539 Forrest Bluff Encinitas, CA 92024

Central Encinitas NeighborhoodEstimated Value: $1,241,963 - $1,392,000

2

Beds

3

Baths

1,814

Sq Ft

$736/Sq Ft

Est. Value

About This Home

This home is located at 539 Forrest Bluff, Encinitas, CA 92024 and is currently estimated at $1,334,241, approximately $735 per square foot. 539 Forrest Bluff is a home located in San Diego County with nearby schools including Park Dale Lane Elementary, Oak Crest Middle School, and La Costa Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2013

Sold by

Sutton Greg

Bought by

Sutton Greg and Sutton Donna M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,500

Outstanding Balance

$24,737

Interest Rate

2.63%

Mortgage Type

New Conventional

Estimated Equity

$1,309,504

Purchase Details

Closed on

Oct 22, 1999

Sold by

Dorscht Beryel D

Bought by

Sutton Greg

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

7.25%

Purchase Details

Closed on

Apr 1, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sutton Greg | -- | None Available | |

| Sutton Greg | $252,500 | Commonwealth Land Title Co | |

| -- | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sutton Greg | $135,500 | |

| Closed | Sutton Greg | $160,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,569 | $387,526 | $144,191 | $243,335 |

| 2024 | $4,569 | $379,928 | $141,364 | $238,564 |

| 2023 | $4,416 | $372,480 | $138,593 | $233,887 |

| 2022 | $4,294 | $365,177 | $135,876 | $229,301 |

| 2021 | $4,206 | $358,017 | $133,212 | $224,805 |

| 2020 | $4,124 | $354,347 | $131,847 | $222,500 |

| 2019 | $4,044 | $347,400 | $129,262 | $218,138 |

| 2018 | $3,979 | $340,589 | $126,728 | $213,861 |

| 2017 | $191 | $333,912 | $124,244 | $209,668 |

| 2016 | $3,797 | $327,365 | $121,808 | $205,557 |

| 2015 | $3,717 | $322,449 | $119,979 | $202,470 |

| 2014 | $3,620 | $316,133 | $117,629 | $198,504 |

Source: Public Records

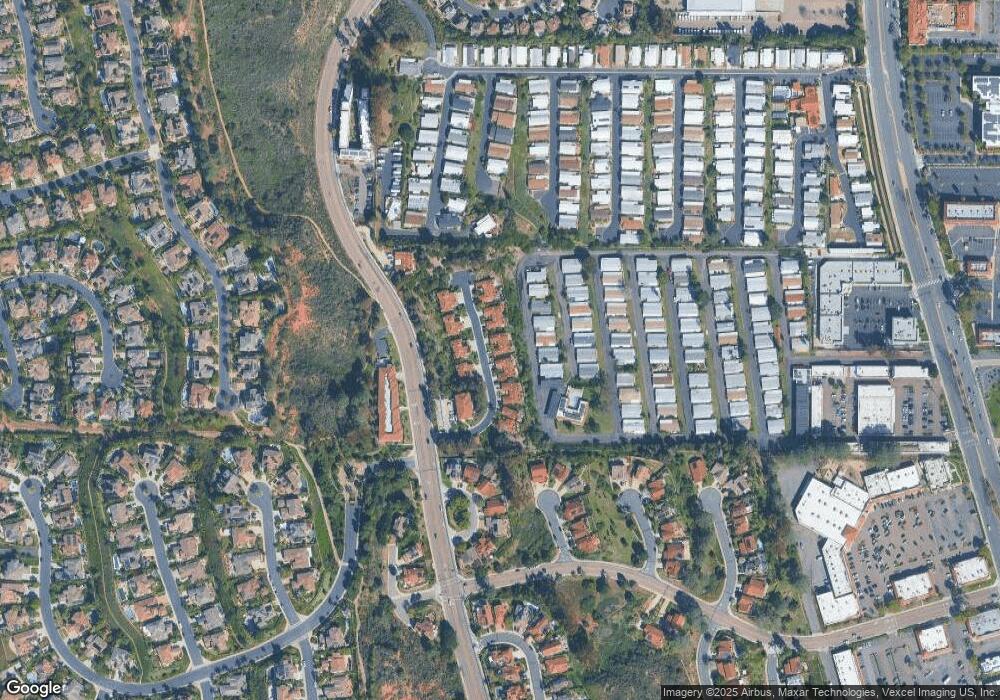

Map

Nearby Homes

- 444 N El Camino Real Unit 47

- 444 N El Camino Real Unit 119

- 444 N El Camino Real Unit 23

- 350 N El Camino Real Unit 78s

- 350 N El Camino Real Unit 72

- 1126 Pacifica Place Unit 62

- 715 Sunflower St

- 1519 Valleda Ln

- 0 Mays Hollow Ln

- 836 Jensen Ct

- 935 Encinitas Blvd

- 1517 Shields Ave

- 548 Quail Pointe Ln

- 756 Fieldstone Ln

- 1617 Blossom Field Way

- 760 Bonita Dr

- 1709 Edgefield Ln

- Lot 10 - Seaside Plan at Ocean Knoll

- Lot 9 - Stonesteps Plan at Ocean Knoll

- Lot 1 - Moonlight Plan at Ocean Knoll

- 547 Forrest Bluff

- 533 Forrest Bluff

- 525 Forrest Bluff

- 551 Forrest Bluff

- 555 Forrest Bluff

- 542 Forrest Bluff

- 521 Forrest Bluff

- 548 Forrest Bluff

- 528 Forrest Bluff

- 515 Forrest Bluff

- 554 Forrest Bluff

- 567 Forrest Bluff

- 572 Forrest Bluff

- 500 Forrest Bluff

- 578 Forrest Bluff

- 509 Forrest Bluff

- 503 Forrest Bluff

- 586 Forrest Bluff

- 5500 Unfurnished

- 590 Forrest Bluff