541 Patchett Rd San Luis Obispo, CA 93401

Estimated Value: $1,520,000 - $2,161,401

3

Beds

3

Baths

1,600

Sq Ft

$1,181/Sq Ft

Est. Value

About This Home

This home is located at 541 Patchett Rd, San Luis Obispo, CA 93401 and is currently estimated at $1,890,350, approximately $1,181 per square foot. 541 Patchett Rd is a home located in San Luis Obispo County with nearby schools including Harloe Elementary School, Judkins Middle School, and Arroyo Grande High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2006

Sold by

Eldredge Kevin E and Eldredge Karen R

Bought by

Darway Earl J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$810,000

Interest Rate

6.37%

Mortgage Type

Unknown

Purchase Details

Closed on

Dec 28, 2004

Sold by

Rulison Craig S

Bought by

Eldredge Kevin E and Eldredge Karen R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$800,000

Interest Rate

5.74%

Mortgage Type

Unknown

Purchase Details

Closed on

Feb 15, 1996

Sold by

Rulison Elizabeth Marie and Rulison Craig S

Bought by

Rulison Craig S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

7.01%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Darway Earl J | $405,000 | First American Title Company | |

| Eldredge Kevin E | $995,000 | First American Title Company | |

| Rulison Craig S | -- | Cuesta Title Guarant Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Darway Earl J | $810,000 | |

| Previous Owner | Eldredge Kevin E | $800,000 | |

| Previous Owner | Rulison Craig S | $185,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,212 | $1,381,703 | $1,085,964 | $295,739 |

| 2024 | $14,049 | $1,354,612 | $1,064,671 | $289,941 |

| 2023 | $14,049 | $1,328,052 | $1,043,796 | $284,256 |

| 2022 | $13,837 | $1,302,013 | $1,023,330 | $278,683 |

| 2021 | $13,812 | $1,276,484 | $1,003,265 | $273,219 |

| 2020 | $13,654 | $1,263,396 | $992,978 | $270,418 |

| 2019 | $13,570 | $1,238,624 | $973,508 | $265,116 |

| 2018 | $13,409 | $1,214,338 | $954,420 | $259,918 |

| 2017 | $13,158 | $1,190,528 | $935,706 | $254,822 |

| 2016 | $12,409 | $1,167,185 | $917,359 | $249,826 |

| 2015 | $12,232 | $1,149,654 | $903,580 | $246,074 |

| 2014 | $11,778 | $1,127,135 | $885,881 | $241,254 |

Source: Public Records

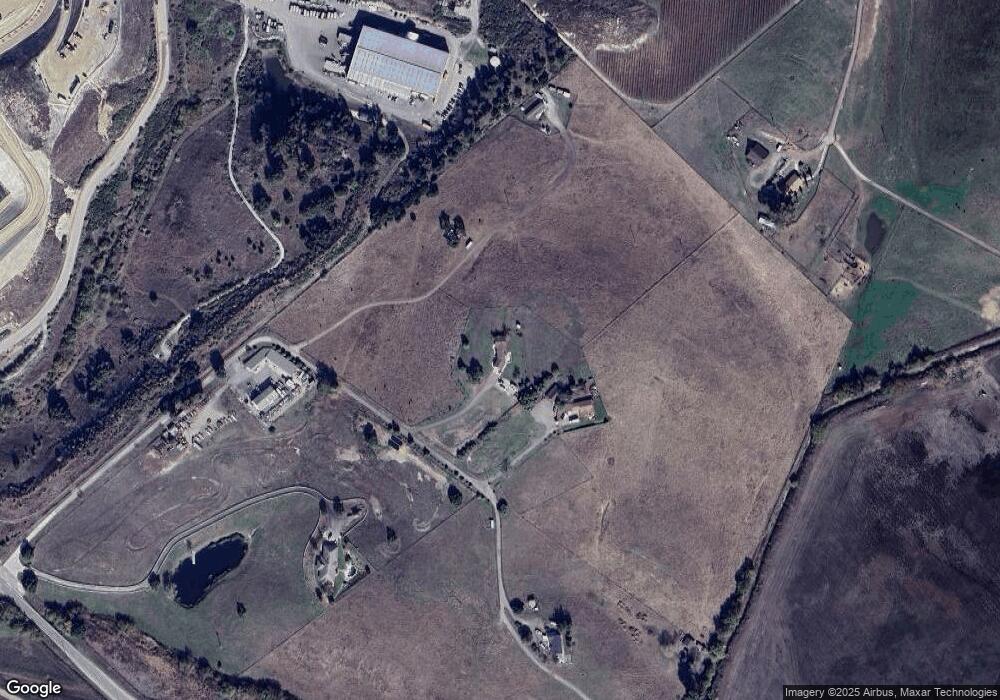

Map

Nearby Homes

- 1640 Corbett Canyon Rd

- 1685 Corbett Highlands Place

- 1190 Montecito Ridge Dr

- 625 W Ormonde Rd

- 1604 Tiffany Ranch Rd

- 1170 Montecito Ridge Dr

- 1398 Deer Canyon Rd

- 1375 Sugar Bush Ct

- 1480 Sugar Bush Ct

- 1186 Ramblin Rose Way

- 1635 Bee Canyon Rd

- 2139 Verde Canyon Rd

- 1155 Carpenter Canyon Rd

- 2545 Nightshade Place

- 2310 Oak Haven Ln

- 515 Windermere Ln

- 2356 Oak Haven Ln

- 190 Country Club Dr

- 649 Asilo

- 455 Mission Springs Rd

- 571 Patchett Rd

- 350 Patchett Rd

- 580 Patchett Rd

- 2125 Corbett Canyon Rd

- 2008 Carpenter Canyon Rd

- 1976 Carpenter Canyon Rd

- 1948 Carpenter Canyon Rd

- 1959 Carpenter Canyon Rd

- 650 Dixie Ln

- 520 Valley Rd

- 2221 Carpenter Canyon Rd

- 2225 Corbett Canyon Rd

- 520 Edna Valley Ln

- 675 Liberetto Ln

- 1955 Carpenter Canyon Rd

- 0 Tiffany Ranch Rd

- 1961 Vineyard View Ln

- 715 Dixie Ln

- 1966 Vineyard View Ln

- 2195 Corbett Canyon Rd