527 5th Ave Newport, MN 55055

Estimated Value: $274,000 - $321,000

2

Beds

2

Baths

1,110

Sq Ft

$265/Sq Ft

Est. Value

About This Home

This home is located at 527 5th Ave, Newport, MN 55055 and is currently estimated at $293,769, approximately $264 per square foot. 527 5th Ave is a home located in Washington County with nearby schools including Newport Elementary School, Oltman Middle School, and East Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2018

Sold by

Alsides Deloris B and Alsides Deloris

Bought by

Giampaolo Wayne Thomas and Giampaolo Louise Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Outstanding Balance

$92,228

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$201,541

Purchase Details

Closed on

Mar 17, 2011

Sold by

Household Industrial Finance Company

Bought by

Alsides Abel and Alsides Delores

Purchase Details

Closed on

Mar 19, 2003

Sold by

Alsides Abel and Alsides Delons B

Bought by

Briseno Jesus and Gonzales Yolanda Jaso

Purchase Details

Closed on

May 29, 1997

Sold by

Alsides Abel and Alsides Deloris B

Bought by

Briseno Jesus and Gonzales Yolanda J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Giampaolo Wayne Thomas | $135,000 | None Available | |

| Alsides Abel | $50,000 | -- | |

| Briseno Jesus | $90,000 | -- | |

| Briseno Jesus | $90,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Giampaolo Wayne Thomas | $126,000 | |

| Closed | Briseno Jesus | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,630 | $267,300 | $90,000 | $177,300 |

| 2023 | $3,630 | $288,700 | $116,000 | $172,700 |

| 2022 | $2,634 | $225,200 | $73,600 | $151,600 |

| 2021 | $2,754 | $182,400 | $61,000 | $121,400 |

| 2020 | $2,696 | $193,500 | $76,700 | $116,800 |

| 2019 | $2,496 | $187,100 | $67,000 | $120,100 |

| 2018 | $2,464 | $168,200 | $57,000 | $111,200 |

| 2017 | $2,128 | $164,100 | $57,000 | $107,100 |

| 2016 | $2,030 | $147,700 | $45,000 | $102,700 |

| 2015 | $1,992 | $120,200 | $38,000 | $82,200 |

| 2013 | -- | $114,300 | $36,000 | $78,300 |

Source: Public Records

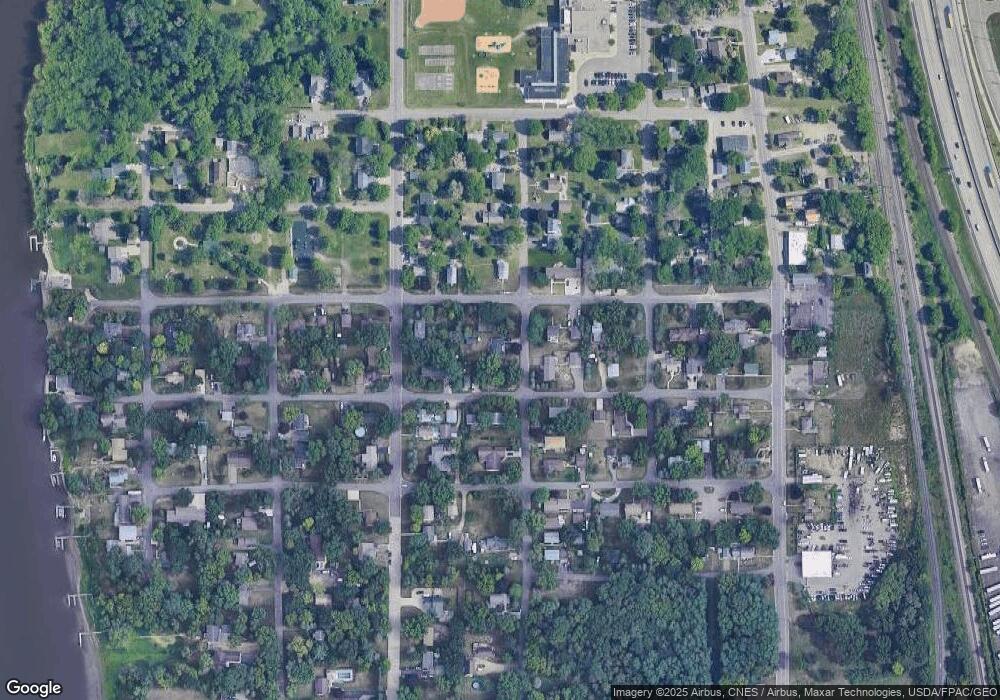

Map

Nearby Homes

- 577 7th Ave

- 1391 12th Ave

- 1621 4th Ave

- TBD Broadway Ave

- 6219 Highland Hills Ln S

- 6513 Delaney Ave

- 1690 2nd Ave

- 6266 61st St S

- 6254 61st St S

- 6248 61st St S

- 6253 61st St S

- 6265 61st St S

- 1761 8th Ave

- 6299 63rd St S

- 7007 River Rd

- 6435 Dawn Way

- 6564 Genevieve Trail

- 1403 Concord St S Unit 15

- 757 Pleasant Ave

- 801 Summit Ave