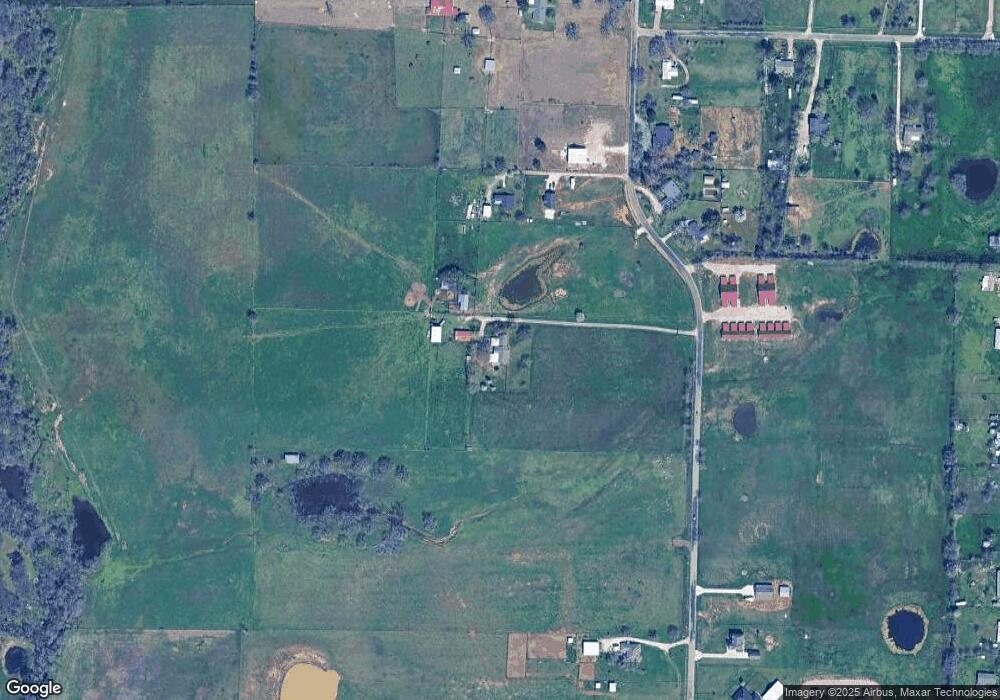

Map

Nearby Homes

- 5012 Pheasant Run Dr

- 4025 Running Brook Dr

- 1301 County Road 705

- 6020 Glenwood Dr

- 6013 Valley View Dr

- 7016 Valley View Dr

- 7008 Valley View Dr

- 2021 Running Brook Dr

- 7004 Valley View Dr

- 4012 Twin Hills Ct

- 2009 Running Brook Dr

- 3012 Valley View Dr

- 3004 Valley View Dr

- 4433 County Road 801

- Scottsdale II Plan at Joshua Meadows

- Lexington SE Plan at Joshua Meadows

- Nottingham I Plan at Joshua Meadows

- Fairview SE Plan at Joshua Meadows

- Wildwood SE Plan at Joshua Meadows

- Henderson Plan at Joshua Meadows

- 5305 County Road 803

- 5303 County Road 803

- 5300 County Road 803

- 5304 County Road 803

- 5145 County Road 803

- 5256 Cr 803

- 5308 County Road 803

- 1500 Valley View Dr

- TBD County Rd 803 C

- TBD County Rd 803 D

- 5109 County Road 803

- 5256 Cr 803

- 5405 County Road 803

- TBD County Rd 803 B

- 1501 Valley View Dr

- 1516 Valley View Dr

- 5144 County Road 803

- 1512 Valley View Dr

- 5408 County Road 803

- TBD County Rd 803 A