5240 Seward Crossing Blvd #33 Murfreesboro, TN 37128

Estimated Value: $397,000 - $466,641

--

Bed

3

Baths

2,066

Sq Ft

$210/Sq Ft

Est. Value

About This Home

This home is located at 5240 Seward Crossing Blvd #33, Murfreesboro, TN 37128 and is currently estimated at $433,910, approximately $210 per square foot. 5240 Seward Crossing Blvd #33 is a home located in Rutherford County with nearby schools including Brown's Chapel Elementary School, Blackman Middle School, and Blackman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2022

Sold by

Jones and John

Bought by

Rooker Ruth Ann and Rooker James Christopher

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$402,573

Outstanding Balance

$384,880

Interest Rate

5.51%

Mortgage Type

FHA

Estimated Equity

$49,030

Purchase Details

Closed on

Sep 30, 2020

Sold by

Chrisman John S

Bought by

Jones Katlyn and Jones John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,405

Interest Rate

2.9%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Apr 24, 2015

Sold by

Ole South Properties Inc

Bought by

Chrisman John S

Purchase Details

Closed on

Aug 12, 2014

Sold by

Milton Investors Group Llc

Bought by

Ole South Properties Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rooker Ruth Ann | $410,000 | Rudy Ttle And Escrow Llc | |

| Jones Katlyn | $289,900 | Rudy Title & Escrow Llc | |

| Chrisman John S | $199,904 | -- | |

| Ole South Properties Inc | $72,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rooker Ruth Ann | $402,573 | |

| Previous Owner | Jones Katlyn | $275,405 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,990 | $105,700 | $13,750 | $91,950 |

| 2024 | $2,990 | $105,700 | $13,750 | $91,950 |

| 2023 | $1,983 | $105,700 | $13,750 | $91,950 |

| 2022 | $1,708 | $105,700 | $13,750 | $91,950 |

| 2021 | $1,695 | $76,350 | $10,000 | $66,350 |

| 2020 | $1,695 | $76,350 | $10,000 | $66,350 |

| 2019 | $1,695 | $76,350 | $10,000 | $66,350 |

Source: Public Records

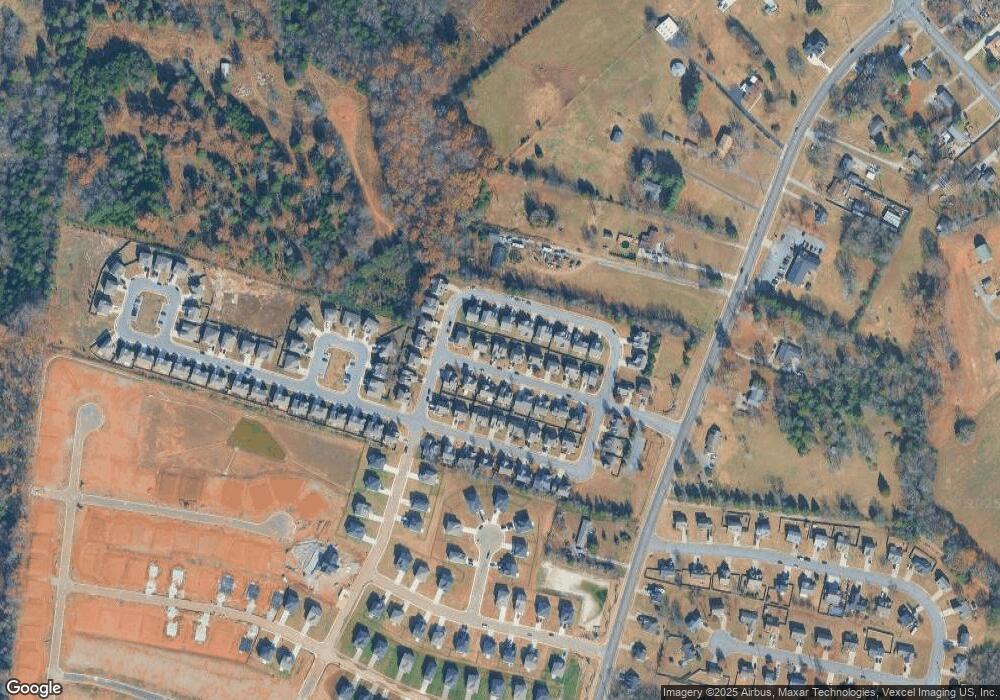

Map

Nearby Homes

- 6826 Chatsworth Ct

- 4946 Camborne Cir

- 4913 Camborne Cir

- Lowry Plan at Sycamore Grove

- Erikson Plan at Sycamore Grove

- Elizabeth Plan at Sycamore Grove

- Davidson Plan at Sycamore Grove

- Bradley Plan at Sycamore Grove

- Bledsoe Plan at Sycamore Grove

- Austin Plan at Sycamore Grove

- 7621 Danswerk Dr

- Melrose Plan at Sycamore Grove

- Brienne Plan at Sycamore Grove

- Mosley Plan at Sycamore Grove

- Hadley Plan at Sycamore Grove

- Cleburne Plan at Sycamore Grove

- Baldwin Plan at Sycamore Grove

- Mercer Plan at Sycamore Grove

- Carson Plan at Sycamore Grove

- 5224 Grassland Dr

- 5240 Seward Crossing Blvd

- 5240 Seward Crossing Blvd

- 5236 Seward Crossing Blvd

- 5244 Seward Crossing Blvd

- 5244 Seward Crossing Blvd #32

- 5244 Seward Crossing Blvd

- 4123 Effie Seward Dr

- 4119 Effie Seward Dr

- 4127 Effie Seward Dr

- 4315 Effie Seward Dr

- 5232 Seward Crossing Blvd

- 5232 Seward Crossing

- 5248 Seward Crossing Blvd #31

- 5248 Seward Crossing Blvd

- 5248 Seward Crossing Blvd

- 5239 Seward Crossing Blvd #28

- 5239 Seward Crossing Blvd

- 4115 Effie Seward Dr

- 5243 Seward Crossing Blvd

- 5243 Seward Crossing Blvd #29