53 Fern Pine Unit 32 Irvine, CA 92618

Oak Creek NeighborhoodEstimated Value: $1,275,000 - $1,918,000

4

Beds

2

Baths

2,047

Sq Ft

$742/Sq Ft

Est. Value

About This Home

This home is located at 53 Fern Pine Unit 32, Irvine, CA 92618 and is currently estimated at $1,519,501, approximately $742 per square foot. 53 Fern Pine Unit 32 is a home located in Orange County with nearby schools including Oak Creek Elementary, Lakeside Middle School, and Woodbridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2002

Sold by

Davis Mark D and Davis Gisele D

Bought by

Chang Szu Tsung and Chang Su Zen Shih

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$385,000

Outstanding Balance

$161,008

Interest Rate

6.52%

Estimated Equity

$1,358,493

Purchase Details

Closed on

Nov 3, 1999

Sold by

Catellus Residential Group Inc

Bought by

Davis Mark D and Davis Gisele D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$311,640

Interest Rate

7.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chang Szu Tsung | $485,000 | Commonwealth Land Title | |

| Davis Mark D | $347,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chang Szu Tsung | $385,000 | |

| Previous Owner | Davis Mark D | $311,640 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,419 | $702,431 | $392,366 | $310,065 |

| 2024 | $7,419 | $688,658 | $384,672 | $303,986 |

| 2023 | $7,228 | $675,155 | $377,129 | $298,026 |

| 2022 | $7,090 | $661,917 | $369,734 | $292,183 |

| 2021 | $7,211 | $648,939 | $362,485 | $286,454 |

| 2020 | $7,569 | $642,285 | $358,768 | $283,517 |

| 2019 | $8,039 | $629,692 | $351,734 | $277,958 |

| 2018 | $7,922 | $617,346 | $344,838 | $272,508 |

| 2017 | $7,681 | $605,242 | $338,077 | $267,165 |

| 2016 | $7,519 | $593,375 | $331,448 | $261,927 |

| 2015 | $7,427 | $584,462 | $326,469 | $257,993 |

| 2014 | $7,315 | $573,014 | $320,074 | $252,940 |

Source: Public Records

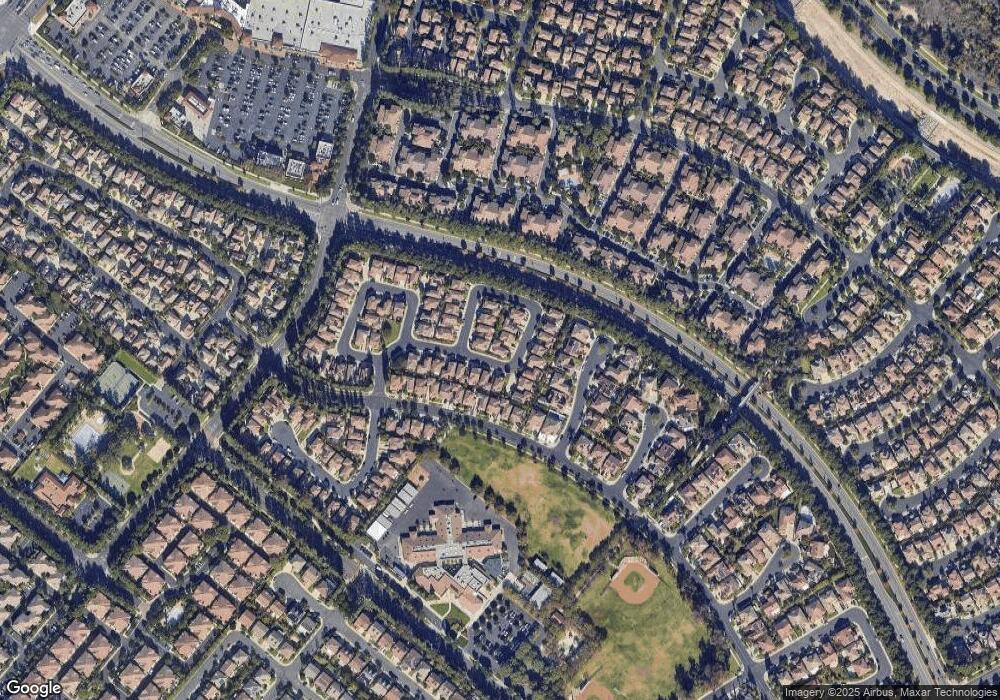

Map

Nearby Homes

- 811 Larkridge

- 29 Poppy Unit 49

- 52 Danbury Ln

- 37 Pheasant Creek

- 3 Birchwood

- 25 Tangelo Unit 292

- 268 Lemon Grove

- 80 Millbrook

- 7201 Apricot Dr

- 124 Tangelo Unit 390

- 43 Glenhurst

- 410 E Yale Loop

- 549 Springbrook N

- 352 Fallingstar Unit 57

- 11 Fallingstar

- 10 Glenhurst Unit 37

- 74 Orchard

- 246 Orange Blossom Unit 42

- 69 Tarocco

- 321 Orange Blossom Unit 166

- 55 Fern Pine

- 72 Peppermint Tree Unit 31

- 70 Peppermint Tree

- 70 Peppermint Tree Unit 30

- 57 Fern Pine Unit 34

- 68 Peppermint Tree

- 46 Fern Pine Unit 44

- 44 Fern Pine Unit 45

- 59 Fern Pine Unit 35

- 42 Fern Pine Unit 46

- 54 Fern Pine Unit 40

- 56 Fern Pine

- 52 Fern Pine

- 66 Peppermint Tree Unit 28

- 66 Peppermint Tree

- 50 Fern Pine

- 40 Fern Pine Unit 47

- 58 Fern Pine Unit 38

- 48 Fern Pine Unit 43

- 45 Eaglecreek