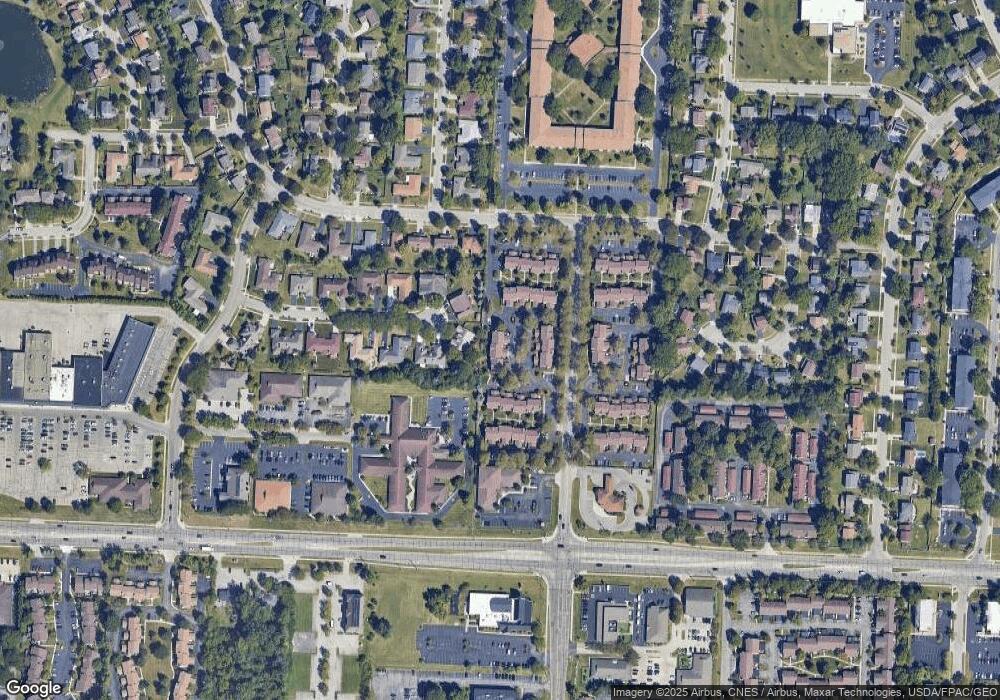

5357 Tartan Ln Columbus, OH 43235

The Gables NeighborhoodEstimated Value: $262,589 - $302,000

3

Beds

2

Baths

1,356

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 5357 Tartan Ln, Columbus, OH 43235 and is currently estimated at $280,147, approximately $206 per square foot. 5357 Tartan Ln is a home located in Franklin County with nearby schools including Daniel Wright Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2023

Sold by

Spangler Living Trust

Bought by

Fleming Catherine G and Lochtefeld Abigail M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,800

Outstanding Balance

$198,179

Interest Rate

6.81%

Mortgage Type

New Conventional

Estimated Equity

$81,968

Purchase Details

Closed on

Apr 4, 2023

Sold by

Spangler Robert J

Bought by

Spangler Living Trust

Purchase Details

Closed on

Jun 6, 2017

Sold by

Snyder Laura Jean

Bought by

Spangler Robert J

Purchase Details

Closed on

Mar 31, 2016

Sold by

Kaplow Joshua D and Whitt Jack G

Bought by

Kaplow Joshua D

Purchase Details

Closed on

Mar 31, 2006

Sold by

Whitt Jack G and Whitt Betty J

Bought by

Whitt Jack G and Whitt Betty J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Interest Rate

6.48%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Jan 19, 1996

Sold by

Borror Richard

Bought by

Whitt Jack G and Whitt Betty

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fleming Catherine G | $253,500 | Northwest Select Title | |

| Spangler Living Trust | -- | None Listed On Document | |

| Spangler Robert J | $102,000 | None Available | |

| Kaplow Joshua D | -- | None Available | |

| Whitt Jack G | -- | Premier Ti | |

| Whitt Jack G | $72,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fleming Catherine G | $202,800 | |

| Previous Owner | Whitt Jack G | $108,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,621 | $76,410 | $17,500 | $58,910 |

| 2023 | $1,325 | $21,770 | $17,500 | $4,270 |

| 2022 | $607 | $9,240 | $6,370 | $2,870 |

| 2021 | $617 | $9,240 | $6,370 | $2,870 |

| 2020 | $3,088 | $46,520 | $6,370 | $40,150 |

| 2019 | $2,683 | $35,770 | $4,900 | $30,870 |

| 2018 | $2,100 | $35,770 | $4,900 | $30,870 |

| 2017 | $2,418 | $35,770 | $4,900 | $30,870 |

| 2016 | $1,496 | $29,540 | $5,110 | $24,430 |

| 2015 | $1,505 | $29,540 | $5,110 | $24,430 |

| 2014 | $1,507 | $29,540 | $5,110 | $24,430 |

| 2013 | $765 | $29,540 | $5,110 | $24,430 |

Source: Public Records

Map

Nearby Homes

- 1683 Saint Albans Ct Unit 22-83

- 5108 Ranstead Ct

- 5268 Captains Ct

- 1739 Paula Dr Unit 1739

- 1865 Willoway Cir N Unit 1865

- 5363 Godown Rd

- 1835 Willoway Cir N

- 4924 Reed Rd Unit B

- 2229 Teardrop Ave Unit 35E

- 5624 Wigmore Dr Unit 50B

- 5283 Ruthton Rd Unit 19

- 1505 Eastmeadow Place

- 2260 Lila Way Unit 62D

- 1466 Weybridge Rd

- 1246 Southport Dr

- 1213 Nantucket Ave

- 5294 Brandy Oaks Ln

- 1221 Bethel Rd

- 4740 Merrifield Place Unit 25

- 5273 Brandy Oaks Ln

- 5355 Tartan Ln

- 5353 Tartan Ln

- 5353 Tartan Ln Unit 18

- 5359 Tartan Ln Unit 21

- 5361 Tartan Ln Unit 22

- 5351 Tartan Ln

- 5351 Tartan Ln Unit 17

- 5370 Tartan Ln Unit 35

- 5388 Tartan Ln

- 5365 Reed Rd Unit 28

- 5363 Reed Rd Unit 27

- 5382 Tartan Ln

- 5357 Reed Rd

- 5390 Tartan Ln

- 5398 Tartan Ln

- 5398 Tartan Ln Unit 38

- 5390 Tartan Ln Unit 42

- 1843 Fontenay Ct Unit 1843

- 1845 Fontenay Ct Unit 1845

- 5335 Tartan Ln