Estimated Value: $554,000 - $594,000

4

Beds

3

Baths

2,767

Sq Ft

$208/Sq Ft

Est. Value

About This Home

This home is located at 5300 Fairfield Oval, Solon, OH 44139 and is currently estimated at $574,644, approximately $207 per square foot. 5300 Fairfield Oval is a home located in Cuyahoga County with nearby schools including Dorothy E Lewis Elementary School, Orchard Middle School, and Solon Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 1996

Sold by

Cook Thomas J

Bought by

Schechter John M and Schechter Lisa J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,600

Outstanding Balance

$13,257

Interest Rate

7.91%

Mortgage Type

New Conventional

Estimated Equity

$561,387

Purchase Details

Closed on

Aug 18, 1988

Sold by

Hanink Dennis N

Bought by

Cook Thomas J

Purchase Details

Closed on

Jun 29, 1984

Sold by

Henry William L 111

Bought by

Hanink Dennis N

Purchase Details

Closed on

Apr 29, 1983

Bought by

Henry William L 111

Purchase Details

Closed on

Jan 28, 1983

Bought by

Park View S&L Assoc

Purchase Details

Closed on

Jan 30, 1980

Bought by

Susman Bros Const Inc

Purchase Details

Closed on

Jun 13, 1978

Bought by

Lawrence Homes Inc

Purchase Details

Closed on

Dec 5, 1977

Sold by

Fuerst Mary B

Bought by

Metro Development Company

Purchase Details

Closed on

Dec 23, 1976

Sold by

Fuerst Geo A

Bought by

Fuerst Mary B

Purchase Details

Closed on

Jan 1, 1975

Bought by

Fuerst Geo A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schechter John M | $276,000 | -- | |

| Cook Thomas J | $245,000 | -- | |

| Hanink Dennis N | $169,000 | -- | |

| Henry William L 111 | $164,000 | -- | |

| Park View S&L Assoc | $103,000 | -- | |

| Susman Bros Const Inc | -- | -- | |

| Lawrence Homes Inc | -- | -- | |

| Metro Development Company | $63,000 | -- | |

| Fuerst Mary B | -- | -- | |

| Fuerst Geo A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schechter John M | $234,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,523 | $174,020 | $54,530 | $119,490 |

| 2023 | $9,707 | $142,110 | $52,470 | $89,640 |

| 2022 | $9,488 | $142,100 | $52,470 | $89,640 |

| 2021 | $9,380 | $142,100 | $52,470 | $89,640 |

| 2020 | $9,674 | $134,050 | $49,490 | $84,560 |

| 2019 | $9,370 | $383,000 | $141,400 | $241,600 |

| 2018 | $8,066 | $134,050 | $49,490 | $84,560 |

| 2017 | $7,817 | $118,100 | $50,160 | $67,940 |

| 2016 | $7,744 | $118,100 | $50,160 | $67,940 |

| 2015 | $7,434 | $118,100 | $50,160 | $67,940 |

| 2014 | $7,434 | $109,350 | $46,450 | $62,900 |

Source: Public Records

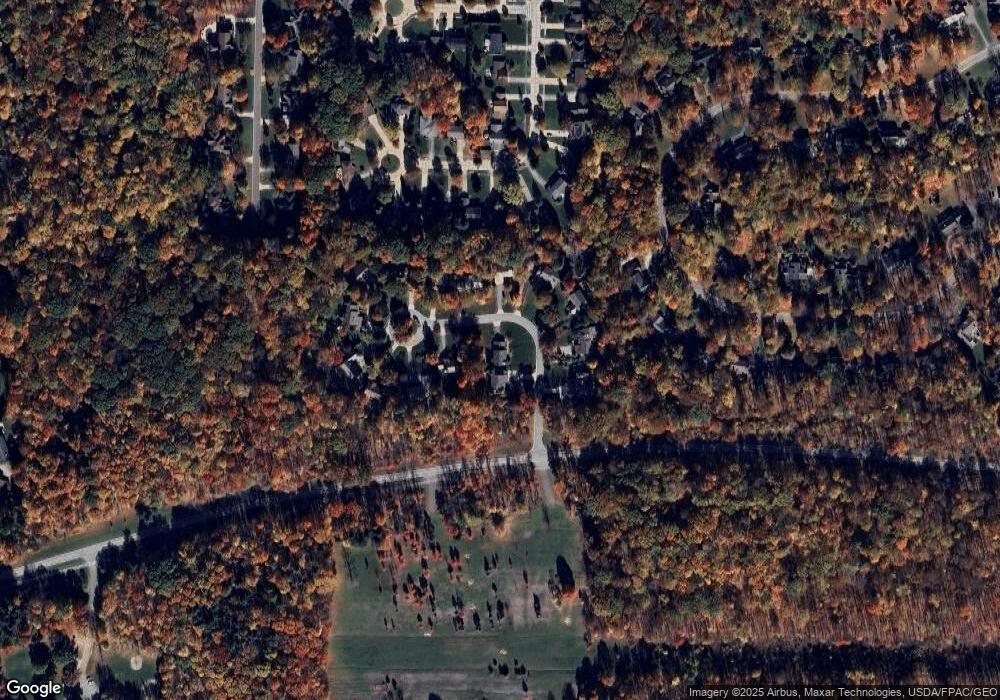

Map

Nearby Homes

- 5158 Lansdowne Dr

- 5130 Cheswick Dr

- 32560 Wintergreen Dr

- 5009 Lansdowne Dr

- 5225 Harper Rd

- 5241 Som Center Rd

- 5151 Som Center Rd

- 30320 Miles Rd

- 29470 W Woodall Dr

- S/L 12 Neptune Oval

- S/L 1 Neptune Oval

- 32775 Ledge Hill Dr

- 112 Meadow Ln

- S/L 2 Neptune Oval

- S/L 13 Neptune Oval

- S/L 11 Neptune Oval

- 5575 Hummingbird Cir

- S/L 3 Neptune Oval

- 32650 Stony Brook Ln

- S/L 4 Neptune Oval

- 5310 Fairfield Oval

- 5260 Fairfield Oval

- 5275 Fairfield Oval

- 5265 Fairfield Oval

- 5305 Fairfield Oval

- 5285 Fairfield Oval

- 5315 Fairfield Oval

- 5250 Fairfield Oval

- 5255 Fairfield Oval

- 5295 Fairfield Oval

- 5245 Fairfield Oval

- 5240 Fairfield Oval

- 31750 Cheswick Place

- 31800 Cheswick Place

- 31700 Cheswick Place

- 5230 Fairfield Oval

- 5225 Fairfield Oval

- 31650 Cheswick Place

- 5235 Fairfield Oval

- 31600 Cheswick Place