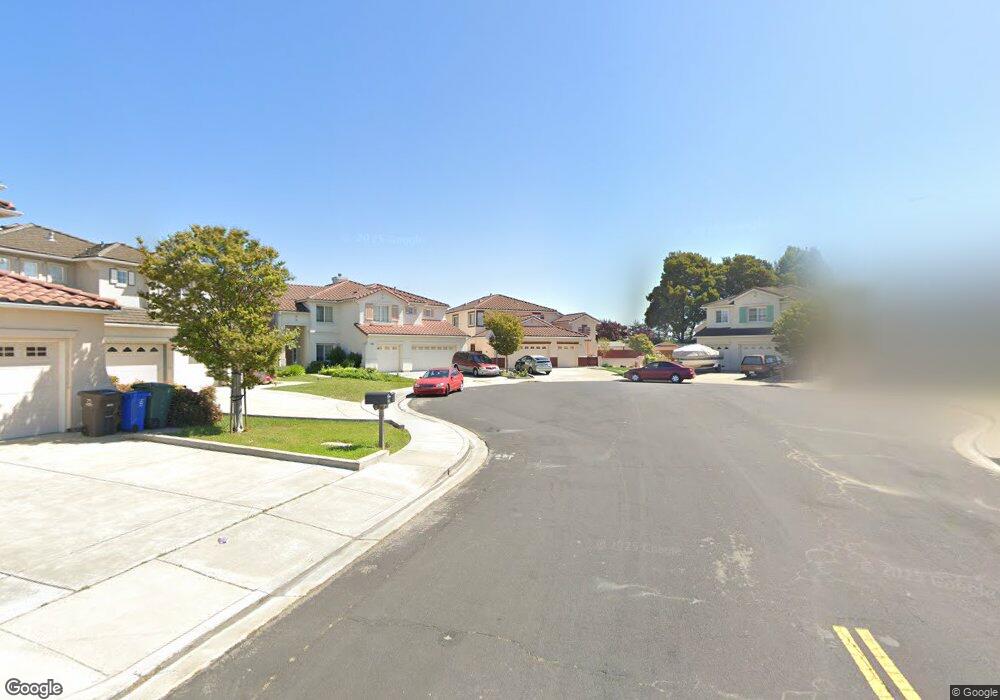

5301 Asilomar Ct Union City, CA 94587

Alvarado NeighborhoodEstimated Value: $1,851,000 - $2,114,000

5

Beds

4

Baths

2,766

Sq Ft

$714/Sq Ft

Est. Value

About This Home

This home is located at 5301 Asilomar Ct, Union City, CA 94587 and is currently estimated at $1,974,733, approximately $713 per square foot. 5301 Asilomar Ct is a home located in Alameda County with nearby schools including Delaine Eastin Elementary School, Itliong-Vera Cruz, and James Logan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2018

Sold by

Sharma Pushpinder K and Sharma Sarita R

Bought by

Sharma Pushpinder K and Sharma Sarita R

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2000

Sold by

Irshad Cava Martha Maguerite Otero and Irshad Shahab Irian

Bought by

Sharma Pushpinder and Sharma Sarita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

8.12%

Purchase Details

Closed on

Dec 15, 1999

Sold by

Standard Pacific Corp

Bought by

Irshad Cava Martha Marguerite Otero and Irshad Shahab Irfan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$411,400

Interest Rate

7.82%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sharma Pushpinder K | -- | None Available | |

| Sharma Pushpinder | $650,000 | North American Title Co | |

| Irshad Cava Martha Marguerite Otero | $515,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sharma Pushpinder | $280,000 | |

| Previous Owner | Irshad Cava Martha Marguerite Otero | $411,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,406 | $972,374 | $293,812 | $685,562 |

| 2024 | $13,406 | $953,173 | $288,052 | $672,121 |

| 2023 | $13,011 | $941,348 | $282,404 | $658,944 |

| 2022 | $12,803 | $915,895 | $276,868 | $646,027 |

| 2021 | $12,518 | $897,800 | $271,440 | $633,360 |

| 2020 | $12,245 | $895,524 | $268,657 | $626,867 |

| 2019 | $12,373 | $877,967 | $263,390 | $614,577 |

| 2018 | $12,091 | $860,755 | $258,226 | $602,529 |

| 2017 | $11,805 | $843,881 | $253,164 | $590,717 |

| 2016 | $11,375 | $827,338 | $248,201 | $579,137 |

| 2015 | $11,165 | $814,917 | $244,475 | $570,442 |

| 2014 | $10,749 | $798,960 | $239,688 | $559,272 |

Source: Public Records

Map

Nearby Homes

- 32447 Pacific Grove Way

- 32425 Pacific Grove Way

- 32409 Elizabeth Way

- 4639 Michelle Ct

- 4611 Carmen Way

- 4506 Birchwood Ct

- 32451 Regents Blvd

- 4633 Granada Way

- 4532 Delores Dr

- 4201 Saturn Way

- 4214 Saturn Way

- 32945 Regents Blvd

- 4263 Queen Anne Dr

- 33018 Soquel St

- 33064 Compton Ct

- 34102 Zaner Way

- 4167 Sunflower Ct

- 4243 Comet Cir

- 4231 Hanford St

- 4100 Aquarius Cir

- 5305 Asilomar Ct

- 5300 Asilomar Ct

- 5309 Asilomar Ct

- 5304 Asilomar Ct

- 5312 Asilomar Ct

- 5308 Asilomar Ct

- 5313 Asilomar Ct

- 5400 New Harbor Way

- 5205 Del Mar Ct

- 5312 Carmel Way

- 5404 New Harbor Way

- 5209 Del Mar Ct

- 5408 New Harbor Way

- 5201 Del Mar Ct

- 32449 New Harbor Way

- 5412 New Harbor Way

- 5213 Del Mar Ct

- 32303 Annette Ct

- 32445 New Harbor Way

- 5200 Del Mar Ct