5404 Fawn Meadow Curve SE Unit 6 Prior Lake, MN 55372

Estimated Value: $262,974 - $273,000

3

Beds

2

Baths

1,450

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 5404 Fawn Meadow Curve SE Unit 6, Prior Lake, MN 55372 and is currently estimated at $267,494, approximately $184 per square foot. 5404 Fawn Meadow Curve SE Unit 6 is a home located in Scott County with nearby schools including Hamilton Ridge Elementary School, Hidden Oaks Middle School, and Twin Oaks Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2021

Sold by

Guldseth James A B and Guldseth Marilyn K

Bought by

Olson Twyla Jean

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Outstanding Balance

$155,725

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$111,769

Purchase Details

Closed on

Jul 24, 2009

Sold by

Maidment Jeffrey D and Maidment Angie M

Bought by

Guldseth James A B and Guldseth Marilyn

Purchase Details

Closed on

Apr 29, 2005

Sold by

Geertsema Dennis L and Geertsema Barbara J

Bought by

Maidmenl Jeffrey D and Maidmenl Angie M

Purchase Details

Closed on

Aug 29, 2001

Sold by

Inc-Minnesota D R Horton

Bought by

Geertsema Dennis L and Geertsema Barbara J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Olson Twyla Jean | $215,000 | Edina Realty Title Inc | |

| Guldseth James A B | $120,000 | -- | |

| Maidmenl Jeffrey D | $178,900 | -- | |

| Geertsema Dennis L | $144,493 | -- | |

| Olson Twyla Twyla | $215,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Olson Twyla Jean | $172,000 | |

| Closed | Olson Twyla Twyla | $212,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,158 | $252,500 | $79,300 | $173,200 |

| 2024 | $2,250 | $242,800 | $76,300 | $166,500 |

| 2023 | $2,196 | $237,800 | $74,800 | $163,000 |

| 2022 | $2,206 | $239,900 | $76,000 | $163,900 |

| 2021 | $2,310 | $208,800 | $60,500 | $148,300 |

| 2020 | $2,272 | $198,600 | $49,500 | $149,100 |

| 2019 | $2,122 | $187,500 | $45,000 | $142,500 |

| 2018 | $1,894 | $0 | $0 | $0 |

| 2016 | $1,774 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

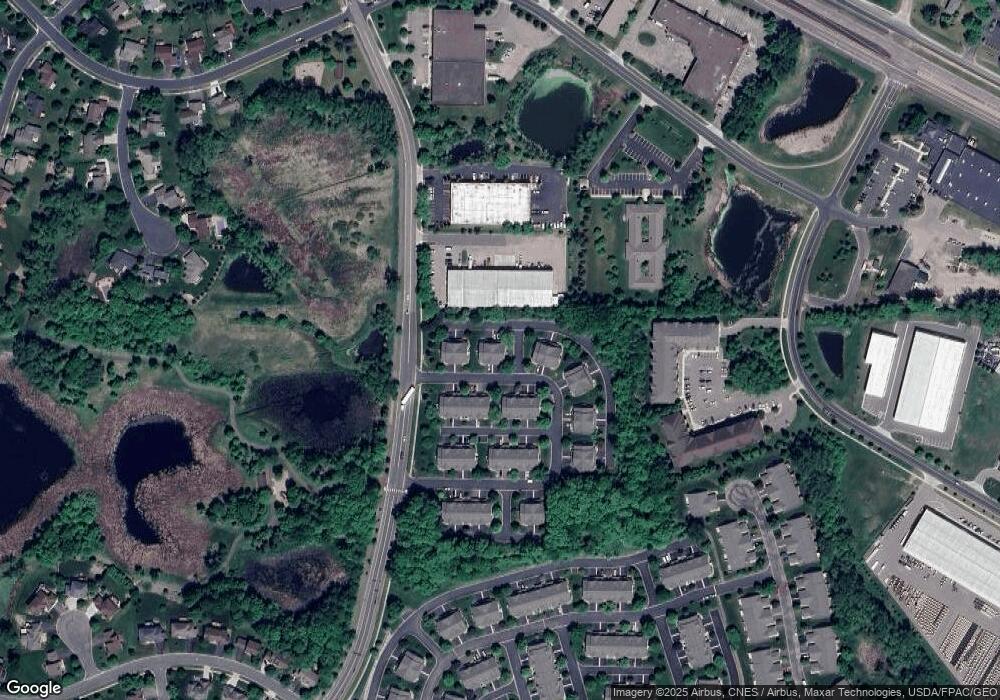

Map

Nearby Homes

- 17473 Deerfield Dr SE

- 17243 Deerfield Dr SE

- 5241 Lexington Ct SE

- 16902 Wilderness Trail SE

- 5096 E Oak Point Dr

- 4956 Bennett St SE

- 4980 Kyla Way SE

- 5453 Brooks Cir SE

- 16357 Timber Crest Dr SE Unit 11

- 16345 Victoria Curve SE

- 16367 Timber Crest Dr SE Unit 13

- 5475 Trailhead Ln SE

- 4680 Tower St SE Unit 109

- 4680 Tower St SE Unit 216

- 17140 Horizon Trail SE

- Parkwood Estates Madison Spec Plan at Parkwood Estates

- Parkwood Estates Brooke Model Plan at Parkwood Estates

- 4943 Bluff Heights Trail SE

- 1X Credit River Rd

- 17660 Jett Cir SE

- 5404 Fawn Meadow Curve SE

- 5406 Fawn Meadow Curve SE Unit 7

- 5405 Fawn Ct SE

- 5407 Fawn Ct SE

- 5403 Fawn Ct SE Unit 4

- 5408 Fawn Meadow Curve SE Unit 10

- 5409 Fawn Ct SE

- 5401 Fawn Ct SE Unit 1

- 5400 Fawn Meadow Curve SE

- 5400 Fawn Meadow Curve SE Unit 2

- 5410 Fawn Meadow Curve SE

- 5411 Fawn Ct SE Unit 12

- 5419 Fawn Meadow Curve SE Unit 31

- 5419 Fawn Meadow Curve SE

- 5423 Fawn Meadow Curve SE Unit 29

- 5417 Fawn Meadow Curve SE Unit 32

- 5425 Fawn Meadow Curve SE

- 5420 Fawn Meadow Curve SE

- 5418 Fawn Meadow Curve SE Unit 30

- 5415 Fawn Meadow Curve SE