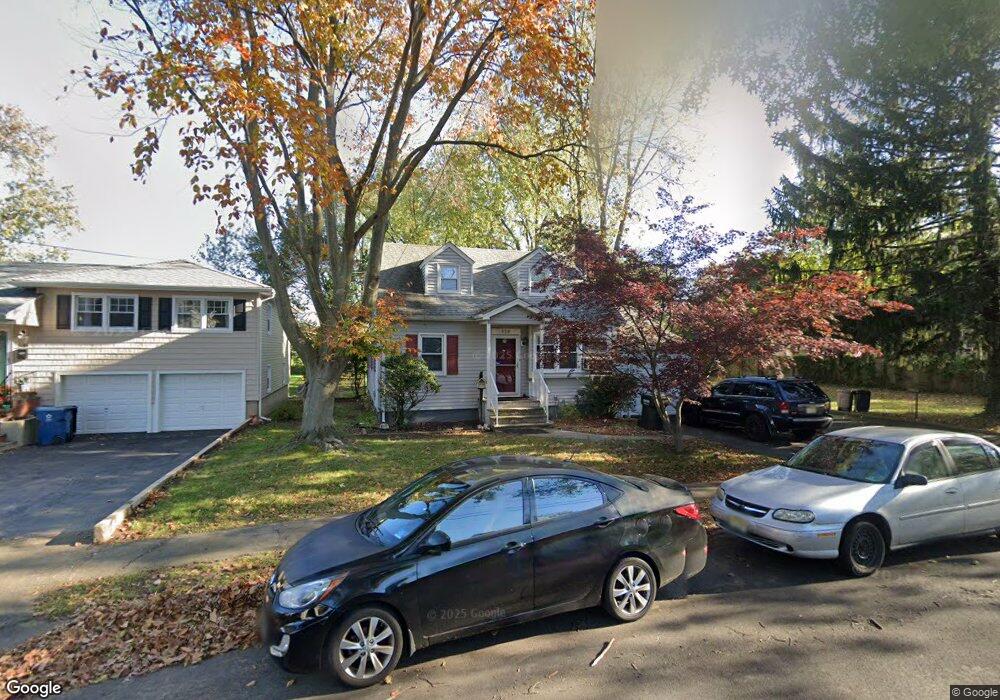

539 Willow Ave Scotch Plains, NJ 07076

Estimated Value: $360,766 - $564,000

--

Bed

--

Bath

1,134

Sq Ft

$442/Sq Ft

Est. Value

About This Home

This home is located at 539 Willow Ave, Scotch Plains, NJ 07076 and is currently estimated at $500,942, approximately $441 per square foot. 539 Willow Ave is a home located in Union County with nearby schools including School One Elementary School, Nettingham Middle School, and Scotch Plains-Fanwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2014

Sold by

Eick Robert F

Bought by

Eick Robert F

Current Estimated Value

Purchase Details

Closed on

May 25, 2006

Sold by

Robert F Eick Jr Exec

Bought by

Eick Robert F

Purchase Details

Closed on

Sep 6, 1994

Sold by

Molinaro Michael

Bought by

Eick Charlotte and Eick Robert F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eick Robert F | $10 | -- | |

| Eick Robert F | -- | -- | |

| Eick Charlotte | $134,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,720 | $65,600 | $18,500 | $47,100 |

| 2024 | $7,492 | $65,600 | $18,500 | $47,100 |

| 2023 | $7,492 | $65,600 | $18,500 | $47,100 |

| 2022 | $7,403 | $65,600 | $18,500 | $47,100 |

| 2021 | $7,391 | $65,600 | $18,500 | $47,100 |

| 2020 | $7,355 | $65,600 | $18,500 | $47,100 |

| 2019 | $7,301 | $65,600 | $18,500 | $47,100 |

| 2018 | $7,178 | $65,600 | $18,500 | $47,100 |

| 2017 | $7,019 | $65,600 | $18,500 | $47,100 |

| 2016 | $6,883 | $65,600 | $18,500 | $47,100 |

| 2015 | $6,771 | $65,600 | $18,500 | $47,100 |

| 2014 | $6,548 | $65,600 | $18,500 | $47,100 |

Source: Public Records

Map

Nearby Homes

- 5 Cecilia Place

- 352 Myrtle Ave

- 1455 Mccrea Place

- 71 Willoughby Rd

- 31 Stewart Place

- 1434 E 2nd St

- 230 Pinehurst Ave

- 263 Colonial Place Unit 65

- 1412 E 2nd St Unit 16

- 183 Watson Rd

- 1368 E 2nd St

- 1415 George St Unit 23

- 351 Terrill Rd

- 190 Carlisle Terrace Unit 94

- 360 Cook Ave

- 177 Pleasant Ave

- 1364 George St

- 193 South Ave

- 1365 Columbia Ave Unit 69

- 24 Deborah Way