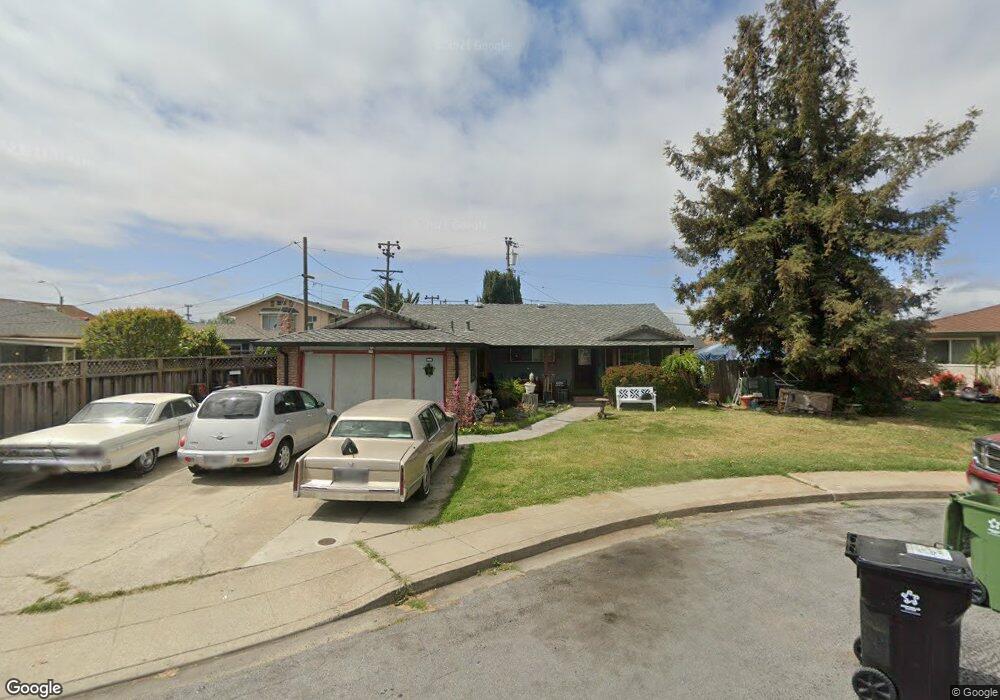

5333 Trio Ct Fremont, CA 94538

Blacow NeighborhoodEstimated Value: $953,000 - $1,209,000

3

Beds

1

Bath

1,064

Sq Ft

$1,045/Sq Ft

Est. Value

About This Home

This home is located at 5333 Trio Ct, Fremont, CA 94538 and is currently estimated at $1,112,327, approximately $1,045 per square foot. 5333 Trio Ct is a home located in Alameda County with nearby schools including Steven Millard Elementary, G.M. Walters Middle School, and John F. Kennedy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 6, 2006

Sold by

Joyce Brenden and Joyce Michelle

Bought by

Joyce James and Joyce Judith

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$409,500

Outstanding Balance

$239,734

Interest Rate

6.12%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$872,593

Purchase Details

Closed on

Sep 21, 2004

Sold by

Joyce Brenden and Joyce Michelle

Bought by

Joyce Brenden and Joyce Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$338,500

Interest Rate

5.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 24, 2003

Sold by

Fairbanks John L

Bought by

Joyce Brenden and Joyce Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,500

Interest Rate

6.75%

Purchase Details

Closed on

Jun 7, 1995

Sold by

Keeling Jan and The Fairbanks Family Trust

Bought by

Fairbanks John L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Joyce James | -- | North American Title Co | |

| Joyce Brenden | $84,618 | Alliance Title Company | |

| Joyce Brenden | $310,000 | -- | |

| Joyce James | -- | -- | |

| Fairbanks John L | -- | United Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Joyce James | $409,500 | |

| Closed | Joyce Brenden | $338,500 | |

| Closed | Joyce Brenden | $263,500 | |

| Closed | Joyce Brenden | $46,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,733 | $441,941 | $134,682 | $314,259 |

| 2024 | $5,733 | $433,140 | $132,042 | $308,098 |

| 2023 | $5,568 | $431,513 | $129,454 | $302,059 |

| 2022 | $5,480 | $416,053 | $126,916 | $296,137 |

| 2021 | $5,349 | $407,760 | $124,428 | $290,332 |

| 2020 | $5,314 | $410,510 | $123,153 | $287,357 |

| 2019 | $5,255 | $402,463 | $120,739 | $281,724 |

| 2018 | $5,149 | $394,573 | $118,372 | $276,201 |

| 2017 | $5,020 | $386,838 | $116,051 | $270,787 |

| 2016 | $4,926 | $379,256 | $113,777 | $265,479 |

| 2015 | $4,853 | $373,561 | $112,068 | $261,493 |

| 2014 | $4,763 | $366,245 | $109,873 | $256,372 |

Source: Public Records

Map

Nearby Homes

- 5341 Audubon Park Ct

- 4860 Bryce Canyon Park Dr

- 40422 Landon Ave

- 4751 Wadsworth Ct

- 4537 Capewood Terrace

- 4533 Capewood Terrace

- 40696 Robin St

- 4840 Piper St

- 43163 Grimmer Terrace

- 5580 Hemlock Terrace

- 42932 Peachwood St

- 4309 Bora Ave

- 41882 Gifford St

- 5560 Boscell Common

- 39850 Sundale Dr

- 39997 Cedar Blvd Unit 153

- 39975 Cedar Blvd Unit 136

- 40116 Crockett St

- 4453 Porter St

- 4421 Cahill St

- 5417 Valpey Park Ave

- 5441 Valpey Park Ave

- 5311 Trio Ct

- 4812 Allegro Ct

- 5465 Valpey Park Ave

- 5300 Trio Ct

- 4813 Allegro Ct

- 4848 Allegro Ct

- 5366 Trio Ct

- 5489 Valpey Park Ave

- 5344 Trio Ct

- 5388 Trio Ct

- 5322 Trio Ct

- 4832 Mezzo Ct

- 4849 Allegro Ct

- 4856 Mezzo Ct

- 5416 Butano Park Dr

- 4884 Allegro Ct

- 4808 Mezzo Ct

- 5439 Fiesta Rd