5411 54th Way West Palm Beach, FL 33409

Palm Beach Lakes NeighborhoodEstimated Value: $261,000 - $377,000

2

Beds

2

Baths

1,236

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 5411 54th Way, West Palm Beach, FL 33409 and is currently estimated at $295,873, approximately $239 per square foot. 5411 54th Way is a home located in Palm Beach County with nearby schools including Seminole Trails Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2003

Sold by

Christman Hsuan Wu

Bought by

Drula Nicholas J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,430

Outstanding Balance

$49,297

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$246,576

Purchase Details

Closed on

Oct 26, 2000

Sold by

Gregor William J

Bought by

Christman Hsuan W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,000

Interest Rate

7.71%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Drula Nicholas J | $119,000 | Universal Land Title Inc | |

| Christman Hsuan W | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Drula Nicholas J | $115,430 | |

| Previous Owner | Christman Hsuan W | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,110 | $75,821 | -- | -- |

| 2024 | $1,110 | $73,684 | -- | -- |

| 2023 | $1,088 | $71,538 | $0 | $0 |

| 2022 | $1,052 | $69,454 | $0 | $0 |

| 2021 | $1,041 | $67,431 | $0 | $0 |

| 2020 | $1,020 | $66,500 | $0 | $0 |

| 2019 | $1,021 | $65,005 | $0 | $0 |

| 2018 | $911 | $63,793 | $0 | $0 |

| 2017 | $872 | $62,481 | $0 | $0 |

| 2016 | $864 | $61,196 | $0 | $0 |

| 2015 | $868 | $60,771 | $0 | $0 |

| 2014 | $872 | $60,289 | $0 | $0 |

Source: Public Records

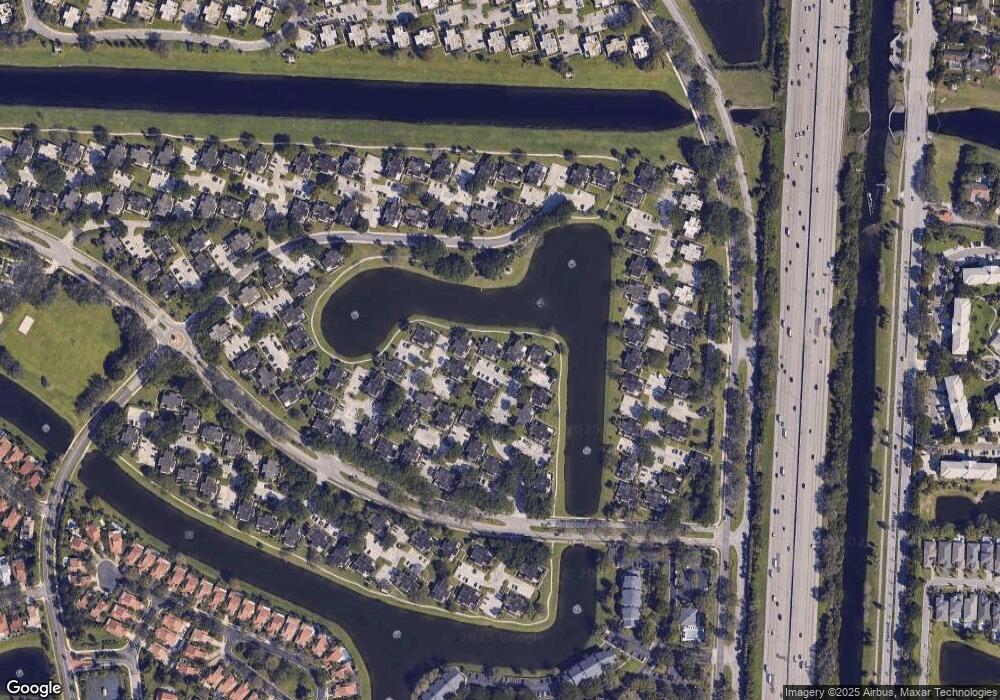

Map

Nearby Homes

- 5321 53rd Way

- 5428 54th Way

- 5209 52nd Way

- 5609 56th Way

- 5616 56th Way

- 6001 60th Way

- 5110 51st Way

- 5905 59th Way

- 2760 Tecumseh Dr

- 620 6th Way

- 6608 66th Way

- 2820 Cuyahoga Ln

- 2670 Tecumseh Dr

- 325 3rd Way

- 505 5th Way

- 2701 Tecumseh Dr

- 302 3rd Way

- 2855 Eagle Ln

- 3525 Village Blvd Unit 2030

- 3521 Village Blvd Unit 1030

- 5412 54th Way

- 5410 54th Way

- 5417 54th Way

- 5414 54th Way

- 5413 54th Way

- 5416 54th Way

- 5415 54th Way Unit 30b

- 5415 54th Way

- 5408 54th Way Unit 5408

- 5408 54th Way Unit 32B

- 5408 54th Way

- 5409 54th Way Unit 32C

- 5409 54th Way

- 5421 54th Way

- 5418 54th Way

- 5725 57th Way

- 5407 54th Way

- 5403 54th Way

- 5726 57th Way Unit 32D

- 5404 54th Way