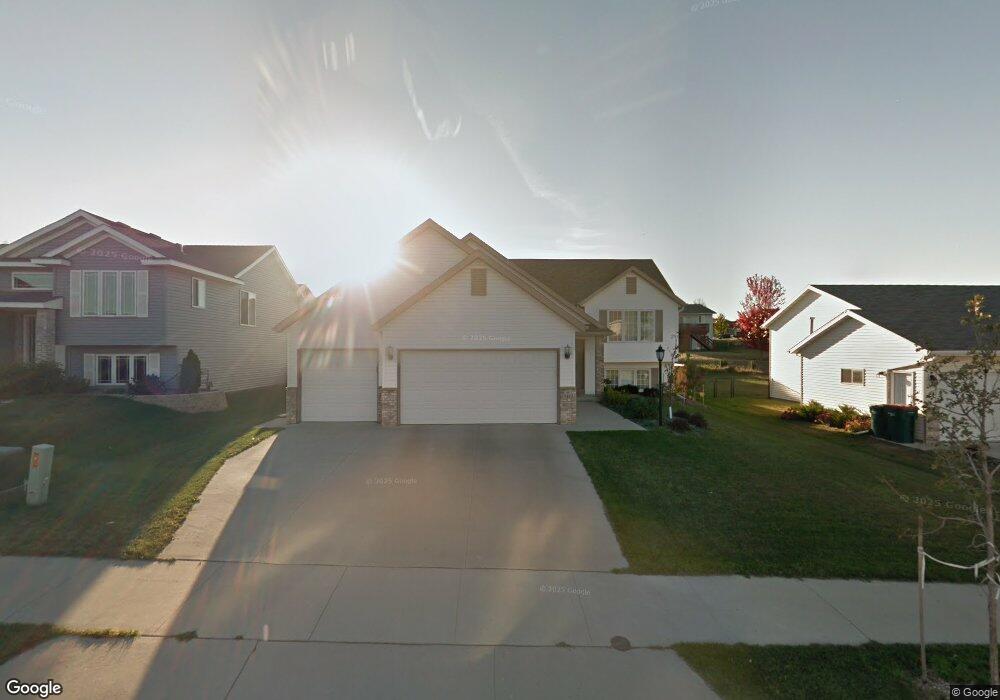

5415 55th Ave NW Rochester, MN 55901

Wedgewood Hills NeighborhoodEstimated Value: $403,000 - $432,000

4

Beds

2

Baths

2,509

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 5415 55th Ave NW, Rochester, MN 55901 and is currently estimated at $415,493, approximately $165 per square foot. 5415 55th Ave NW is a home located in Olmsted County with nearby schools including George W. Gibbs Elementary School, John Marshall Senior High School, and Rochester Beacon Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2020

Sold by

Conrad Mark and Conrad My

Bought by

Mccane Casey and Mccane Lindsey

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$313,300

Outstanding Balance

$278,792

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$136,701

Purchase Details

Closed on

Jun 21, 2019

Sold by

Trost Landon W and Trost Jennifer L

Bought by

Conrad My and Conrad Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$278,730

Interest Rate

4%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 21, 2006

Sold by

Lurken Leslie and Lurken Raegen

Bought by

Trost Landon W and Trost Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,920

Interest Rate

6.2%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mccane Casey | $330,000 | None Available | |

| Conrad My | $293,400 | Rochester Title & Escrow Co | |

| Trost Landon W | $194,900 | Edina Title Rochester | |

| Mccane Casey Casey | $330,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mccane Casey | $313,300 | |

| Previous Owner | Conrad My | $278,730 | |

| Previous Owner | Trost Landon W | $155,920 | |

| Closed | Mccane Casey Casey | $313,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,086 | $374,200 | $60,000 | $314,200 |

| 2023 | $4,320 | $348,100 | $40,000 | $308,100 |

| 2022 | $3,948 | $351,300 | $40,000 | $311,300 |

| 2021 | $3,876 | $296,100 | $40,000 | $256,100 |

| 2020 | $3,936 | $290,800 | $40,000 | $250,800 |

| 2019 | $3,396 | $284,100 | $40,000 | $244,100 |

| 2018 | $3,056 | $250,100 | $40,000 | $210,100 |

| 2017 | $2,940 | $234,200 | $40,000 | $194,200 |

| 2016 | $2,682 | $198,700 | $36,700 | $162,000 |

| 2015 | $2,466 | $177,000 | $36,000 | $141,000 |

| 2014 | $2,652 | $173,700 | $35,900 | $137,800 |

| 2012 | -- | $190,200 | $36,454 | $153,746 |

Source: Public Records

Map

Nearby Homes

- 5307 55th Ave NW

- 5307 54th Ave NW

- 5519 Sundown Place NW

- 5569 Harrow Ln NW

- 5523 Sundown Place NW

- 5515 Sundown Place NW

- Townhome 2 Plan at Harvest West

- Townhome 3 Plan at Harvest West

- Townhome 4 Plan at Harvest West

- Townhome 1 Plan at Harvest West

- 5386 King Arthur Dr NW

- 5350 King Arthur Dr NW

- 5368 King Arthur Dr NW

- 5425 Queens Dr NW

- 5419 Queens Dr NW

- 5413 Queens Dr NW

- 5407 Queens Dr NW

- 5401 Queens Dr NW

- 5227 Harvest Square Ln NW

- 5203 Harvest Square Ln NW

- 5433 55th Ave NW

- 5397 55th Ave NW

- 5379 5379 55-Avenue-nw

- 5394 Kingston Place NW

- 5379 55th Ave NW

- 5378 Kingston Place NW

- 5410 Kingston Place NW

- 5362 Kingston Place NW

- 5420 55th Ave NW

- 5398 55th Ave NW

- 5398 5398 55-Avenue-nw

- 5426 Kingston Place NW

- 5469 55th Ave NW

- 5361 55th Ave NW

- 5442 55th Ave NW

- 5346 Kingston Place NW

- 5492 Duvall St NW

- 5464 55th Ave NW

- 5330 Kingston Place NW

- 5487 55th Ave NW