5269 W 3625 S Unit 5 Hooper, UT 84315

Estimated Value: $710,959 - $931,000

3

Beds

2

Baths

3,055

Sq Ft

$253/Sq Ft

Est. Value

About This Home

This home is located at 5269 W 3625 S Unit 5, Hooper, UT 84315 and is currently estimated at $772,990, approximately $253 per square foot. 5269 W 3625 S Unit 5 is a home located in Weber County with nearby schools including Kanesville Elementary School, Rocky Mountain Junior High School, and Quest Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2021

Sold by

Gruenwald Chris M and Gruenwald Laurie A

Bought by

Gruenwald Christian Michael and Gruenwald Laurie A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$494,000

Outstanding Balance

$441,599

Interest Rate

2.67%

Mortgage Type

New Conventional

Estimated Equity

$331,391

Purchase Details

Closed on

May 21, 2020

Sold by

Nilson And Company Inc

Bought by

Gruenwald Chris M and Gruenwald Laurie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$379,200

Interest Rate

3.3%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gruenwald Christian Michael | -- | Stewart Title Ins Agcy Of | |

| Gruenwald Chris M | -- | Stewart Title Ins Agcy Of | |

| Nilson And Company Inc | -- | Stewart Title Ins Agcy Of |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gruenwald Christian Michael | $494,000 | |

| Closed | Gruenwald Chris M | $379,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,770 | $669,992 | $224,996 | $444,996 |

| 2024 | $3,629 | $361,349 | $123,730 | $237,619 |

| 2023 | $3,856 | $380,600 | $123,734 | $256,866 |

| 2022 | $3,808 | $384,450 | $104,490 | $279,960 |

| 2021 | $2,259 | $385,569 | $124,945 | $260,624 |

| 2020 | $0 | $0 | $0 | $0 |

Source: Public Records

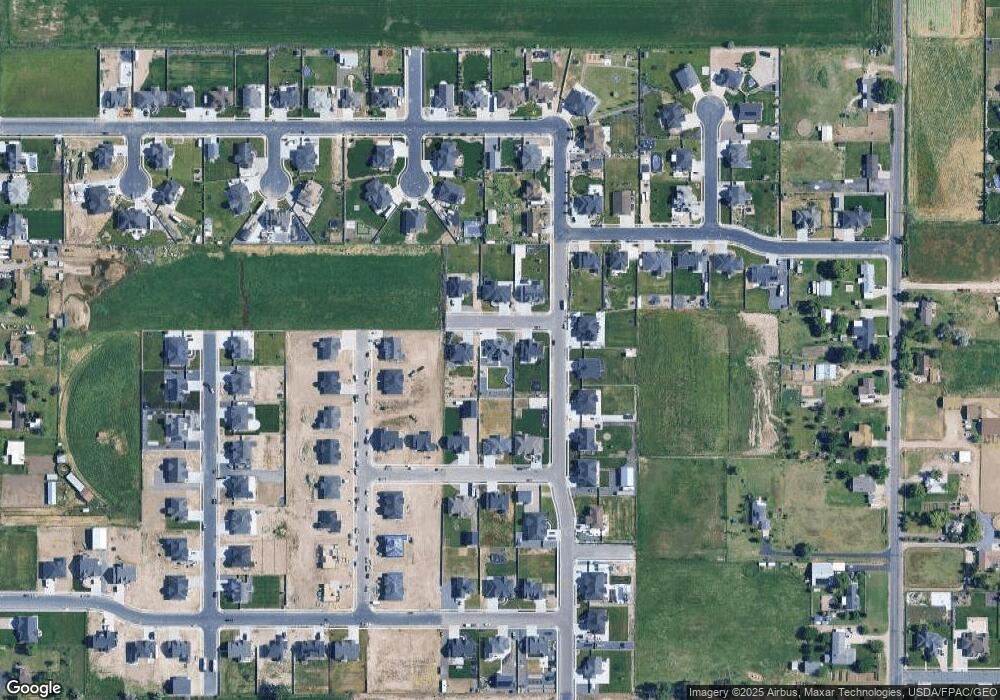

Map

Nearby Homes

- 3561 S 5160 W

- 5478 W 3750 S

- 3731 S 4975 W

- 3245 S 4975 W Unit 13

- 3223 S 4975 W Unit 15

- 3257 S 4975 W Unit 12

- 3269 S 4975 W Unit 11

- 3233 S 4975 W Unit 14

- 3691 S 5600 W Unit 20

- 3268 S 4950 W

- 3192 S 4950 W Unit 28

- 3238 S 4950 W

- 3706 S 5650 W Unit 9

- 4838 W 3625 S

- 3842 S 5675 W

- 4111 S 5350 W

- 3910 Country Cove Way

- 3660 S 4700 W

- 4126 S 4950 W

- 3661 S 4625 W Unit 204

- 5272 W 3625 S Unit 2

- 5255 W 3625 S Unit 6

- 5293 W 3625 S

- 5290 W 3625 S

- 5256 W 3625 S

- 3630 S 5250 W

- 3638 S 5250 W

- 3652 S 5250 W

- 5233 W 3575 S

- 3654 S 5325 W Unit 33

- 3573 S 5250 W

- 5270 W 3675 S

- 3662 S 5250 W

- 5294 W 3675 S

- 5254 W 3675 S

- 5306 W 3675 S

- 5306 W 3675 S Unit 31

- 5205 W 3575 S Unit 30

- 3574 S 5325 W Unit 23

- 3574 S 5325 W

Your Personal Tour Guide

Ask me questions while you tour the home.