5272 Franklyn Blvd Unit A Willoughby, OH 44094

Downtown Willoughby NeighborhoodEstimated Value: $187,675 - $223,000

3

Beds

2

Baths

918

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 5272 Franklyn Blvd Unit A, Willoughby, OH 44094 and is currently estimated at $203,669, approximately $221 per square foot. 5272 Franklyn Blvd Unit A is a home located in Lake County with nearby schools including Edison Elementary School, Willoughby Middle School, and South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2007

Sold by

Jacobs Steven and Hach Jacobs Roberta

Bought by

Jacobs Stevens A and Hach Roberta L

Current Estimated Value

Purchase Details

Closed on

Aug 14, 2006

Sold by

Andrews Sarah and Barber Cheryl M

Bought by

Jacobs Steven and Hach Jacobs Roberta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,600

Outstanding Balance

$70,873

Interest Rate

6.83%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$132,796

Purchase Details

Closed on

Aug 16, 2005

Sold by

Barber Cheryl M

Bought by

Barber Cheryl M and Andrews Sarah

Purchase Details

Closed on

Apr 10, 1999

Sold by

Janke Mildred B

Bought by

Barber Cheryl M and Cheryl M Barber Trust Agreement

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,200

Interest Rate

7.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 11, 1996

Sold by

Gordish Esther

Bought by

Janke Mildred B

Purchase Details

Closed on

Jan 1, 1990

Bought by

Gordish Esther

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jacobs Stevens A | -- | All Title Services Inc | |

| Jacobs Steven | $147,000 | Enterprise Title | |

| Barber Cheryl M | -- | -- | |

| Barber Cheryl M | $119,000 | Midland Title Security Inc | |

| Janke Mildred B | $95,000 | -- | |

| Gordish Esther | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jacobs Steven | $117,600 | |

| Closed | Barber Cheryl M | $95,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $56,470 | $9,070 | $47,400 |

| 2023 | $3,851 | $40,670 | $7,430 | $33,240 |

| 2022 | $2,573 | $40,670 | $7,430 | $33,240 |

| 2021 | $2,583 | $40,670 | $7,430 | $33,240 |

| 2020 | $2,458 | $34,470 | $6,300 | $28,170 |

| 2019 | $2,286 | $34,470 | $6,300 | $28,170 |

| 2018 | $2,256 | $34,670 | $11,340 | $23,330 |

| 2017 | $2,407 | $34,670 | $11,340 | $23,330 |

| 2016 | $2,398 | $34,670 | $11,340 | $23,330 |

| 2015 | $2,315 | $34,670 | $11,340 | $23,330 |

| 2014 | $2,201 | $34,670 | $11,340 | $23,330 |

| 2013 | $2,203 | $34,670 | $11,340 | $23,330 |

Source: Public Records

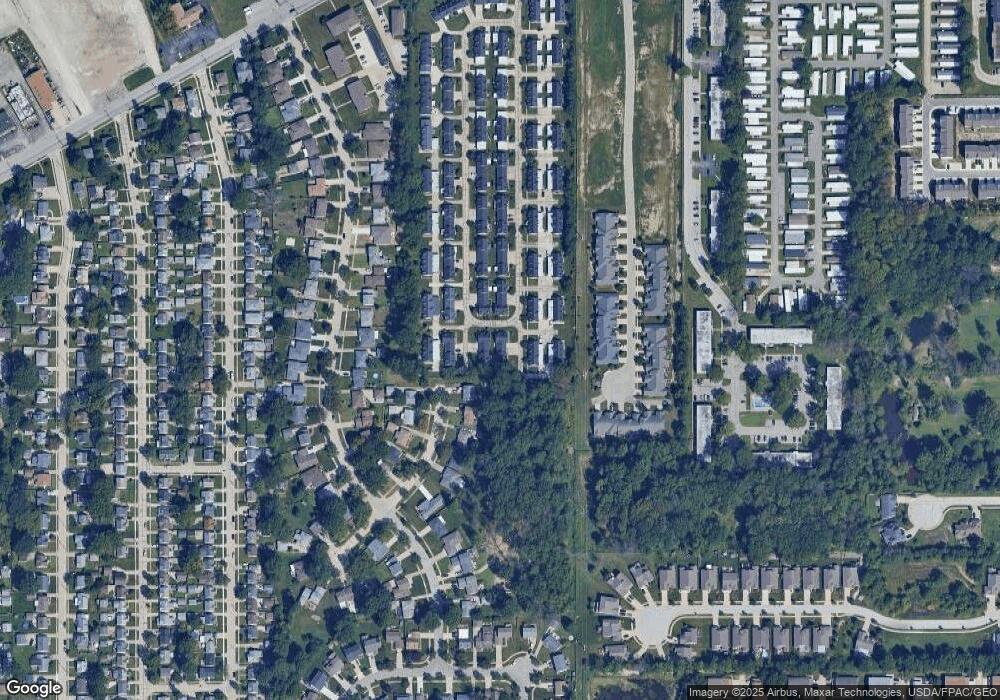

Map

Nearby Homes

- 5143 Shepherds Glen Unit 41

- 5084 Shepherds Glen

- 5082 Shepherds Glen

- 5085 Shepherds Glen

- 5080 Shepherds Glen

- 5078 Shepherds Glen

- 5083 Shepherds Glen

- 5081 Shepherds Glen

- 5076 Shepherds Glen

- 5079 Shepherds Glen

- 5074 Shepherds Glen

- 5068 Shepherds Glen

- 5362 Oak Ridge Dr

- 5062 Shepherds Glen

- 5065 Shepherds Glen Unit 7

- 5060 Shepherds Glen

- Seagrove II Plan at Aspire at Shepherds Glen

- 5051 Shepherds Glen

- 34615 Ethan Way

- 5465 Millwood Ln Unit 40-C

- 5272 Franklyn Blvd Unit B

- 5271 Liberty Ln Unit A

- 5271 Liberty Ln Unit B

- 5275 Franklyn Blvd Unit A

- 5275 Franklyn Blvd Unit B

- 5252 Franklyn Blvd Unit A

- 5252 Franklyn Blvd Unit B

- 5255 Franklyn Blvd Unit A

- 5255 Franklyn Blvd Unit B

- 5255 Franklyn Blvd

- 5274 Liberty Ln Unit A

- 5274 Liberty Ln Unit B

- 5279 Franklyn Blvd Unit A

- 5279 Franklyn Blvd Unit B

- 5251 Liberty Ln Unit A

- 5251 Liberty Ln Unit B

- 5291 Hickory Ln

- 5254 Liberty Ln Unit B

- 5259 Franklyn Blvd Unit A

- 5259 Franklyn Blvd Unit B